Expense management cards to streamline business purchases

Employee business expense cards are revolutionizing how UK companies manage workplace spending. These automated expense management solutions provide your employees with dedicated corporate cards that streamline business purchases while maintaining complete financial control.

Your finance team benefits from real-time expense tracking, automated receipt capture, and simplified reporting processes. Expense cards for employees eliminate traditional reimbursement delays, reduce administrative burden, and ensure compliance with UK tax regulations.

By implementing these digital payment solutions, your organization can transform expense management from a time-consuming process into an efficient, automated system that saves both time and money.

What are expense management cards?

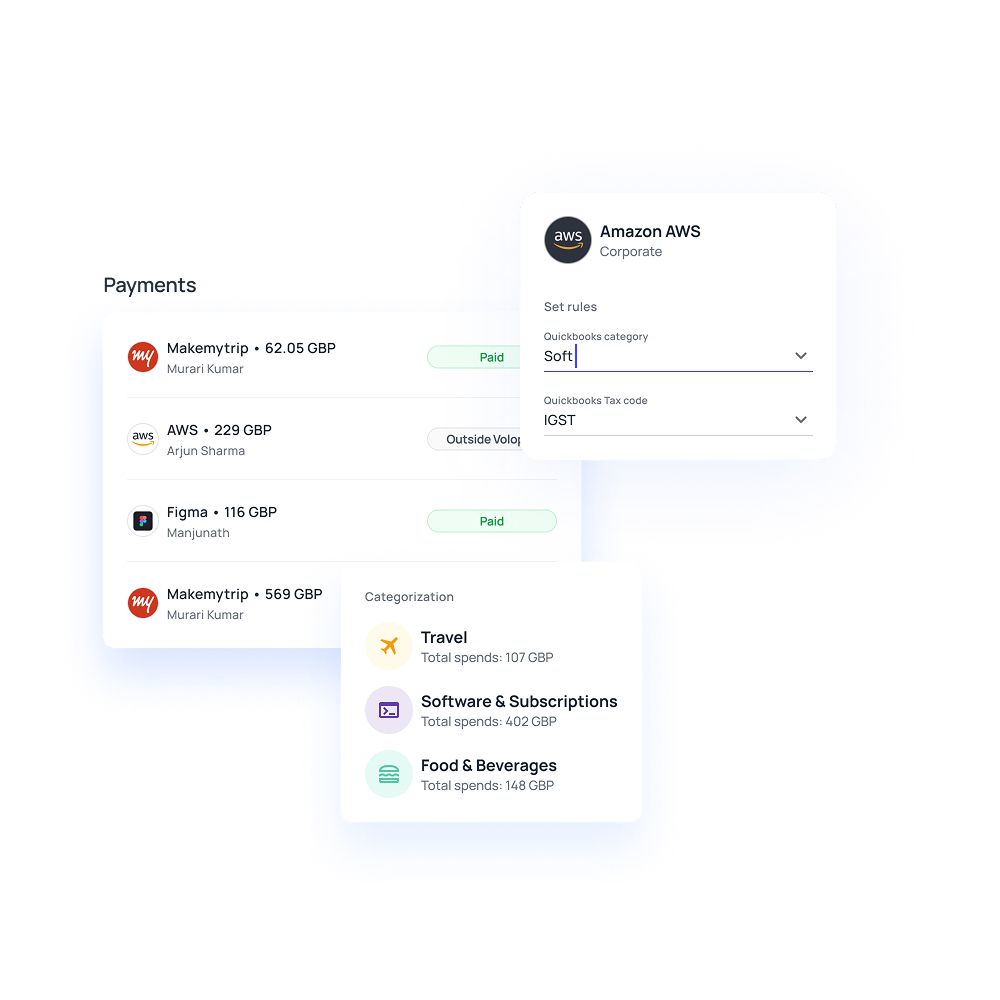

Expense management cards are corporate payment cards that help UK businesses control and track employee spending in real-time. You can set spending limits, restrict merchant categories, and require receipt uploads automatically.

These cards streamline your accounting by categorizing expenses and generating detailed reports that comply with HMRC requirements. You'll find they eliminate the need for employees to use personal funds and submit expense claims manually.

The cards integrate with your accounting software, making VAT recovery easier and ensuring you maintain proper documentation for tax purposes. They provide you with greater visibility and control over company expenditures while reducing administrative burden.

Key advantages of expense management cards for businesses in the UK

With expense management cards, you can track spending as it happens across your entire organization. This immediate visibility allows you to identify irregularities or unusual spending patterns early, preventing potential issues before they escalate.

Real-time monitoring means you're always aware of your company's financial position and can make informed decisions quickly.

Gone are the days of employees collecting paper receipts and manually submitting expense claims. Modern expense management systems allow your team to upload receipts instantly via mobile apps, capturing transaction details automatically.

This digital approach reduces administrative burden and ensures no receipts are lost or forgotten in jacket pockets.

You can establish customized spending controls tailored to different departments, roles, or specific purposes within your business.

Whether it's setting daily limits for sales teams or restricting certain categories of spending, these controls ensure everyone operates within approved budgets while maintaining the flexibility your business needs.

Robust approval workflows and custom card rules help prevent misuse of company funds.

By implementing automated controls and requiring appropriate authorization for different spending levels, you create multiple layers of protection that significantly reduce the risk of fraudulent or inappropriate transactions.

Automated expense management systems can instantly route claims to the appropriate manager based on predefined rules.

This eliminates bottlenecks in the approval process and ensures consistent application of your company's policies, while reducing the time spent on administrative tasks.

Integration with your accounting systems means transaction data flows seamlessly into your financial records.

Instead of spending weeks reconciling expenses manually, you can complete your monthly close in days, giving you faster access to accurate financial expense reporting.

Streamline your expenses with Volopay's corporate cards

How Volopay simplifies business spending in the UK

Volopay transforms how UK businesses manage their corporate expenses by providing a comprehensive platform that combines employee business expense cards with intelligent automation.

You'll discover how this solution eliminates the traditional pain points of expense management while giving you unprecedented control over your company's spending patterns.

Complete visibility over every pound spent

You receive a live feed of expenses categorised by team, location, or spending category, giving you instant insight into where your money goes. This real-time visibility means you can spot trends, identify cost-saving opportunities, and make data-driven decisions about your business spending without waiting for monthly reports.

Download tax-friendly reports instantly

Volopay automatically generates VAT-ready expense reports that you can submit directly to HMRC or your accountant. The system ensures all transactions are properly categorised and formatted according to UK tax requirements, saving you hours of manual preparation and reducing the risk of compliance errors.

Customize spend categories by function

You can classify expenses under specific functions like marketing, travel, SaaS subscriptions, and more, creating a clear picture of departmental spending. This categorisation helps you track budget performance by function and makes it easier to identify which areas of your business are driving costs.

Set daily, weekly, or monthly card budgets

You can establish spending limits without micromanaging your team—the system enforces rules automatically. Whether you need daily limits for petty cash expenses or monthly budgets for department heads, these controls ensure spending stays within approved parameters while maintaining operational flexibility.

Reconcile transactions without spreadsheet headaches

Manual data entry becomes a thing of the past as Volopay automatically syncs receipts with ledger codes and transaction details. This seamless integration means your accounting team can focus on analysis rather than data processing, significantly reducing the time spent on month-end reconciliation.

UK-based help when you need it

You have access to local support during your business hours, with 24/7 availability when urgent issues arise. This UK-based support team understands local business practices and regulations, ensuring you receive relevant assistance that addresses your specific needs quickly and effectively.

Control access by department and role

You can assign permissions and approval rights based on your organisational hierarchy, ensuring appropriate oversight at every level. This role-based access control means junior employees can make necessary purchases within limits while senior managers maintain oversight of larger expenditures.

Auto-route spend requests to the right approver

Pre-defined routing rules automatically direct expense requests to the appropriate manager based on amount, category, or department. This automation accelerates your expense workflows by eliminating manual routing decisions and ensures consistent application of your approval policies across the organisation.

Stay compliant with UK business expense policies and HMRC rules

Managing corporate expenses while staying compliant with UK regulations doesn't have to be complicated. With the right expense cards for employees, you can streamline your processes while ensuring every transaction meets HMRC requirements and your internal policies.

1. Built-in VAT compliance for every receipt

You'll never miss a VAT receipt again with automated collection and matching systems. Every transaction triggers receipt capture, ensuring your VAT claims are supported by proper documentation.

The system automatically validates receipts against HMRC requirements, flagging any missing information before it becomes a compliance issue. This eliminates the manual chase for receipts and reduces the risk of rejected VAT claims during audits.

2. Enforce custom spend guidelines by team

Different departments have different spending needs, and your expense policies should reflect that reality. You can create tailored policy templates for each business unit, setting appropriate limits and rules for marketing, sales, operations, and other teams.

Each template automatically applies relevant restrictions, approval workflows, and spending categories, ensuring every team operates within their designated parameters while maintaining overall corporate compliance.

3. Generate audit-ready reports anytime

When HMRC comes calling or internal audits are required, you'll have everything ready at your fingertips. The system maintains comprehensive logs of all transactions, receipt images, approval chains, and policy applications.

You can generate detailed reports instantly, complete with supporting documentation, transaction histories, and compliance verification. This preparation significantly reduces audit stress and demonstrates your commitment to proper financial governance.

4. Control where and how cards are used

You maintain complete control over corporate spending through intelligent card restrictions and usage parameters. Set geographical limits to prevent unauthorized overseas spending, restrict transactions to approved vendor categories, and establish time-based controls that prevent after-hours purchases. These controls work in real-time, blocking non-compliant transactions before they occur rather than addressing issues after the fact.

5. Align with per diem or category limits

Prevent budget overruns and policy violations by embedding spending limits directly into your expense cards for employees. You can set daily, weekly, or monthly limits for different expense categories, ensuring meals, travel, and other business expenses stay within approved ranges.

The system automatically tracks spending against these thresholds, alerting both employees and managers when limits are approached, maintaining financial discipline across your organisation.

Setting up Volopay expense management cards

Choose the right corporate card type

Select virtual cards for online purchases, subscriptions, and remote team members who need instant access. Choose physical cards for in-person transactions, client dinners, and field expenses.

You can issue both types simultaneously, switching between them based on your team's specific spending needs and operational requirements.

Define rules, budgets, and permissions

Set spending limits by department, individual, or project. Configure merchant restrictions to prevent unauthorized purchases. Establish daily, weekly, or monthly budget caps that automatically decline transactions when exceeded.

You control who spends what, where, and when, ensuring complete financial oversight across your organisation.

Automate approval flows in minutes

Use the intuitive drag-and-drop interface to create custom approval workflows. Set up multi-level approvals for high-value transactions while allowing automatic approval for routine expenses.

Define approval paths based on amount thresholds, department heads, or project managers. Your approval process becomes streamlined and efficient instantly.

Integrate with popular accounting platforms

Connect directly with your existing accounting software, including Xero, QuickBooks, and NetSuite. Transaction data flows automatically into your accounting system, eliminating manual data entry errors.

Real-time synchronization ensures your books stay updated, reducing month-end reconciliation time and improving financial accuracy significantly.

Receive live spend notifications

Receive instant notifications for every transaction via email, SMS, or mobile app. Monitor spending patterns in real-time through your dashboard.

Set up alerts for unusual activity, budget thresholds, or specific merchant categories. You'll never miss a transaction, maintaining complete visibility over your company's spending activities.

Assign permissions per role or location

Create role-based access controls for full-time employees and part-time staff. Set location specific spending rules for different offices or regions.

Configure permissions based on seniority levels, department functions, or project requirements. Each team member gets appropriate access without compromising your financial security.

Issue cards instantly, no bank visit needed

Generate virtual cards immediately from your dashboard without paperwork or bank visits. Physical cards ship within 24 hours to any UK address.

Add new team members and issue cards in seconds. Deactivate lost cards instantly and issue replacements immediately, maintaining business continuity without administrative delays.

Start spending & tracking with zero delay

Begin using your expense management system immediately after account setup. No waiting periods, no complex onboarding processes. Your team can start making purchases while you simultaneously track expenses in real-time.

Complete visibility and control are available from day one, transforming your expense management approach instantly.

Volopay card features tailored for UK businesses

Load money via UK Faster Payments

Top up your business card accounts instantly using the UK's Faster Payments system directly from your business bank account. This seamless integration ensures your team always has access to funds when they need them, eliminating delays and keeping your operations running smoothly across all departments.

Full mobile app access for employees

Your employees can manage their corporate cards effortlessly through our comprehensive mobile application. They can upload receipts instantly, check real-time balances, view transaction history, and submit expense reports on the go, ensuring complete transparency and efficient expense management from anywhere in the field.

Reload cards or freeze them instantly

Take complete control of your corporate spending with our intuitive admin panel. You can reload individual cards, set spending limits, freeze cards immediately if lost or stolen, and manage all team members' access with just one click, providing unprecedented oversight and security for your business finances.

Spend globally with zero surprise fees

Your team can use their cards internationally without worrying about hidden charges or unexpected fees. Our transparent foreign exchange rates and clear fee structure mean you'll know exactly what you're paying for international transactions, helping you budget accurately for global business operations and travel expenses.

Secure support in your time zone

Access dedicated UK-based customer support during your business hours, ensuring you receive timely assistance when you need it most. Our local support team understands UK business regulations, banking practices, and market conditions, providing relevant solutions tailored specifically to your operational requirements and compliance needs.

Acceptable at all major merchants worldwide

Your Volopay cards ensure universal acceptance at millions of merchants globally. Whether your team is shopping for office supplies locally, booking business travel, or making purchases internationally, your cards will work seamlessly wherever business takes you, providing reliable payment solutions.

PCI-DSS and 2FA security

Your business data and payment information are protected by enterprise-grade security measures, including PCI-DSS compliance and two-factor authentication.

These robust security protocols ensure that your financial transactions remain safe from fraud and unauthorized access, giving you peace of mind for all corporate spending activities.

Works with payroll & bookkeeping tools

Seamlessly integrate your Volopay cards with popular UK accounting software, including NetSuite, Xero, QuickBooks, and other essential business tools. This integration streamlines your financial workflows, automates expense categorization, and ensures accurate bookkeeping, saving your finance team valuable time while maintaining comprehensive financial records.

Everyday use cases of Volopay expense management cards in the UK

Employee travel & client meals

You can issue cards with pre-set spending limits for business trips and client meetings.

Your employees receive instant access to funds for hotels, meals, and transport without waiting for reimbursements.

You maintain full visibility over travel expenses while ensuring your team has the resources needed for successful client relationships and productive work trips.

Marketing campaign spend

You can track advertising spend and agency costs by assigning dedicated cards to each marketing campaign.

Your marketing team gets real-time budget control while you monitor ROI across different channels.

This approach eliminates mixed expenses and provides clear campaign-specific spending data for better decision-making and budget optimisation across all your marketing initiatives.

Recurring SaaS or IT subscriptions

You can assign virtual cards to each software tool and subscription service to prevent payment failures and service interruptions.

Your IT team manages renewals seamlessly while you track which tools are actually being used.

This method provides complete visibility into your software stack costs and ensures business continuity for essential services.

Contractor & freelancer payments

You can disburse funds directly to contractors and freelancers through dedicated cards, eliminating payment delays and administrative overhead.

Your external team members receive immediate access to project-related funds, while you track all contractor expenses in a centralized system.

This approach improves vendor relationships and speeds up project delivery timelines significantly.

Department-specific budgeting

You can allocate separate cards to different teams—HR, Operations, Sales—allowing them to manage their own spending within approved limits.

Your department heads gain autonomy over their budgets while you maintain oversight through real-time reporting.

This streamlines expense management and creates accountability across all business units within your organisation.

Onboarding & equipment expenses

You can issue temporary cards for new hires and remote employees to purchase necessary equipment and supplies.

Your new team members can immediately access funds for office supplies and setup costs without waiting for traditional procurement processes.

This accelerates onboarding while maintaining spending control and expense tracking for all employee-related costs.

Events & field ops

You can enable secure local spending for road shows, trade shows, and site visits by providing event-specific cards to your field teams.

Your representatives can handle unexpected expenses, local suppliers, and venue costs without carrying cash or using personal funds.

This ensures smooth event execution while maintaining complete expense visibility and control.

Project-based budgeting

You can allocate dedicated card budgets for specific projects or client deliverables, ensuring precise cost tracking and budget adherence.

Your project managers gain real-time spending visibility while you monitor profitability across different initiatives.

This approach simplifies project accounting and provides accurate cost attribution for improved client billing and project evaluation.

Volopay for startups, SMEs, and enterprise UK teams

From fast-moving startups to complex global teams, Volopay adapts to your business stage. Whether you're launching your first venture or managing enterprise-wide operations, our platform scales with your growth, providing the financial tools you need at every milestone.

1. Startups

● Rapid setup and minimal admin

Launch your expense management system in minutes, not weeks. Volopay's streamlined onboarding eliminates lengthy setup processes, letting you focus on growing your business. Pre-configured templates and automated workflows mean your team can start managing expenses immediately without complex administrative overhead.

● Simple UI for non-finance users

Your developers and marketers shouldn't need finance degrees to submit expenses. Volopay's intuitive interface makes expense reporting effortless for everyone. Clear visual cues, mobile-first design, and automated categorisation ensure your entire team can manage spending without constant finance team support.

● Helps build early financial discipline

Establish strong financial foundations from day one with built-in spending controls and approval workflows. Volopay's automated policies prevent overspending while detailed reporting helps founders make informed decisions. Real-time visibility into cash flow creates accountability and financial awareness across your growing team.

2. Small businesses

● Tracks every transaction across growing teams

Never lose sight of company spending as your team expands. Volopay captures every transaction automatically, from coffee purchases to software subscriptions. Real-time transaction feeds and comprehensive audit trails ensure complete visibility across departments, making month-end reconciliation effortless for your finance team.

● Automates recurring vendor and SaaS payments

Eliminate manual payment processing for your regular expenses. Volopay's intelligent automation handles recurring vendor payments, subscription renewals, and utility bills seamlessly. Scheduled payments ensure you never miss deadlines, while automated three-way matching streamlines invoice processing for your accounting team.

● Enables controlled card distribution at scale

Issue virtual and physical cards to team members without losing control. Set spending limits, category restrictions, and approval requirements per card. Real-time monitoring alerts prevent unauthorized spending while detailed transaction data provides complete visibility into how company funds are being used.

3. Mid-size and large teams

● Supports multi-entity expense tracking

Manage complex organisational structures with ease across subsidiaries, departments, and cost centers. Volopay's multi-entity framework provides consolidated reporting while maintaining separate accounting books. Cross-entity visibility helps finance leaders optimize spending patterns and identify opportunities for cost savings across the organization.

● Advanced analytics for finance leaders

Transform expense data into strategic insights with powerful analytics dashboards. Volopay's reporting engine delivers real-time spend analysis, budget variance tracking, and predictive forecasting. Customizable reports and automated alerts help CFOs make data-driven decisions while identifying trends and opportunities for optimization.

● Works across departments and geographies

Scale globally without compromising control or compliance. Volopay supports multiple currencies, local payment methods, and regional compliance requirements. Centralized policy management ensures consistent spending controls, while department-specific workflows accommodate unique operational needs across your international organization.

FAQs: Expense management cards in the UK

Yes, you can customize individual spending limits for each team member using expense management cards. This feature allows you to control budgets based on employee roles, departments, or project requirements, ensuring better financial oversight and preventing overspending across your organisation.

Absolutely, Volopay expense cards work seamlessly for remote employees throughout the UK. Your distributed team can make purchases, track expenses, and submit receipts from anywhere, providing real-time visibility into spending patterns regardless of their location.

Volopay's expense management cards for business can track various expenses, including office supplies, travel costs, client entertainment, software subscriptions, and operational purchases. The system automatically categorises transactions and captures receipt data for comprehensive expense reporting.

Yes, Volopay expense cards are fully compliant with UK financial regulations and standards. The platform adheres to FCA requirements, ensures proper audit trails, and provides the necessary documentation and reporting features required for UK tax compliance.

Yes, Volopay expense cards are accepted internationally wherever major card networks operate. Your employees can use them for business travel, international purchases, and cross-border transactions while maintaining the same expense tracking and approval workflows.

Bring Volopay to your business

Get started now