Maximize the benefits of prepaid cards for your UK business

Understanding prepaid cards for UK business expenses

Prepaid cards serve as essential prepaid debit tools designed specifically for UK businesses seeking to streamline employee and operational spending. You'll find these cards remarkably simple to implement, requiring no credit checks for eligibility, making them accessible to businesses of all sizes.

Benefits of prepaid debit cards include enhanced budget control and seamless management of decentralized teams across multiple locations. You can load predetermined amounts onto each card, ensuring spending stays within approved limits while giving your employees the flexibility they need for business expenses. This approach eliminates the complexity of traditional corporate credit arrangements while maintaining full oversight of your company's expenditure.

What are prepaid cards for businesses?

Prepaid cards are debit-like payment tools that you preload with a specific amount of funds, functioning independently of traditional credit facilities or bank overdrafts. You can use these cards for various business expenses, including travel costs, petty cash requirements, employee reimbursements, and even payroll distributions. Unlike credit cards that extend borrowing facilities, prepaid cards only allow spending up to the preloaded amount, providing absolute control over your business expenditure.

Benefits of prepaid card usage extend beyond simple spending control. You can distribute these cards to employees, contractors, or specific departments without worrying about credit checks or personal guarantees.

This makes them particularly valuable for startups, small businesses, or companies with limited credit history. The cards work seamlessly with existing payment systems, accepting payments wherever debit cards are accepted, both online and in-store.

You maintain complete visibility over transactions through detailed reporting features, allowing real-time monitoring of spending patterns. This transparency helps with budgeting, expense tracking, and compliance requirements.

Top benefits of prepaid cards for smarter business finances

You can establish precise spending parameters tailored to each department's unique needs and responsibilities.

Configure category-specific limits for marketing, operations, or travel expenses while setting role-based restrictions that align with employee authority levels.

This granular control ensures every team member operates within predetermined boundaries, preventing unauthorized purchases and maintaining budget discipline across your entire organization.

You eliminate the risk of unexpected charges by loading exact amounts onto each card before distribution.

This preloaded approach creates natural spending boundaries that prevent employees from exceeding allocated budgets, protecting your cash flow from surprise expenses.

Unlike traditional credit arrangements, preloaded funds ensure you never face bills that exceed your planned expenditures, giving you complete predictability over monthly expenses and enhanced financial control.

Benefits of prepaid cards include real-time visibility through dashboard monitoring that transforms your financial oversight capabilities.

You receive immediate notifications for every transaction, allowing you to track expenses as they occur rather than discovering spending patterns weeks later.

This instant transparency enables proactive budget management, helps identify spending trends quickly, and ensures compliance with company policies across all departments and employee levels.

You can automate the traditionally time-consuming reconciliation process by leveraging integrated expense management systems that match transactions with receipts instantly.

Digital receipt capture eliminates manual paperwork while automated categorization reduces accounting workload significantly.

This streamlined approach transforms hours of administrative work into minutes of review time, freeing your finance team to focus on strategic analysis rather than routine data entry and expense tracking.

You maintain complete security control through immediate card management capabilities that protect against unauthorized usage and potential fraud.

Remote card freezing eliminates the delays associated with traditional banking processes, allowing instant response to lost cards.

This rapid response capability minimizes financial exposure while maintaining business continuity, ensuring your operations continue smoothly even when security incidents occur unexpectedly across your organization.

Benefits of prepaid cards for managing employee expenses

No more out-of-pocket travel payments

You eliminate the frustration of employees waiting weeks for expense reimbursements by providing preloaded travel cards before business trips. Your team members can cover accommodation, meals, and transportation costs immediately without personal financial strain.

This approach improves employee satisfaction while ensuring consistent cash flow management. You maintain complete control over travel budgets while removing the administrative burden of processing numerous reimbursement requests and supporting documentation.

Safer alternative to petty cash

Benefits of prepaid cards include replacing vulnerable cash systems with secure, traceable payment solutions that protect your business from theft and misuse. You can issue cards for office supplies, client entertainment, and unexpected purchases while maintaining complete transaction visibility.

Unlike cash handouts, prepaid cards provide detailed spending records and eliminate the risk of internal fraud. This digital approach ensures accountability while simplifying audit trails and expense reporting processes.

Empower teams with controlled flexibility

You enable employees to make necessary purchases within established parameters without seeking approval for every transaction. This autonomy speeds up procurement processes while maintaining budget discipline through preset spending limits and category restrictions.

Your teams can respond quickly to client needs and operational requirements without bureaucratic delays. You balance employee empowerment with financial control, creating efficient workflows that support business objectives while preventing unauthorized spending patterns.

Quick top-ups during urgent tasks

You can instantly add funds to employee cards through your centralized dashboard when unexpected expenses arise during critical projects. This real-time funding capability ensures your teams never face payment delays during important client meetings or urgent operational needs.

You maintain spending control while providing immediate financial support for time-sensitive situations. This flexibility prevents project delays and maintains professional relationships while keeping all transactions within your established expense management framework.

Spend monitoring that builds accountability

You promote responsible spending behavior by providing employees with real-time access to their card balances and transaction history. This transparency helps team members understand their spending patterns and remaining budgets, encouraging thoughtful purchase decisions.

You create a culture of financial awareness where employees take ownership of their expense management. This visibility reduces overspending incidents while fostering trust between management and staff through open financial communication and shared responsibility.

Essential benefits of prepaid cards for small businesses in the UK

Small and medium businesses (SMBs) in the UK face unique financial challenges that traditional banking solutions often fail to address effectively. Prepaid cards offer a flexible, accessible alternative that caters specifically to the needs of growing businesses.

No credit checks or loans needed

Your startup or sole trader business can access prepaid cards immediately without lengthy credit assessments or collateral requirements.

Traditional business cards often require extensive financial history, personal guarantees, and established trading records that new businesses simply don't possess.

Prepaid cards completely eliminate these barriers entirely, allowing you to quickly establish essential business spending capabilities from day one.

This instant accessibility proves invaluable for entrepreneurs launching ventures or sole traders transitioning from employment to self-employment in the competitive UK market.

Avoid bank overheads and credit fees

You'll escape the substantial annual fees, interest charges, and penalty costs that plague traditional business credit cards.

Prepaid cards operate on a straightforward fee structure without hidden APRs, late payment charges, or over-limit penalties that can devastate small business cash flow.

Your business maintains complete cost predictability while avoiding the debt accumulation risks associated with credit facilities.

This transparent pricing model allows you to allocate resources more effectively toward growth initiatives rather than servicing expensive banking products.

Tailored limits for growing teams

Benefits of prepaid cards include customizable limits that adapt to your expanding workforce and changing operational requirements.

You can assign different spending thresholds to various team members based on their roles and responsibilities, ensuring appropriate budget control across departments.

As your business grows, you can easily adjust these limits without renegotiating credit agreements or undergoing additional approval processes.

This flexibility proves essential for managing seasonal fluctuations, project-based spending, and the dynamic nature of small business operations.

Seamless accounting integration

Your prepaid card transactions sync with popular accounting software like Xero, QuickBooks, and Sage, eliminating manual entry and reducing errors.

Real-time transaction categorization streamlines expense tracking and simplifies VAT preparation for your business.

Digital receipts and automated expense reporting save countless hours during monthly reconciliation processes.

This integration ensures accurate financial records while freeing up valuable time for strategic business activities rather than administrative tasks that drain productivity.

Pay freelancers and vendors easily

You can make immediate payments to freelancers, suppliers, and service providers without the delays and complications of traditional bank transfers.

Prepaid cards enable instant transactions that improve supplier relationships and ensure timely service delivery.

Your business maintains better cash flow control by eliminating the need for checks or complex payment approval processes.

This payment flexibility is valuable for project-based businesses that rely on contractors and need strong relationships through prompt payment practices.

Benefits of prepaid cards for risk-free, compliant spending

Prepaid cards deliver comprehensive protection against financial fraud while ensuring your business stays compliant with UK regulations. You can set spending limits, control merchant categories, and receive instant notifications for every transaction.

These cards eliminate the risk of overspending since they're loaded with predetermined amounts, preventing unauthorized purchases that could compromise your business. Real-time monitoring and automatic controls create a secure spending environment that protects your company's financial integrity.

1. HMRC-ready records for all transactions

Your prepaid card system automatically generates detailed transaction records that meet HMRC requirements for VAT and tax reporting. Every purchase creates a digital receipt with merchant details, amounts, and timestamps that you can easily export for your accounting systems.

This eliminates manual record-keeping and ensures you never miss crucial documentation during tax season. The automated logging system captures all necessary information for seamless VAT reclaim processes and comprehensive audit trails.

2. Policy-based spend enforcement

You can configure your prepaid cards to automatically enforce company spending policies through customizable controls and restrictions. Set specific merchant category limits, block certain types of purchases, and establish daily or monthly spending thresholds that align with your business guidelines.

These built-in controls prevent policy violations before they occur, eliminating the need for manual oversight and post-purchase corrections. Your team can spend confidently knowing every transaction automatically complies with established company rules.

3. PCI-DSS and GDPR aligned

Benefits of prepaid debit cards include advanced security features that ensure full compliance with PCI-DSS payment standards and GDPR data protection requirements. Your card data is protected through industry-leading encryption protocols, secure tokenization, and multi-layered authentication systems.

Personal and financial information remains completely secure throughout every transaction, meeting strict European data protection standards. These comprehensive security measures protect both your business and employees from data breaches and identity theft.

4. Real-time alerts and card control

You receive instant notifications for every transaction, giving you complete visibility and control over your company's spending activities. The system sends immediate alerts via email or SMS when cards are used, allowing you to spot unauthorized transactions within seconds.

You can instantly freeze or block cards remotely through your management dashboard, preventing further unauthorized use. This real-time monitoring capability ensures you maintain complete control over your business expenses at all times.

5. Financial transparency for audits

Your prepaid card system provides comprehensive, audit-friendly reports that simplify financial reviews and compliance checks. Every transaction is automatically categorized and stored in detailed reports that auditors can easily review and verify.

The system generates clear spending summaries, merchant breakdowns, and employee activity reports that demonstrate complete financial transparency. These detailed records reduce audit preparation time and provide the documentation needed for regulatory compliance and internal financial reviews.

Comparing prepaid cards to other business payment methods

When choosing the right payment solution for your business, you need to weigh the advantages and limitations of each option. Understanding how prepaid cards stack up against traditional payment methods helps you make informed decisions that align with your company's financial goals and operational needs.

Prepaid vs credit cards

Benefits of prepaid cards become evident when you consider the approval process and financial requirements. Unlike credit cards, prepaid cards don't require credit checks, personal guarantees, or extensive financial documentation.

You can obtain them regardless of your business credit score or history. This eliminates the risk of accumulating debt since you can only spend what you've preloaded. Additionally, prepaid cards won't impact your credit utilization ratio, making them ideal for businesses looking to preserve their credit profile while maintaining payment flexibility.

Prepaid vs debit cards

Traditional business debit cards require you to link directly to your primary business bank account, exposing your entire account balance to potential fraud or unauthorized access. Prepaid cards offer superior security by creating a buffer between your main accounts and daily spending.

You maintain complete control over fund allocation without risking your core business capital. This separation also simplifies expense tracking and budgeting, as you can designate specific prepaid cards for different departments or projects while keeping your main banking relationships secure and separate.

Prepaid vs cash

Cash transactions leave you vulnerable to theft, loss, and provide no digital trail for accounting purposes. Prepaid cards offer you trackable, secure, and fully auditable payment solutions that integrate seamlessly with your financial management systems. Every transaction generates detailed records with timestamps, merchant information, and spending categories.

You can instantly view balances, transaction history, and spending patterns through online portals or mobile apps. This digital footprint simplifies expense reporting, tax preparation, and financial analysis while eliminating the security risks associated with carrying large amounts of cash.

Fees and maintenance costs

Benefits of prepaid cards extend to their cost-effective fee structure compared to traditional corporate credit cards. You'll typically encounter lower monthly maintenance fees, reduced transaction costs, and fewer penalty charges. Many prepaid card programs offer transparent pricing without hidden fees, annual charges, or interest rates.

The predictable cost structure helps you budget more effectively while avoiding surprise expenses. Additionally, you can often negotiate volume discounts or custom fee arrangements based on your usage patterns, making prepaid cards particularly attractive for businesses seeking to optimize their payment processing costs.

Flexibility and real-time spend control

Benefits of prepaid debit cards shine when you need to empower your team without losing oversight of company spending. You can instantly load funds, set spending limits, and restrict merchant categories in real-time through management dashboards. This granular control allows you to delegate purchasing authority while maintaining strict budget parameters.

Team members can make necessary purchases immediately without waiting for approvals, while you monitor every transaction as it occurs. The ability to freeze cards instantly, adjust limits on demand, and receive immediate spending alerts ensures you maintain complete financial control while providing your team with the flexibility they need to operate efficiently.

Everyday use cases of prepaid cards for UK companies

You can streamline your business operations across multiple departments by implementing prepaid cards strategically. These versatile payment tools offer controlled spending, real-time tracking, and simplified expense management.

From travel bookings to contractor payments, prepaid cards eliminate the need for complex reimbursement processes while maintaining full oversight of your company's expenditures across various teams and projects.

Employee travel & events

You can issue dedicated prepaid cards to travelling employees for seamless hotel bookings, restaurant meals, and public transport expenses. This eliminates the need for personal credit card advances and lengthy reimbursement processes.

Your team members gain spending autonomy while you maintain complete visibility over travel budgets, with real-time transaction monitoring and automatic spending limits ensuring costs stay within approved parameters.

Paying non-PAYE workers

You can simplify payments to contractors, freelancers, and gig workers by loading prepaid cards with agreed-upon fees. This approach eliminates bank transfer delays and reduces the administrative overhead associated with traditional payment methods.

Your finance team saves time on processing individual invoices while contractors receive immediate access to their earnings, improving working relationships and cash flow management for both parties.

Managing marketing budgets

You can preload marketing cards for PPC campaigns, social media advertising, and influencer collaboration fees. Benefits of prepaid cards include preventing overspend on digital marketing platforms and enabling quick campaign adjustments without lengthy approval processes.

Your marketing team gains flexibility to respond to opportunities while you maintain strict budget controls through predetermined spending limits and category restrictions.

Tools & SaaS subscriptions

You can assign vendor-specific prepaid cards for recurring software payments, cloud services, and digital tool subscriptions. This approach prevents service interruptions due to expired corporate cards while providing clear spending attribution for each department.

Your IT team manages software renewals efficiently while finance maintains complete visibility over technology expenditures, reducing the risk of forgotten subscriptions and duplicate payments.

Backup funds for field teams

You can empower remote workers and field teams with emergency spending access through prepaid cards loaded with contingency funds. This ensures your mobile workforce can handle unexpected expenses like equipment repairs, emergency accommodation, or urgent transport needs.

Your field teams operate with confidence while you maintain spending controls through real-time notifications and adjustable limits based on specific operational requirements.

Prepaid card challenges and how to solve them

Even with their advantages, prepaid cards can present certain obstacles for businesses. Understanding these challenges and implementing the right solutions will help you maximize the benefits of prepaid card programs while minimizing potential disruptions to your operations.

Merchant acceptance limits

Not all merchants accept prepaid cards, which can limit where your employees can make purchases. This restriction may force them to use alternative payment methods or seek reimbursement later.

To minimize this issue, choose widely accepted prepaid cards that carry major network logos. Research your industry's common vendors and suppliers to ensure your selected cards work at essential business locations.

Consider always having reliable backup payment options available for critical situations where prepaid cards aren't accepted by vendors or service providers.

Potential reloading costs

Frequent card reloading can become expensive due to transaction fees, monthly maintenance charges, or reload penalties. These costs can quickly accumulate and impact your budget efficiency.

Frequent card reloading can become expensive due to transaction fees, monthly maintenance charges, or reload penalties. These costs can quickly accumulate and impact your budget efficiency.

Compare providers' fee schedules and negotiate better rates based on usage volume. Look for cards with no reload fees, and consider automatic reloading to reduce manual costs.

Constant need for staff training

Employees may struggle with card activation, spending limits, transaction procedures, or reporting requirements without proper guidance. This learning curve can lead to mistakes or compliance issues.

Benefits of prepaid card programs are only realized when staff understand how to use them effectively. Offer comprehensive onboarding sessions covering card rules, spending policies, and available tools.

Create easy-to-follow guides and provide ongoing support through help desks or online resources. Regular training updates ensure employees stay current with program changes.

ERP or payroll integration gaps

Many prepaid cards don't seamlessly integrate with existing enterprise resource planning or payroll systems, creating manual data entry work and potential errors. This disconnect can complicate expense tracking, reporting, and reconciliation processes.

Select cards that offer robust API connections or direct integration capabilities with your current accounting and payroll tools. Work with providers who support popular business software platforms and can facilitate smooth data synchronization.

Consider the long-term compatibility of your chosen solution with planned system upgrades or changes to ensure smooth integration and future business scalability.

Manual oversight for multiple cards

Managing numerous prepaid cards manually becomes time-consuming and error-prone as your program scales. Tracking spending, monitoring balances, and ensuring compliance across multiple cards requires significant administrative effort.

Use specialized software platforms to automate expense visibility and control across your entire card portfolio. These tools provide real-time spending alerts, automated reporting, and centralized management dashboards.

Implement approval workflows and spending controls that reduce the need for constant manual monitoring while maintaining appropriate oversight and governance.

Best practices to maximize prepaid card ROI

Running an efficient prepaid card programme requires strategic implementation and ongoing management. These proven practices will help you optimize your return on investment while maintaining control over company spending.

Implement role-based spend limits

Configure spending limits based on employee roles and departments to maintain budget control while enabling productivity. Senior managers might receive higher limits for client entertainment, while junior staff get smaller amounts for daily expenses.

This approach prevents overspending while ensuring each team member has appropriate access to funds. Benefits of prepaid cards include this granular control that traditional expense accounts can't match, allowing you to align spending power with actual job responsibilities and reducing the risk of unauthorized purchases.

Audit weekly and flag anomalies

Establish a routine of reviewing all transactions weekly to identify unusual spending patterns or policy violations. Set up automated alerts for transactions exceeding predetermined thresholds or occurring outside business hours.

This proactive monitoring helps catch fraudulent activity early and ensures compliance with company policies. Regular audits also provide valuable insights into spending trends, helping you refine your programme over time and maintain accurate financial records for better decision-making.

Automate routine top-ups

Create automated funding rules that replenish card balances when they fall below specified thresholds. This eliminates the administrative burden of manual top-ups while ensuring employees never face disruptions due to insufficient funds.

Set different trigger points for various card types perhaps auto-funding when balances drop below $100 for regular employee cards or £500 for management cards. Automation reduces processing time, prevents delays in critical business activities, and maintains consistent cash flow management.

Use tags and categories

Implement a comprehensive tagging system to categorize all transactions by department, project, or expense type. This systematic approach transforms chaotic expense data into organized, actionable insights. Train employees to use consistent tags when making purchases, and consider setting up merchant category codes for automatic categorization.

Benefits of prepaid cards shine through this feature, as digital categorization makes reconciliation faster and more accurate than traditional receipt-based systems, enabling better budget tracking and simplified financial reporting.

Centralize spend reviews in one dashboard

Consolidate all prepaid card activity into a single management dashboard that provides real-time visibility across your entire programme. This centralized approach eliminates the need for multiple spreadsheets and manual data compilation.

Your dashboard should display key metrics like total spend, remaining balances, top merchants, and spending trends by department. Having everything in one place enables faster decision-making, reduces administrative overhead, and provides the comprehensive oversight needed to optimize your prepaid card programme's performance and ROI.

Go beyond prepaid cards with Volopay's spend platform

While the benefits of prepaid cards are clear, your business deserves more than just payment tools. Volopay's comprehensive spend platform transforms how you manage company expenses with an all-in-one solution that goes far beyond traditional cards.

You get intelligent approval workflows that streamline expense authorization, real-time analytics that provide instant spending insights, and automated accounting capabilities that eliminates manual reconciliation.

Our scalable infrastructure grows with your business, while our dedicated live support team ensures you're never left waiting for help. With enterprise-level security and full UK compliance, Volopay delivers the robust, integrated spend management platform your growing business needs to stay ahead.

Volopay's commitment to simplicity and support for UK finance teams

Managing corporate spend shouldn't feel like rocket science. That's why Volopay puts you first with intuitive tools that work seamlessly from day one. Our advanced prepaid cards give you complete control over company expenses while eliminating the headaches of traditional corporate banking.

Whether you're tracking petty cash or managing departmental budgets, you get real-time visibility and automated processes that actually make your job easier.

Rapid onboarding, no IT setup needed

Get your team up and running in minutes, not months. Volopay's cloud-first platform requires zero complex IT configurations or lengthy implementation periods. Simply sign up, verify your business details, and start issuing cards.

No server installations, no database migrations, no technical consultants required. Your finance team can begin controlling spend and gaining visibility today, without waiting for IT approvals or system integrations that slow down other solutions.

Live UK-based support that knows your business

When you need help, you'll speak with real finance professionals who understand UK business regulations, VAT requirements, and local banking nuances. Our support team isn't reading from scripts.

They're experts who know the challenges of managing corporate expenses in today's business environment. Get answers via live chat or phone calls from people who actually understand your compliance needs and operational realities.

Built for finance, loved by teams

Volopay strikes the perfect balance between powerful finance features and user-friendly design. Finance teams get sophisticated controls, automated reconciliation, and detailed real-time reporting capabilities that they need for accurate bookkeeping.

Yet the interface remains so intuitive that marketing managers, operations staff, and field teams can use it without training sessions or complicated procedures. The result? Universal adoption across your organization, not just grudging compliance from frustrated users who avoid the system whenever possible.

Why UK businesses trust Volopay for scalable spend control

When you're managing business expenses, you need solutions that grow with your company. Volopay delivers the benefits of prepaid debit cards through a comprehensive platform that scales from startup to enterprise. Our integrated approach combines expense management, corporate cards, and real-time controls, giving you complete visibility over every transaction.

With customizable approval processes, you maintain oversight while empowering your team to make necessary purchases efficiently.

Volopay-specific section to highlight long-term value.

Transform your spend management from reactive to proactive. Volopay's platform evolves with your business needs, delivering measurable ROI through reduced processing costs and improved financial control.

From seed to scale — one platform

Whether you're 5 or 500 employees, Volopay adapts seamlessly to your business size. Our platform scales effortlessly, supporting everything from simple expense tracking for small teams to complex multi-department workflows for large enterprises.

You won't outgrow our solution or need costly migrations. Add users, create new approval chains, and implement advanced policies as your company expands, all within the same intuitive interface.

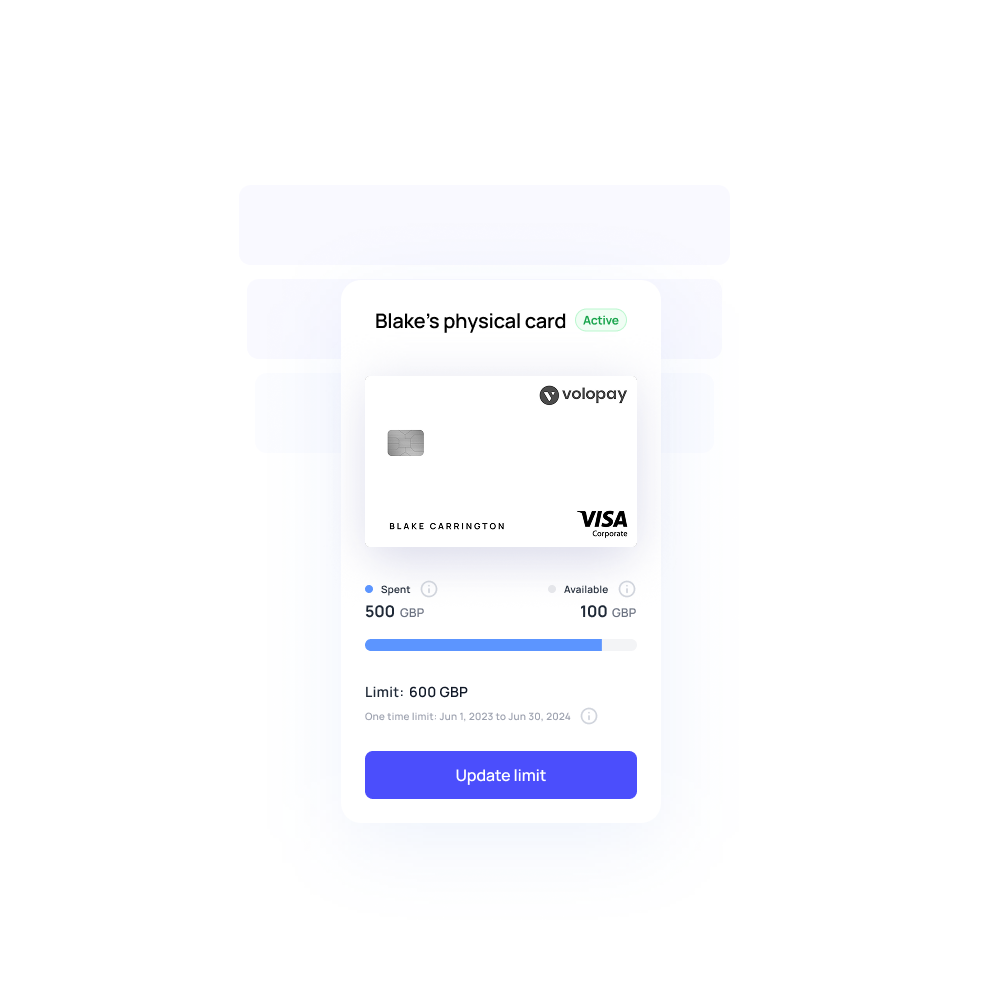

Corporate cards — virtual or physical, always controlled

Issue virtual cards for online spend or physical ones for travel instantly. Set rules by team, role, or vendor to stay in control while enabling flexible employee access. Real-time spending limits, merchant restrictions, and automatic categorization ensure every transaction aligns with your budget.

Your team gets the purchasing power they need, while you maintain complete oversight and prevent unauthorized expenses before they happen.

Built for multi-entity, multi-currency teams

Support for GBP, EUR, USD, and entity-level views makes international operations seamless. Whether you're managing subsidiaries across Europe or handling cross-border transactions, Volopay provides consolidated reporting with granular visibility.

Multi-currency support eliminates foreign exchange confusion, while entity-level controls ensure compliance with local regulations. Your global financial operations become as manageable as domestic ones, with unified oversight and streamlined processes.

Transparent pricing, no surprise fees

Straightforward cost structure ideal for growing UK firms. The benefits of prepaid debit cards include predictable costs without hidden transaction fees or monthly surprises. Our pricing scales with your usage, ensuring you only pay for what you need.

No setup fees, no maintenance charges, and no penalties for growth. This transparency allows accurate budgeting and cost forecasting, essential for businesses focused on sustainable expansion and financial planning.

Backed by FCA-regulated issuers

Cards issued under UK financial oversight provide the security and compliance your business demands. Our partnership with FCA-regulated institutions ensures your funds are protected and transactions meet stringent regulatory standards.

This backing provides peace of mind for finance teams while maintaining the flexibility needed for modern business operations. Your corporate spending benefits from banking-grade security without sacrificing speed or convenience.

Trusted by finance teams across industries

From tech startups to logistics giants Volopay fits all business models and industries. Our platform adapts to sector-specific needs, whether you're managing R&D expenses, field operations, or client entertainment.

Finance teams across diverse industries rely on Volopay for its flexibility, reliability, and comprehensive reporting capabilities. Join thousands of UK businesses that have streamlined their expense management and gained better financial control.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs about the benefits of prepaid cards in the UK

Prepaid cards offer superior expense control since spending is limited to loaded amounts, preventing debt accumulation. They provide real-time visibility, simplified budgeting, and reduced fraud risk compared to traditional credit cards for business operations.

Most small UK businesses can qualify for Volopay's prepaid cards with minimal requirements. The application process typically involves basic business verification, making it accessible for startups, SMEs, and established companies seeking better expense management solutions.

Yes, reputable prepaid card providers ensure HMRC compliance by maintaining detailed transaction records, providing necessary documentation for tax purposes, and supporting VAT reclaim processes. This helps businesses meet regulatory requirements while managing expenses efficiently.

No, employees cannot overspend on prepaid cards since transactions are declined when the loaded balance is insufficient. This built-in spending control eliminates overspending risks and helps businesses maintain strict budget adherence across all employee expenses.

Lost or stolen prepaid cards can be immediately blocked through online platforms or mobile apps, preventing unauthorized access. Replacement cards are typically issued quickly, and remaining balances are transferred, ensuring minimal business disruption and financial protection.