Business credit card vs corporate credit card - A detailed comparison

Choosing the right payment solution is crucial for managing company expenses efficiently. Understanding the differences in the business vs corporate credit cards comparison helps organizations pick the best fit for their financial structure.

Whether you're a startup or a large enterprise, evaluating the features of a corporate credit card vs business credit card ensures better control over spending, reporting, and employee access. Let’s explore twelve key differences between these two financial tools.

Understanding business credit cards

Essential features

Business credit cards offer expense tracking, preset spending limits, rewards programs, and employee card issuance. They help companies manage operational costs efficiently while separating business and personal transactions. Most come with detailed reporting tools. These features support better budget control and compliance.

Eligible applicants

Small business owners, freelancers, LLCs, and corporations can apply for business credit cards. Financial institutions may require a business tax ID and proof of revenue. Applicants must typically have good personal or business credit. Both startups and established firms may qualify.

Common use cases

They are widely used for travel bookings, office supplies, software subscriptions, and vendor payments. Businesses also rely on them for covering recurring expenses. Monthly statements help monitor spending categories. Business credit cards support smoother cash flow management.

Personal use restrictions

Business cards are intended strictly for business-related purchases and not personal spending. Misuse may lead to legal and tax complications. It can also violate card issuer terms. Always maintain a clear separation of personal and business expenses.

Suitability for startups

Startups benefit from simplified expense tracking and initial cash flow support. Many cards offer low or no annual fees and early-stage rewards. These tools help build business credit over time. They’re often more accessible than corporate cards for new ventures.

Application process

Applicants must submit basic business information, financial statements, and possibly a personal guarantee. Online applications are common, and decisions are often quick. Some providers require a business checking account. The process is usually simpler than applying for corporate cards.

Understanding corporate credit cards

Essential features

Corporate credit cards provide centralized expense control, customized spending limits, and real-time transaction monitoring. They also support integration with accounting systems, enable detailed reporting, and improve policy enforcement. These cards help streamline finance operations and reduce manual reconciliation work.

Eligible applicants

Typically, only incorporated entities like corporations or large partnerships are eligible for corporate credit cards. Applicants must demonstrate stable revenue, a solid credit history, and consistent financial practices. Approval often requires a personal guarantee or company liability agreement.

Common use cases

Corporate cards are used for travel bookings, vendor payments, software subscriptions, and employee expenses. They help manage recurring payments and business-related purchases efficiently. Organizations benefit from simplified expense tracking and approval workflows.

Personal use restrictions

Corporate credit cards must be used strictly for authorized business transactions. Personal purchases are not permitted and may violate company policy. Misuse can result in disciplinary action and revocation of card access.

Suitability for business

They are ideal for medium to large enterprises needing scalable expense management tools. These cards support multiple users with varying limits and approval levels. Understanding the difference between corporate vs business credit card options is key to choosing the right fit.

Application process

Applying involves submitting company financials, registration documents, and sometimes personal guarantees. The issuer evaluates creditworthiness, business size, and operating history. Comparing business vs corporate credit cards helps determine which suits operational and financial goals best.

Business credit card vs. Corporate credit card

Choosing the right card for you

Business size

Think about where your business stands—startups and small teams usually go for business cards, while larger companies lean toward corporate cards.

It's all about matching the card to your team’s size and complexity. That way, you're not over- or under-equipped when weighing business vs corporate credit cards.

Spending patterns

Take a close look at how your company spends—are your purchases frequent and consistent, or more sporadic? Business cards fit flexible spending, while corporate cards are built for bigger, ongoing expenses.

Knowing your patterns makes it easier to choose wisely in the corporate vs business credit card debate.

Management tools

Need help keeping tabs on team expenses? Look for features like spend limits, approval flows, and real-time tracking. Business cards offer the basics, but corporate cards give you more control.

Strong management tools can be a game-changer when comparing corporate credit card vs business credit card options.

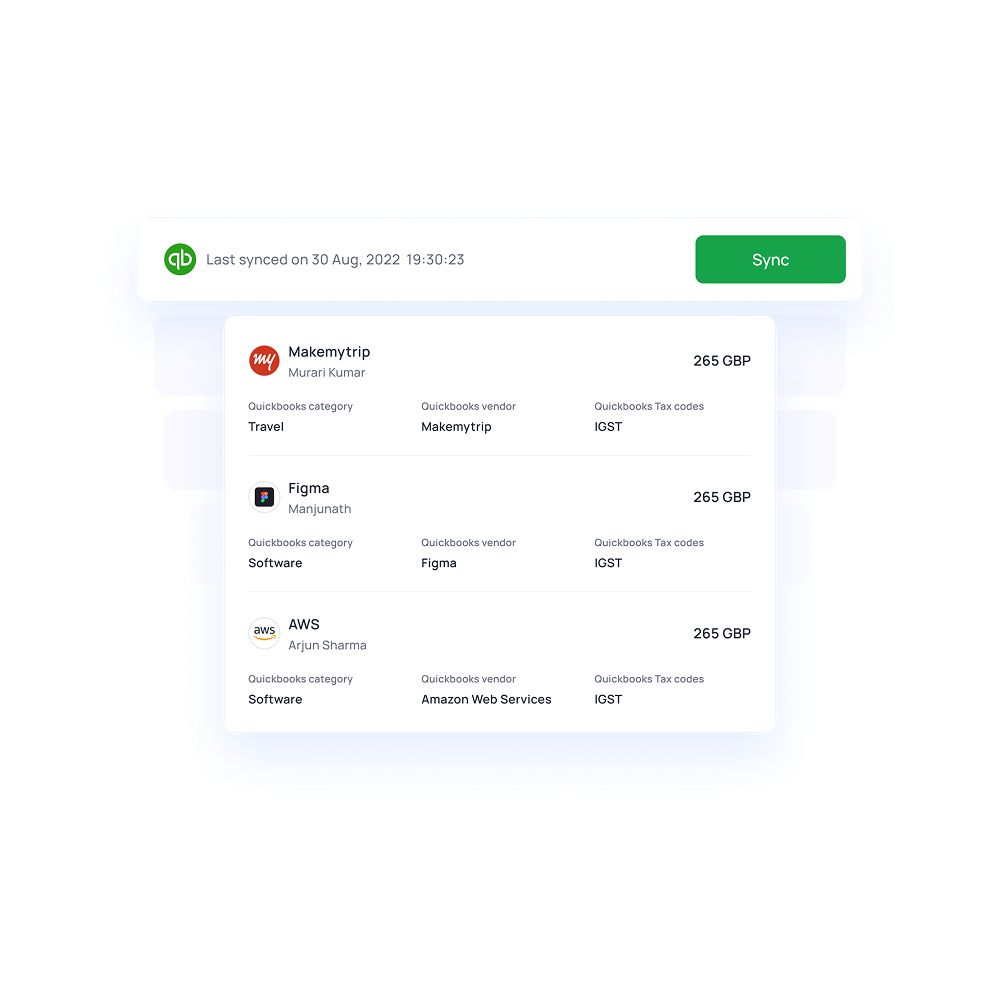

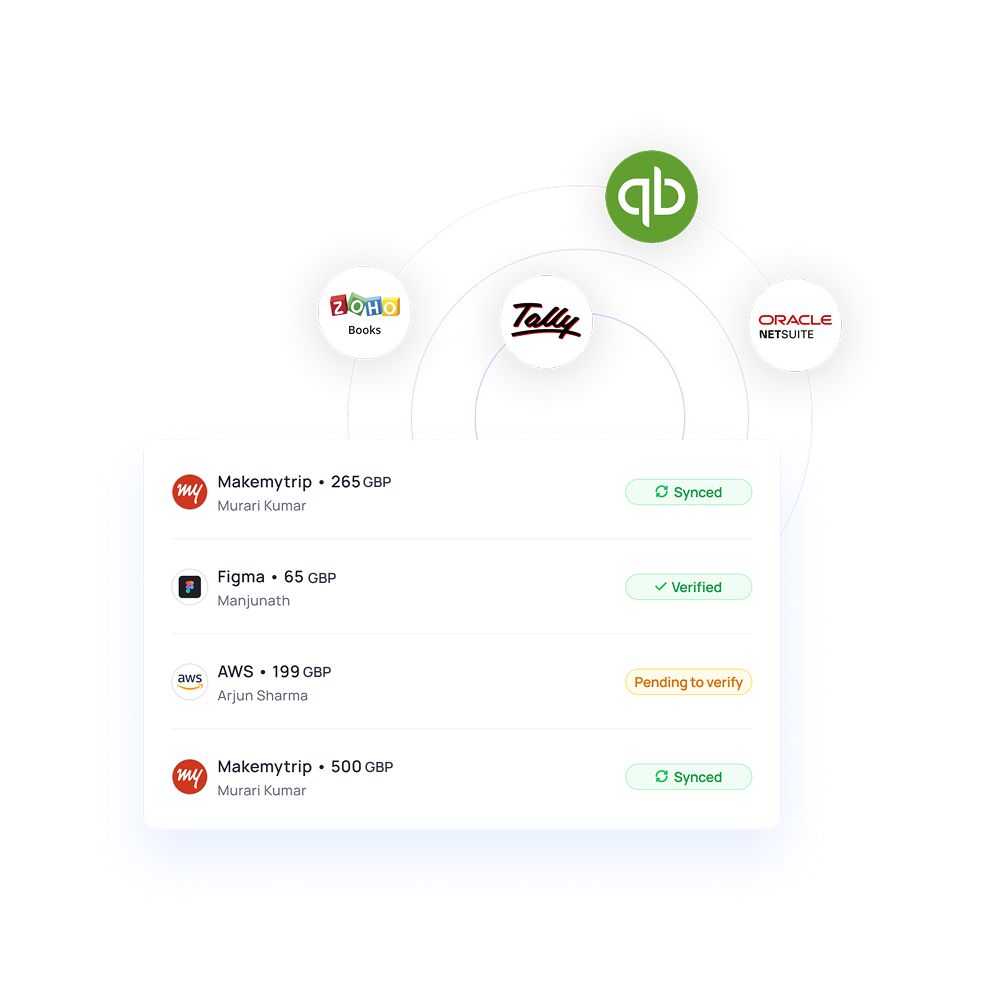

Accounting integration

Pick a card that works smoothly with your accounting software—whether it's QuickBooks, Xero, or another tool. Business cards often offer basic syncing, while corporate cards go deeper with automation.

Easy integration saves time and headaches, and it's a key factor in the business vs corporate credit cards decision.

Growth planning

If your business is expanding, it’s essential to choose a card that can scale alongside it. Corporate cards offer higher spending limits, flexible user management, and advanced tools designed for larger teams.

Business cards work well for smaller operations, but long-term growth requires a solution that supports evolving financial needs.

Regulatory compliance

Make sure your card keeps your records clean and audit-ready. Corporate cards usually offer better reporting tools that help with tax filings and audits. Business cards are more basic but fine for smaller needs.

When it comes to compliance, it's smart to consider this in your credit card comparison.

Automation in credit card management

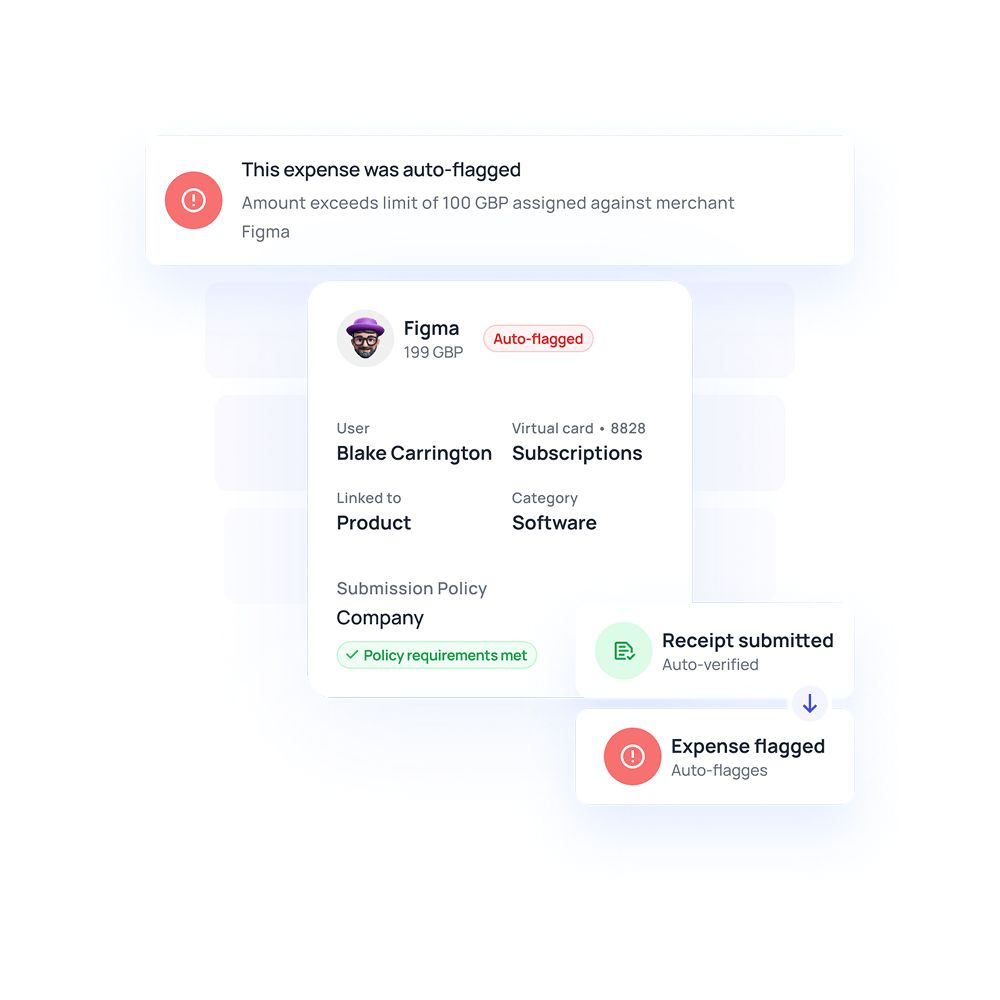

Real-time monitoring

Dashboards provide instant visibility into all credit card expenses, allowing businesses to track spending as it happens.

This helps maintain budget control and ensures oversight across departments, preventing overspending and improving financial transparency. Instant alerts on unusual patterns also enable quicker corrective actions.

Expense categorization

Transactions are automatically sorted into predefined categories, such as travel, office supplies, or meals. This automation streamlines bookkeeping, reduces manual data entry, and speeds up financial reporting for businesses of all sizes. It also facilitates easier audit trails and compliance with company policies.

Accounting sync

Credit card systems can seamlessly integrate with popular accounting software, syncing transactions in real time.

This connection enhances efficiency by minimizing errors, saving time on reconciliations, and ensuring accurate financial records. It also supports faster month-end closing and reporting processes.

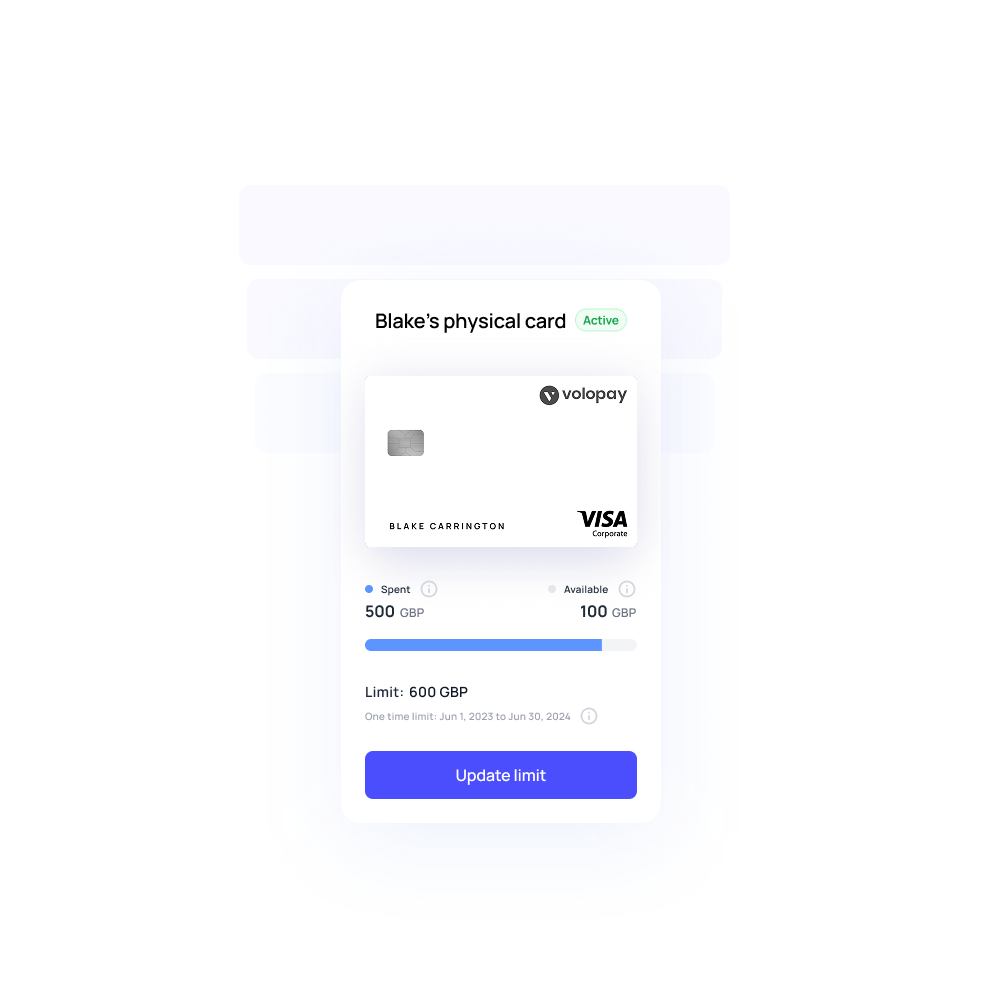

Spend limits

Companies can set specific spending caps on individual cards or per employee, tailoring budgets to roles and needs.

These limits help maintain control over expenditures and prevent unauthorized or excessive spending within the organization. Adjustments to limits can be made dynamically to align with changing business priorities.

Fraud detection

Automated fraud detection tools monitor transactions continuously, sending real-time alerts when suspicious activity is detected.

This proactive approach safeguards your company's finances by enabling quick responses to potential fraud or unauthorized use. Advanced machine learning algorithms improve detection accuracy over time.

Industry applications of credit cards

Tech startups

Credit cards help tech startups manage expenses like software subscriptions and hardware purchases efficiently.

They provide flexible spending limits and real-time tracking, enabling founders to control costs and improve cash flow.

These features support fast-paced innovation while maintaining budget discipline.

By automating expense reporting, teams spend less time on administrative tasks and more on product development.

Manufacturing

Manufacturers benefit from credit cards by streamlining procurement and paying vendors promptly.

Centralized expense tracking helps monitor raw material costs and operational expenses accurately.

This improves financial control and supports timely production schedules.

Integrated analytics further enable manufacturers to forecast spending trends and negotiate better supplier terms.

Retail operations

Retail businesses use credit cards to handle inventory purchases and marketing expenses smoothly.

Cards simplify vendor payments and track spending by category, making budgeting easier.

This streamlined approach improves cash management and supports timely restocking and promotional campaigns.

Detailed expense insights also help retailers optimize margin strategies and seasonal planning.

Freelancers

Freelancers use credit cards to separate business and personal expenses clearly, easing tax filing.

Detailed statements help track deductible costs such as travel and supplies.

This separation simplifies accounting and enhances financial organization for independent professionals.

Additionally, many card issuers offer rewards and cashback on common business purchases, boosting overall earnings.

Why choose business credit cards when Volopay offers corporate cards

Unified platform

Volopay’s unified platform consolidates corporate cards, invoice management, and expense management in one interface. Teams access budgets, approvals, and payments seamlessly without toggling multiple tools.

This centralized solution reduces manual processes, streamlines workflows, and enhances collaboration across departments. By integrating spend controls and real-time updates, finance leaders gain visibility and control.

Virtual cards

Volopay’s virtual cards empower teams to generate unique card numbers instantly for vendors, projects, or individuals. Administrators set limits, expiration dates, and controls before issuance.

These disposable cards prevent overspending and reduce fraud risk by isolating transactions. With easy deactivation and automated reconciliation, businesses maintain tighter budget governance and security.

Real-time analytics

Volopay’s real-time analytics deliver actionable insights into spending patterns across teams, projects, and categories. Interactive dashboards visualize transactions instantly, highlighting anomalies and budget variances.

By drilling down into granular data, finance managers identify cost-saving opportunities and optimize allocations. Predictive forecasts based on trends enable proactive planning and fiscal discipline.

Accounting integration

Volopay’s accounting integration synchronizes corporate card transactions with ERP and bookkeeping systems automatically. Payments, receipts, and vendor invoices reconcile in real time, eliminating manual data entry and system gaps.

By aligning expense categories with the chart of accounts, custom mapping ensures accurate ledgers. This seamless integration accelerates month-end closing and boosts audit readiness.

Bring Volopay to your business

Get started now