Volopay prepaid cards: A smart alternative to company prepaid credit cards in the UK

When managing business expenses, you need more control and transparency than traditional options provide. Volopay prepaid cards offer a flexible, modern alternative to company prepaid credit cards, helping you streamline expense tracking, reduce misuse, and simplify reconciliation.

With real-time insights and customizable controls, you gain smarter ways to empower teams while avoiding unnecessary complexities and financial risks.

What is a prepaid card?

A prepaid card is a payment tool preloaded with funds, designed for spending without relying on credit. You add money in advance, and the cardholder can only spend what’s available. This prevents overspending, reduces financial risk, and makes budgeting simpler.

Prepaid cards are ideal for organizations that want secure, trackable, and controlled payment solutions without the obligations of traditional borrowing.

Prepaid cards vs prepaid credit cards

Unlike prepaid company credit cards, prepaid cards don’t rely on credit lines or debt. Instead, you allocate funds upfront, giving you direct control over spending. This eliminates interest charges and borrowing risks, making financial management more predictable.

Additionally, prepaid cards offer enhanced visibility with real-time tracking, transaction limits, and detailed reports, ensuring accountability. Compared to credit-based options, prepaid cards empower you with smarter expense control, tighter budgets, and reduced financial exposure, ultimately creating a safer and more efficient system for managing company expenditures.

Why choose Volopay prepaid cards?

Instant top-ups for your cards

You can instantly add funds to Volopay prepaid cards using a simple online dashboard. This ensures employees never face payment delays and always have the balance required.

Whether for travel, subscriptions, or daily expenses, UK businesses benefit from seamless fund transfers that are quick, secure, and available for immediate use without hassles.

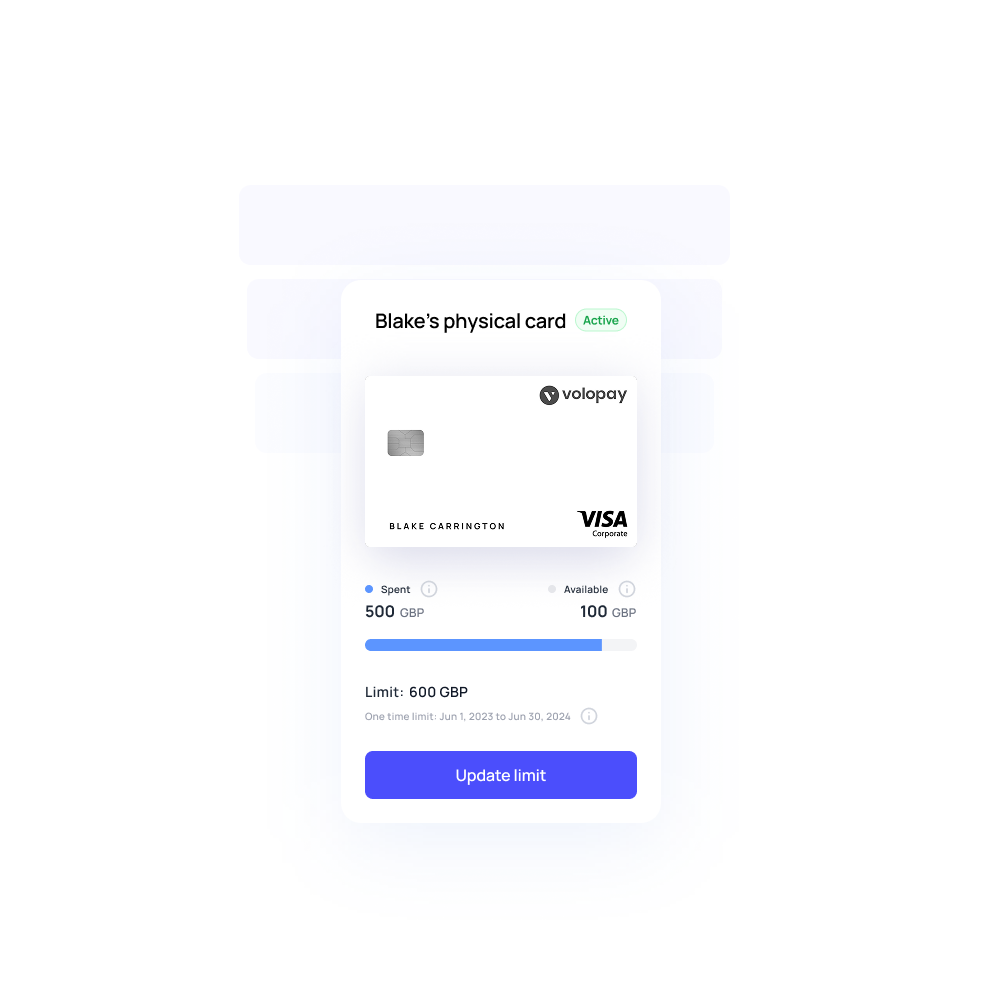

Custom spending controls

With Volopay's corporate cards, you decide how much employees spend and where. Set per-card limits or restrict cards to specific merchants to prevent misuse.

These smart controls help protect budgets, reduce unauthorized purchases, and provide clear oversight. Unlike company prepaid credit cards, prepaid options from Volopay give you tighter control with minimal effort.

Real-time transaction tracking

Every purchase made with Volopay prepaid cards is instantly recorded and viewable in your dashboard. You gain complete transparency into where funds are used, eliminating hidden expenses.

Real-time data allows you to analyze spending patterns, monitor budget usage, and take corrective action quickly, ensuring better financial control and accountability across your business operations.

Seamless accounting integration

Volopay integrates directly with UK accounting software such as Xero, QuickBooks, and Sage. This sync automates reconciliation, saving time and reducing errors. Receipts and transaction data flow seamlessly, eliminating manual data entry.

By simplifying bookkeeping, you make your finance team’s job easier while keeping accurate records. Prepaid company credit cards rarely offer such convenience.

Multi-currency wallet for international payments

Volopay provides a built-in multi-currency wallet, allowing you to pay vendors and manage subscriptions globally without high exchange fees. You can hold, transfer, and spend in multiple currencies seamlessly.

This ensures businesses operating across borders handle transactions cost-effectively, making global payments straightforward while supporting employees traveling or working internationally with simplified financial management.

Unlimited virtual cards for online spending

You can generate unlimited virtual prepaid cards for online expenses, ensuring safe, trackable payments. Assign cards to specific vendors or subscriptions, reducing the risk of fraud and unauthorized charges.

Virtual cards simplify budget tracking and provide better financial control. UK businesses gain flexibility in managing online purchases while ensuring security and transparency.

Automated expense reimbursements

Employees can easily claim reimbursements via Volopay’s mobile app. Using OCR technology, receipts are scanned and processed instantly, eliminating paperwork. This ensures quicker settlements and greater accuracy in reporting.

You streamline reimbursement processes, save time, and keep employees satisfied with faster payouts, making expense management smooth, efficient, and more transparent for your entire workforce.

Leading security standards

Volopay follows ISO and PCI DSS compliance to ensure data protection and payment safety. You can freeze or block cards instantly if suspicious activity occurs, preventing fraud.

These features provide peace of mind and stronger control over financial operations, ensuring your business transactions remain safe, reliable, and fully compliant with industry-leading security standards.

Multi-level approval workflows

You can streamline expense authorization with Volopay’s customizable approval workflows. Pre-set policies and multi-tier reviews ensure every request follows the correct chain before approval.

This prevents overspending and unauthorized usage while maintaining accountability. With structured processes, finance teams stay in control, making expense management more efficient, transparent, and compliant with internal company rules.

Mobile app for on-the-go management

Volopay’s mobile app keeps you connected to your business spending anytime, anywhere. Managers can approve requests, track transactions, and manage cards instantly.

Employees can submit expenses, upload receipts, and monitor balances. This mobility empowers your team to stay efficient, reduce delays, and simplify financial operations, whether working in the office or remotely.

Get the perfect prepaid card for your business!

Use cases for every team

Corporate travel expenses

With Volopay prepaid cards, you can assign dedicated budgets for flights, hotels, and meals. Employees avoid overspending, and you track costs in real time.

Unlike company prepaid credit cards, these solutions eliminate debt exposure, provide complete transparency, and simplify reporting, making travel expense management smarter, safer, and more efficient for both teams and finance.

Ad hoc business purchases

For sudden purchases like office supplies or emergency equipment, you can instantly issue prepaid cards with set limits. Employees make necessary payments quickly, while you maintain control and oversight.

This prevents unauthorized spending and ensures accountability. With instant issuance, you gain flexibility and convenience in handling unexpected business needs without affecting financial plans.

Subscription and SaaS payments

You can issue unique prepaid cards for each software subscription, ensuring payments remain organized and trackable. This prevents service interruptions while reducing the risk of fraud. Real-time visibility helps you monitor recurring charges effectively.

Prepaid company credit cards lack this flexibility, but Volopay ensures every subscription remains controlled, secure, and properly allocated to its budget.

Supplier and vendor transactions

Paying suppliers or vendors becomes simple with prepaid cards dedicated to each partner. You can track payments, avoid delays, and reconcile expenses automatically. This eliminates confusion and streamlines relationships.

By assigning funds upfront, you prevent misuse and overspending, making supplier transactions more efficient, transparent, and cost-effective compared to traditional payment methods commonly used by businesses.

Effortless budget allocation with Volopay

Departmental budgets

You can assign prepaid card budgets to individual departments, ensuring precise control over spending. Each team operates within its allocated funds, reducing misuse and overspending.

With real-time tracking, you maintain visibility into departmental expenses, enabling better financial planning and accountability across your organization while keeping budgets aligned with overall company goals and policies.

Project-specific funding

Volopay allows you to allocate funds directly to specific projects, such as marketing campaigns, events, or product launches. This keeps spending organized and separate from general budgets.

By assigning prepaid cards to each initiative, you gain transparency and control, ensuring funds are used appropriately while avoiding overlaps, misallocations, or hidden expenses that impact financial clarity.

Flexible budget adjustments

When project scopes or departmental needs change, you can easily adjust budgets in real time. Volopay’s dashboard makes reallocating funds quick and transparent. This flexibility allows you to stay responsive to shifting priorities without delays.

With instant adjustments, financial planning remains accurate, efficient, and better aligned with evolving organizational strategies and dynamic business requirements.

Automated budget alerts

Volopay sends automated notifications when budgets approach set limits, helping you prevent overspending. These alerts keep managers informed in real time, ensuring expenses remain controlled.

By identifying potential issues early, you avoid budget overruns and improve decision-making. This automation creates accountability, reduces financial risks, and strengthens the overall effectiveness of your company’s expense management process.

Tailored solutions for every role

1. Finance managers

You gain powerful tools to oversee and control company-wide spending. With Volopay, finance managers can set policies, approve requests, and track expenses in real time.

Automated reconciliations reduce manual effort, while detailed reports improve forecasting. This ensures better decision-making, tighter compliance, and more efficient use of resources across your entire business operation.

2. IT and tech managers

For software subscriptions, vendor tools, and technology purchases, you can assign prepaid cards with controlled budgets. This eliminates shadow IT spending and ensures compliance with company policies.

Real-time visibility allows you to track usage, prevent unauthorized transactions, and optimize software costs, making IT expense management more efficient, transparent, and directly aligned with business needs.

3. Accounting teams

Volopay automates reconciliation by syncing transactions and receipts directly with accounting software. You reduce manual data entry, avoid costly errors, and save time on reporting.

Accounting teams gain clear visibility into categorized expenses, ensuring books remain accurate and up-to-date. This makes financial processes smoother, compliant, and far more efficient compared to traditional reconciliation methods.

4. Marketing directors

You can issue prepaid cards dedicated to campaigns, ads, or event budgets, ensuring precise control and oversight. This prevents overspending while giving marketing teams flexibility to act quickly.

Real-time tracking shows exactly where funds go, helping directors analyze performance, optimize ROI, and manage multiple initiatives without losing visibility into their allocated financial resources.

Supporting businesses of all sizes

You can maintain tighter control over cash flow by using prepaid cards to assign specific budgets for expenses. Startups benefit from real-time tracking, ensuring funds are spent wisely.

With clear visibility into every transaction, you reduce financial risks, improve accountability, and build stronger financial discipline during the early, growth-focused stages of your business.

Small and medium-sized businesses gain efficiency with Volopay’s streamlined approval processes and seamless accounting integrations. You can eliminate manual paperwork, track team expenses, and manage vendor payments faster.

These features free up time for business growth while ensuring compliance, stronger budget control, and a more professional approach to financial operations and expense management overall.

Enterprises benefit from advanced analytics and multi-level workflows that simplify managing complex financial structures. You gain real-time visibility into spending across departments, with automated controls ensuring compliance.

Predefined policies and detailed reports provide greater accuracy and oversight. This helps large organizations reduce inefficiencies, eliminate overspending, and maintain full control of global business finances.

Bring Volopay to your business

Get started now