Business debit cards - What are they and how to get one

Managing business finances can feel overwhelming, with constant expense tracking and spending control needs. Using personal cards or cash often creates disorganized records and potential overspending. Business debit cards offer a modern, debt-free solution for businesses, from freelancers to limited companies.

These debit cards for business enable efficient purchase management while keeping spending in check. Business debit cards provide better financial control, clearer record-keeping, and streamlined expense management for all business types.

What is a business debit card and why it matters

A business debit card is a payment card directly linked to your business bank account, allowing purchases or cash withdrawals using only available funds. This eliminates debt risk and interest charges entirely.

These debit cards for business are essential for maintaining financial discipline, ensuring secure transactions, and providing spending transparency. Business debit cards streamline financial operations while avoiding credit-based payment complexities.

They offer real-time expense tracking, better cash flow management, and simplified accounting processes for modern businesses.

5 benefits of using a business debit card

Spend with confidence, no debt involved

Business debit cards let you make purchases using only available funds, eliminating interest or overdraft risks. This debt-free approach promotes responsible financial management for businesses.

Unlike credit options, debit cards for business ensure spending stays within budget limits, providing peace of mind while maintaining complete control over your company's cash flow and expenses.

Prepare for making tax digital (MTD)

Business debit cards support HMRC's Making Tax Digital compliance by recording all transactions digitally. These debit cards for business simplify VAT submissions through clear, automated record-keeping, reducing tax filing errors.

Digital transaction data integrates seamlessly with accounting software, streamlining quarterly returns and ensuring accurate financial reporting for businesses navigating MTD requirements.

Simplify daily business purchases

From supplier payments to software subscriptions, business debit cards streamline daily transactions efficiently. They eliminate cash handling and personal card reimbursements, saving valuable time and reducing administrative burden.

These debit cards for business create seamless purchasing processes, allowing immediate expense tracking while maintaining professional separation between personal and business finances throughout operations.

Empower your team with spending access

Business debit cards enable employee spending autonomy through individual limits, allowing necessary purchases without full account access. This balanced approach provides team flexibility while maintaining financial oversight.

Debit cards for business offer real-time spending monitoring, ensuring employees can handle operational expenses efficiently while management retains complete control over budget allocation and expenditure tracking.

Stay protected by regulated institutions

Business debit cards from FCA-regulated providers like Barclays or Lloyds ensure secure transactions with robust protection features. Chip-and-PIN technology and advanced fraud detection safeguard business funds effectively.

These debit cards for business offer institutional-grade security, protecting against unauthorized access while providing reliable payment processing backed by established financial institutions and regulatory compliance.

How business debit cards work in everyday operations

Direct link to your business bank account

Business debit cards connect directly to your account, with funds deducted instantly for real-time financial transparency. This immediate processing ensures accurate cash flow monitoring and eliminates payment delays.

Debit cards for business provide seamless integration with bank systems, offering instant transaction confirmation and automatic record-keeping for efficient business finance management.

Ideal for on-the-go or online payments

Business debit cards work seamlessly for in-person purchases, online subscriptions, and international transactions wherever major card networks are accepted.

These debit cards for business provide payment flexibility across multiple channels, from supplier payments to e-commerce platforms, ensuring operational continuity whether conducting business locally or globally with universal acceptance.

Zero interest, just simple spending

Unlike credit cards, spend only what’s available—no loans, no surprises. Since business debit cards involve no credit, they eliminate interest charges and loan repayments entirely. This makes budgeting straightforward and predictable for businesses.

These debit cards for business offer debt-free spending control, allowing companies to maintain financial discipline while avoiding the complexities and costs associated with credit-based payment methods.

Flexible for all account types

Business debit cards work with various banking providers, from high-street banks like HSBC to challenger banks like Starling. This flexibility suits different business models and banking preferences.

These debit cards for business offer compatibility across diverse financial institutions, ensuring companies can choose providers that best match their operational needs and service requirements.

Unlock smarter expense management with Volopay cards

When should you get a business debit card?

1. As soon as you register a business

Upon registering with Companies House, open a business account and secure a business debit card immediately. This establishes proper financial separation from personal finances from day one.

Getting debit cards for business early ensures professional money management, clean bookkeeping, and proper regulatory compliance from your company's inception through future growth stages.

2. Once you start accepting payments

When your business begins receiving income, business debit cards help manage expenses and maintain clean bookkeeping efficiently. This prevents mixed financial records and ensures professional money management.

These debit cards for business provide essential expense tracking capabilities, enabling clear financial oversight as revenue streams develop and operational spending requirements increase.

3. When hiring or scaling your team

As you grow, issuing business debit cards to employees with set spending limits streamlines expense management significantly. This reduces reimbursement needs and administrative burden while maintaining financial control.

These debit cards for business enable team autonomy for necessary purchases while providing managers with real-time spending visibility and budget oversight capabilities.

4. To elevate your professional brand

Using business debit cards for client or vendor transactions projects professionalism and enhances business credibility. This creates positive impressions during payment processes and builds trust with partners.

These debit cards for business demonstrate financial stability and proper business practices, contributing to brand reputation and potentially improving supplier relationships and negotiation outcomes.

5. When you need expense oversight

As spending increases, business debit cards with tracking and limit-setting features provide essential visibility and control without micromanaging. This enables strategic financial monitoring and better budget management.

These debit cards for business offer real-time expense insights, helping identify spending patterns and optimize financial operations for improved business performance.

How to choose the right business debit card for your business

Regulated provider backed by FCA

Choose business debit cards from FCA-authorized providers for guaranteed security and UK regulatory compliance. These regulated institutions offer robust fraud protection and financial stability.

Selecting debit cards for business from established, compliant providers ensures your funds remain protected while meeting all necessary regulatory requirements for UK operations.

Adjustable spend controls

Select business debit cards offering customizable spending limits per user or transaction type, preventing overspending and enhancing budget control effectively. These controls provide managers with granular oversight while maintaining operational flexibility.

Quality debit cards for business include real-time limit adjustments, enabling dynamic budget management as business needs evolve and spending patterns change.

Multi-user functionality for growing teams

Ensure your provider supports issuing multiple business debit cards with individual permissions, perfect for teams or departments requiring spending access. This functionality enables scalable expense management as your workforce grows.

These debit cards for business offer centralized control with distributed access, allowing managers to maintain oversight while empowering team members appropriately.

Fit for your business size and model

Startups, freelancers, SMEs, and enterprises have unique operational requirements requiring tailored solutions. Select business debit cards matching your scale and specific needs effectively.

Different providers offer specialized features for various business models. These debit cards for business should align with your operational complexity, transaction volume, and growth trajectory for optimal functionality.

Built-in expense tracking tools

Choose business debit cards that integrate seamlessly with accounting software like Xero or Sage for simplified expense tracking and financial reporting. These integrations automate transaction categorization and reduce manual bookkeeping tasks significantly.

Advanced debit cards for business offer real-time expense monitoring, automated receipt capture, and comprehensive reporting features for streamlined financial management.

Accepted online and internationally

Verify your business debit cards support global merchant acceptance and foreign currency capabilities, essential for international business dealings. Universal acceptance ensures operational continuity across different markets and payment environments.

These debit cards for business should offer competitive exchange rates and broad international compatibility for seamless global commerce operations.

Transparent pricing

Review all costs associated with business debit cards, including monthly fees, foreign transaction charges, and card issuance fees, to avoid unexpected expenses. Understanding pricing structures helps budget accurately for banking services.

Quality debit cards for business offer clear fee schedules with no hidden charges, enabling informed financial planning and cost management.

Get the perfect card for your business

What you’ll need to apply for a business debit card

Proof of business registration

Provide your Companies House number, VAT certificate, or sole trader documentation to verify legitimate business status when applying for business debit cards. This documentation confirms your company's legal standing and operational authority.

These debit cards for business require proper registration proof to ensure compliance with UK business banking regulations and requirements.

Personal identity documents

Directors or business owners must submit valid identification, such as passport, driving licence, or other government-issued ID, when applying for business debit cards. This verification ensures authorized access and regulatory compliance.

These debit cards for business require proper identity confirmation to prevent fraud and maintain security standards throughout the application process.

Business address verification

Submit utility bills, lease agreements, or bank statements confirming your business address to complete the application for business debit cards. This documentation verifies your operational location and establishes business legitimacy.

These debit cards for business require proper address confirmation to comply with UK banking regulations and anti-money laundering requirements.

Proof of operational legitimacy

If required, provide trading licences or industry-specific documents demonstrating active operational status when applying for business debit cards. This documentation confirms that your business conducts legitimate commercial activities.

These debit cards for business may require additional verification depending on industry regulations and the provider's specific compliance requirements.

Bank account details

Link business debit cards to your business bank account by providing accurate account details during the application process. This connection enables seamless fund access and transaction processing.

These debit cards for business require proper account linkage to ensure secure, direct access to business funds while maintaining appropriate financial controls and monitoring capabilities.

How to get a business debit card in the UK

Compare providers

Research various banks and fintech platforms to find the best business debit cards for your needs. Compare fees, features, and customer support offerings carefully.

Evaluate which debit cards for business provide the most value based on your specific requirements, industry focus, and operational preferences for optimal financial management.

Choose the right card type

Decide between physical business debit cards for in-person transactions or virtual cards for online purchases, or select both options. Consider your business model and payment needs when making this choice.

These debit cards for business offer flexibility in payment methods, ensuring you can handle various transaction types efficiently and securely.

Gather required documents

Collect essential documentation, including proof of business registration, personal identification, business address verification, and bank account details, before applying for business debit cards.

Having these ready streamlines the application process significantly. These debit cards for business require proper documentation to ensure compliance with UK banking regulations and verification requirements.

Submit application online or in-app

Complete the business debit cards application through your chosen provider's website or mobile app, ensuring accuracy to avoid processing delays. Double-check all information before submission for faster approval.

These debit cards for business applications are typically processed digitally, making the process convenient and efficient for busy business owners.

Add funds and activate

Once approved, fund your account and activate your business debit cards immediately. Some providers offer instant digital access, while others mail physical cards.

These debit cards for business typically become functional within minutes of activation, enabling immediate use for business expenses and transactions with proper funding in place.

Customise card settings

Set spending limits, merchant restrictions, and enable real-time notifications for effective business debit cards management. These customization options provide enhanced control over business expenses and spending oversight.

Properly configured debit cards for business offer optimized security and budget management, ensuring transactions align with your business policies and financial objectives.

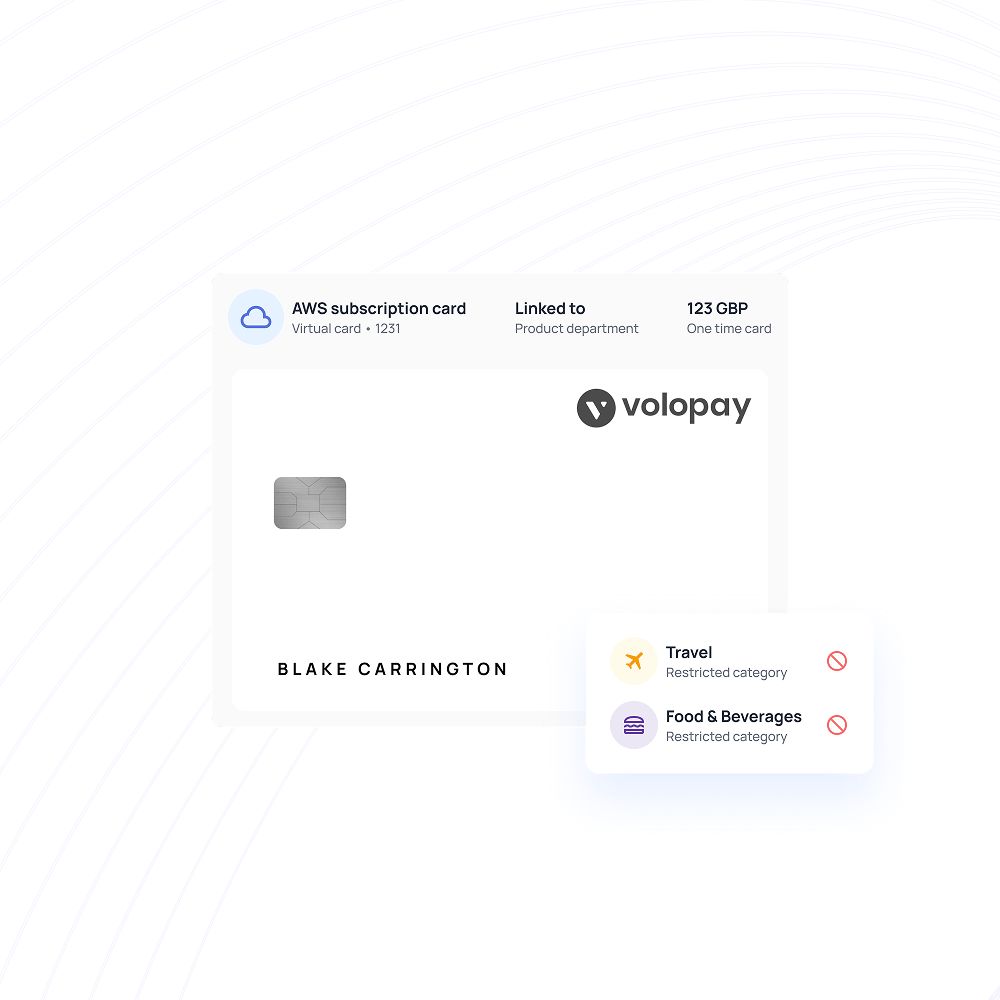

Volopay prepaid cards—A smarter alternative to traditional debit cards

For UK businesses seeking advanced solutions, Volopay's prepaid cards offer superior control and flexibility compared to traditional business debit cards. Ideal for startups, growing teams, or distributed workforces, Volopay combines modern financial tools with robust security.

These innovative debit cards for business provide comprehensive expense management capabilities beyond conventional banking options.

Instant fund top-ups and budget control

Volopay prepaid card offer instant fund transfers to individual cards with real-time budget adjustments by team or department. This precise financial control surpasses traditional banking limitations, enabling dynamic budget management as business needs evolve.

These advanced debit cards for business provide immediate fund allocation, ensuring teams have the necessary resources while maintaining strict spending oversight and operational flexibility.

Real-time expense tracking with alerts

Monitor every transaction live through Volopay's platform, with instant alerts tracking spending across departments using these advanced business debit cards. This real-time visibility eliminates delayed expense reporting and provides immediate spending insights.

These sophisticated debit cards for business offer comprehensive expense monitoring capabilities, enabling managers to identify spending patterns and optimize budget allocation strategies for improved financial control.

Simplified accounting with integrations

Seamless integration with Xero, QuickBooks, and NetSuite automates reconciliation when using Volopay business debit cards, reducing manual work and errors significantly. This streamlined accounting process saves valuable time and improves accuracy.

These integrated debit cards for business eliminate tedious data entry tasks, providing automated expense categorization and real-time financial reporting for more efficient business operations.

Unlimited virtual cards for online purchases

Issue unlimited virtual cards for subscriptions, advertising, or SaaS tools, minimizing fraud risks by avoiding shared physical cards. This approach enhances security while providing flexible payment options for digital transactions.

These specialized debit cards for business enable secure online spending with unique card numbers for each vendor, reducing exposure to potential breaches.

Enterprise-grade security and compliance

Issue unlimited virtual business debit cards for subscriptions, advertising, or SaaS tools, minimizing fraud risks by avoiding shared physical cards. This approach enhances security while providing flexible payment options for digital transactions.

These specialized debit cards for business enable secure online spending with unique card numbers for each vendor, reducing exposure to potential breaches.

Multi-level approvals for expense control

Implement custom approval workflows allowing team members to request funds and managers to approve before spending with these sophisticated business debit cards. This structured approach ensures proper oversight while maintaining operational efficiency.

These intelligent debit cards for business provide customizable approval processes, enabling companies to maintain financial control while empowering teams with streamlined expense management capabilities.

Bring Volopay to your business

Get started now