What is a purchasing card? A guide for UK businesses

The UK business landscape is experiencing a fundamental shift in how organizations manage their procurement processes and business expenses.

As companies across the United Kingdom seek more efficient ways to control spending and streamline operations, purchasing cards have emerged as a game-changing solution that's revolutionizing corporate finance management.

What is a purchasing card (P-card)?

A purchasing card, commonly known as a P-card, is a specialized payment card designed specifically for business procurement activities. Unlike traditional corporate credit cards, a P-card serves as a targeted financial tool that enables employees to make authorized business purchases while maintaining strict spending controls and comprehensive oversight.

When you ask "what is a purchasing card," you're essentially looking at a sophisticated payment instrument that combines the convenience of plastic money with robust expense management capabilities.

Your P-card functions as both a payment method and a control mechanism, allowing your organization to set specific spending limits, restrict merchant categories, and track every transaction in real-time.

The primary purpose of a purchasing card extends beyond simple payment processing. Your P-card serves as a strategic tool for managing decentralized purchasing, reducing administrative overhead, and improving cash flow management.

By implementing a P-card system, you're essentially creating a streamlined procurement process that eliminates the need for traditional purchase orders, invoices, and reimbursement procedures for routine business expenses.

Why UK businesses are adopting P-cards?

The adoption of corporate purchasing cards across the UK has accelerated dramatically in recent years, driven by several compelling factors that align with modern business needs. Your organization likely faces similar challenges that make procurement cards an attractive solution for managing business expenses.

Digital transformation has become a cornerstone of UK business strategy, with companies seeking to eliminate paper-based processes and manual administrative tasks. When you implement a P-card system, you're embracing this digitalization trend by replacing cumbersome purchase requisitions and approval workflows with instant, controlled spending capabilities.

How they differ from traditional methods

Understanding what is a purchasing card becomes clearer when you compare it to traditional payment methods. Your P-card offers distinct advantages over conventional approaches to business expenses and procurement.

Traditional reimbursement systems require employees to pay out-of-pocket and submit expense reports, creating cash flow challenges and administrative burdens. With a purchasing card, you eliminate these issues by providing direct access to company funds while maintaining complete control over spending authorization.

How do P-cards work in a business?

Understanding how a purchasing card functions within your organization requires examining the complete workflow from initial setup to final reconciliation.

Your P-card system operates through a structured process that ensures spending control while maximizing operational efficiency.

Card issuance and controls

When implementing a P-card program, your finance team begins by establishing spending parameters and user profiles. Each purchasing card is generated with specific controls tailored to individual roles and departments. You can set daily, weekly, or monthly spending limits, restrict merchant categories, and define geographical usage boundaries.

Your P-card issuance process typically involves employee authorization through HR and finance approval. Once approved, the procurement card is activated with predetermined controls that align with your company's spending policies. These controls ensure that every P-card transaction falls within authorized parameters, providing automatic compliance monitoring.

Authorised use and spending

Your employees can use their purchasing card for pre-approved business expenses such as office supplies, travel bookings, equipment purchases, and vendor payments. Each P-card transaction is tracked in real-time, capturing merchant details, purchase amounts, and transaction timestamps.

When you make a purchase using your purchasing card, the system automatically validates the transaction against established controls. If the purchase exceeds limits or violates merchant restrictions, the transaction is declined instantly. This real-time monitoring ensures that every P-card usage aligns with company policies without requiring pre-approval for routine purchases.

Integration with accounting systems

Your P-card data seamlessly integrates with existing accounting software, eliminating manual data entry and reducing reconciliation time. Most corporate purchasing card systems offer direct API connections to popular accounting platforms, ensuring that transaction data flows automatically into your general ledger.

When you ask "What is a purchasing card" in terms of accounting efficiency, you're looking at a system that automatically categorizes expenses, applies appropriate cost center codes, and generates detailed spending reports without manual intervention.

Reconciliation and reporting

Your P-card reconciliation process occurs automatically through integrated systems that match transactions with receipts and supporting documentation. Employees typically upload receipts through mobile apps or web portals, which the system then matches to corresponding purchasing card transactions.

Monthly reporting provides comprehensive spending analysis, showing departmental usage, vendor relationships, and compliance metrics. Your procurement card system generates detailed reports that support budget planning, vendor negotiations, and policy adjustments, making the entire procurement process more transparent and manageable.

Benefits of P-cards for UK businesses

Implementing a purchasing card system delivers transformative advantages that address common financial management challenges faced by UK organizations.

Your P-card program creates measurable improvements across multiple business operations while reducing administrative burden and enhancing financial control.

1. Reduce petty cash and manual reimbursements

Your purchasing card eliminates the need for maintaining petty cash floats and processing employee reimbursement claims. Traditional systems require employees to pay out-of-pocket for business expenses, then submit receipts for reimbursement, creating cash flow strain and administrative overhead.

With a P-card system, your employees access company funds directly for authorized purchases, eliminating personal financial exposure. This shift reduces your finance team's workload by removing the need to process expense claims, verify receipts, and issue reimbursement payments.

Your organization saves significant time and resources while improving employee satisfaction by removing the burden of fronting business expenses. The reduction in manual processing also minimizes errors and fraud risks associated with traditional reimbursement systems, providing better financial accuracy and control.

2. Improve cash flow management

Your corporate purchasing card provides superior cash flow predictability compared to traditional payment methods. Instead of managing multiple vendor payment schedules and processing numerous invoices, your P-card consolidates purchases into a single monthly statement with predictable payment terms.

This consolidation allows you to optimize working capital by extending payment cycles while maintaining positive vendor relationships. Your purchasing card typically offers 30-45 day payment terms, improving your organization's cash position compared to immediate payments required by traditional procurement methods.

Enhanced cash flow visibility enables better financial planning and budgeting, as you can track spending patterns in real-time rather than waiting for monthly invoices to arrive.

3. Centralised spend visibility

What is a purchasing card's greatest advantage? Complete spending transparency across your entire organization. Your P-card system provides real-time visibility into all procurement activities, enabling immediate identification of spending trends, budget variances, and cost-saving opportunities.

This centralized visibility eliminates spending blind spots that exist with decentralized procurement methods. You can monitor departmental spending, track vendor relationships, and identify duplicate purchases or maverick spending that undermines negotiated contracts.

Your procurement card data integrates with business intelligence tools, providing detailed analytics that support strategic decision-making and budget optimization.

4. Enhanced spend controls

Your P-card system implements automated controls that prevent unauthorized spending before it occurs. Unlike traditional methods that rely on post-purchase approvals, your purchasing card enforces spending policies at the point of transaction.

These controls include merchant category restrictions, spending limits, and geographical boundaries that ensure compliance with company policies. Your system can block transactions that violate established parameters, preventing policy breaches and unauthorized expenses.

Real-time alerts notify managers of unusual spending patterns or policy violations, enabling immediate corrective action.

5. Strengthened vendor relationships

Your procurement card improves vendor relationships by ensuring prompt payment and reducing the administrative burden on suppliers.

Vendors receive payment according to card terms rather than waiting for lengthy invoice processing cycles. This reliability strengthens your negotiating position for better terms, discounts, and service levels.

Your purchasing card also provides vendors with guaranteed payment security, often resulting in improved pricing and priority service delivery.

Benefits of P-cards for employees and teams in the UK

Your purchasing card system transforms the employee experience by eliminating traditional procurement frustrations and empowering teams with direct access to company resources. When employees understand what is a purchasing card and its capabilities, they gain significant operational advantages that enhance productivity and job satisfaction.

Faster access to funds

Your P-card eliminates the lengthy approval processes and reimbursement delays that plague traditional expense management. Instead of submitting purchase requests and waiting for approvals, your employees can make authorized purchases immediately using their purchasing cards.

This immediate access proves particularly valuable for urgent business needs, travel expenses, and time-sensitive procurement activities. Your team members no longer need to use personal funds and wait weeks for reimbursement, removing financial stress and improving employee satisfaction.

The speed advantage extends to emergency purchases where traditional approval workflows would create operational delays. Your purchasing card enables rapid response to business needs while maintaining spending control through automated limits and restrictions.

Clarity on approved spend categories

Your P-card system provides clear spending guidelines by restricting merchant categories and purchase types at the card level. This built-in clarity eliminates confusion about what expenses are covered under company policy, reducing the risk of declined reimbursements or policy violations.

Your employees receive immediate feedback when attempting unauthorized purchases, as the procurement card system automatically blocks transactions that fall outside approved categories. This real-time validation prevents policy breaches and provides instant clarity on spending boundaries.

Mobile access and real-time updates

Your corporate purchasing card integrates with mobile applications that provide instant transaction notifications and spending updates. Your employees can track their purchases, upload receipts, and monitor spending limits directly from their smartphones.

This mobile access enables immediate expense documentation and receipt management, eliminating the risk of lost receipts or forgotten transactions. Your team members gain complete visibility into their P-card usage, supporting better budget management and expense tracking throughout the month.

P-cards vs. other payment methods

Understanding when to choose a purchasing card over alternative payment methods helps you optimize your organization's financial processes.

Your P-card offers distinct advantages in specific scenarios, making it essential to compare these options systematically.

1. P-cards vs. corporate cards

● P-card

Your P-card provides superior spending control compared to traditional corporate cards through granular merchant restrictions and automated compliance monitoring. Your purchasing card enforces specific procurement policies at the transaction level, preventing unauthorized purchases before they occur.

● Corporate card

Corporate cards offer general spending flexibility. Traditional corporate cards typically require manual expense categorization and post-purchase approvals, creating administrative overhead.

Visibility represents another key differentiator. What is a purchasing card's advantage over corporate cards? Complete procurement transparency with real-time spending analytics specifically designed for business purchasing rather than general expense management. Your purchasing card automatically captures detailed transaction data with proper expense coding, eliminating manual processing requirements.

2. P-cards vs. employee reimbursements

● P-card

P-card eliminates significant inefficiencies and fraud risks. Your purchasing card removes reimbursement fraud risks by eliminating manual receipt processing and expense claim verification. The automated transaction capture and real-time validation prevent common reimbursement issues like duplicate claims, inflated expenses, or fictitious receipts.

● Employee reimbursements

Employee reimbursement systems create significant inefficiencies and fraud risks. Traditional reimbursements require employees to pay out-of-pocket, submit expense reports, and wait for processing, creating cash flow challenges and administrative burden.

3. P-cards vs. traditional procurement systems

● P-card

Your P-card streamlines routine procurement by eliminating paperwork and approval workflows for authorized spending categories. When you ask "What is a purchasing card" in procurement contexts, you're looking at a solution that transforms £50 office supply purchases from multi-step approval processes into instant transactions with automatic compliance monitoring.

● Traditional procurement systems

Traditional procurement systems involving purchase orders, invoices, and three-way matching prove inefficient for low-value purchases.

Advanced features of modern P-card platforms

Modern purchasing card platforms deliver sophisticated capabilities that transform traditional procurement processes into streamlined, automated systems.

Your P-card solution incorporates cutting-edge features that provide unprecedented control and visibility over organizational spending.

Instant card generation

Your P-card platform enables immediate virtual card creation for urgent business needs or temporary employees. This instant generation capability allows you to issue purchasing cards within minutes rather than waiting days for physical card delivery.

Virtual P-cards provide the same controls and functionality as physical cards while offering enhanced security through single-use or time-limited activation. Your organization can respond instantly to procurement needs without compromising spending oversight or policy compliance.

Role-based access and approvals

Your purchasing card system implements sophisticated user hierarchies that align spending authority with organizational roles. Department heads receive different P-card controls than junior employees, ensuring appropriate spending limits match responsibility levels.

This role-based approach enables automated approval workflows where larger purchases require manager authorization, while routine expenses process automatically. Your procurement card adapts to organizational structures, providing flexible control mechanisms that scale with business growth.

Spend caps and merchant restrictions

Advanced P-card platforms offer granular spending controls, including daily, weekly, and monthly limits combined with specific merchant category restrictions. Your purchasing card can prevent transactions at unauthorized retailers while allowing approved business purchases.

These restrictions prevent policy violations automatically, eliminating the need for post-purchase corrections or policy enforcement discussions. Your corporate purchasing card becomes a proactive compliance tool rather than a reactive expense monitoring tool.

Real-time spend alerts and controls

Your P-card system provides instant notifications when spending approaches limits or violates established policies. These real-time alerts enable immediate corrective action before budget overruns occur.

Automated controls can temporarily suspend cards when suspicious activity is detected, protecting your organization from fraudulent transactions while maintaining operational efficiency for legitimate business purchases.

Integration with procurement and ERP systems

What is a purchasing card's greatest technical advantage? Seamless integration with existing business systems, including procurement platforms, ERP software, and accounting systems.

Your P-card data flows automatically into financial reporting, eliminating manual data entry and reducing reconciliation time while ensuring complete audit trails and compliance documentation.

How to set up a P-card program in the UK

Implementing a successful purchasing card program requires systematic planning and execution tailored to UK regulatory requirements and business practices.

Your P-card implementation journey involves strategic decisions that will impact long-term program success and organizational efficiency.

Assess current procurement processes

Your P-card program begins with a comprehensive analysis of existing spending patterns and procurement workflows. Document current payment methods, identify pain points in reimbursement processes, and quantify administrative costs associated with traditional procurement activities.

Review your organization's spending data to determine optimal P-card transaction volumes and categories. Analyze supplier relationships, payment terms, and cash flow patterns to understand how a purchasing card will impact existing financial arrangements.

Evaluate current approval hierarchies and spending authorities to inform P-card policy development. Understanding what is a purchasing card role in your specific organizational context ensures proper program design and stakeholder buy-in.

Select a UK-compliant provider

Choose a P-card provider that meets UK regulatory requirements, including FCA authorization, GDPR compliance, and local customer support capabilities. Your purchasing card provider should offer sterling-denominated cards and understand UK business practices and tax requirements.

Evaluate provider features, including spending controls, reporting capabilities, and integration options with UK accounting software. Consider providers with established relationships with UK suppliers and merchants to ensure broad acceptance and optimal transaction processing.

Request detailed pricing structures including transaction fees, monthly charges, and implementation costs. Your corporate purchasing card provider should offer transparent pricing without hidden fees that could impact program ROI.

Define card policies and approval flows

Develop comprehensive P-card policies that specify authorized spending categories, transaction limits, and approval requirements. Your purchasing card policies should align with existing company procedures while leveraging automated controls to reduce administrative overhead.

Establish spending limits based on employee roles and departmental budgets. Define merchant category restrictions that prevent unauthorized purchases while enabling the efficient procurement of approved business expenses.

Create clear approval workflows for exception handling and limit increases. Your P-card policies should specify consequences for policy violations and procedures for addressing declined transactions or spending disputes.

Integrate with finance and HR tools

Connect your purchasing card system with existing accounting software to enable automatic transaction coding and reconciliation. Integration with your ERP system ensures P-card data flows seamlessly into financial reporting and budget tracking processes.

Coordinate with HR systems to align P-card issuance with employee onboarding and termination procedures. Your procurement card program requires automated processes for card activation, suspension, and cancellation based on employment status changes.

Implement expense management integration that matches P-card transactions with digital receipts and supporting documentation. This integration streamlines the reconciliation process while maintaining complete audit trails.

Train users and monitor performance

Provide comprehensive training for P-card holders covering authorized usage, policy requirements, and receipt management procedures. Your purchasing card training should emphasize the benefits of immediate access to funds while reinforcing spending control responsibilities.

Train finance team members on P-card administration, reporting capabilities, and exception handling procedures. Ensure administrators understand how to modify spending limits, generate reports, and respond to policy violations.

Establish ongoing monitoring procedures that track program performance, identify cost savings opportunities, and ensure continued policy compliance. Regular program review ensures your P-card system continues delivering optimal results while adapting to changing business needs.

Compliance and security for P-cards in the UK

Your purchasing card program must meet stringent UK regulatory requirements and security standards to protect organizational data and ensure legal compliance.

Understanding these compliance frameworks provides confidence in P-card implementation and ongoing operations.

FCA registration and UK regulation

Your P-card provider must hold appropriate Financial Conduct Authority authorization to issue payment cards and process transactions within the UK market. This FCA registration ensures your purchasing card program operates under proper regulatory oversight and consumer protection frameworks.

UK-compliant P-card providers maintain adequate capital reserves, follow prescribed governance standards, and submit regular regulatory reporting. Your corporate purchasing card program benefits from these regulatory protections, ensuring provider stability and operational continuity.

Choose providers that understand UK-specific requirements, including VAT handling, statutory reporting obligations, and employment law considerations that impact P-card usage and expense management processes.

PCI DSS and payment security

Your purchasing card system must comply with Payment Card Industry Data Security Standards (PCI DSS) that govern card data protection and transaction processing security. These standards ensure your P-card transactions benefit from industry-leading security measures.

PCI DSS compliance includes encrypted data transmission, secure card storage, and regular security audits that protect against data breaches and fraudulent transactions. Your P-card provider implements tokenization and other advanced security measures that eliminate sensitive card data exposure.

Multi-factor authentication and real-time fraud monitoring provide additional security layers that protect your organization from unauthorized P-card usage while maintaining operational efficiency for legitimate business purchases.

GDPR and user data handling

What is a purchasing card's data protection responsibility? Your P-card system must comply with General Data Protection Regulation requirements for collecting, storing, and processing employee personal information and transaction data.

GDPR compliance includes obtaining proper consent for data collection, implementing data retention policies, and providing employee rights regarding personal information access and deletion.

Your procurement card provider must demonstrate appropriate data protection measures, including encryption, access controls, and breach notification procedures that safeguard sensitive organizational and employee information throughout the P-card program lifecycle.

Fees associated with P-cards

Understanding the complete cost structure of your purchasing card program ensures accurate ROI calculations and prevents unexpected expenses that could impact program profitability.

Your P-card investment requires careful evaluation of all potential charges and fee structures.

1. Monthly or annual platform fees

Your P-card provider typically charges monthly platform fees ranging from £5–15 per card, depending on features and transaction volumes. These fees cover system access, reporting capabilities, and customer support services that maintain your purchasing card program operations.

Some providers offer annual payment discounts or tiered pricing based on total card volumes within your organization. Your corporate purchasing card costs may decrease significantly with volume commitments or multi-year agreements that provide predictable pricing structures.

Enterprise-level P-card programs often include implementation fees ranging from £1,000–5,000 covering system setup, integration services, and initial user training. These one-time costs should be factored into your total program investment calculations.

2. Foreign transaction and FX charges

International P-card usage incurs foreign exchange charges typically ranging from 2.5–3.5% above prevailing exchange rates. Your purchasing card may also include fixed foreign transaction fees of £1-3 per international purchase, regardless of transaction amount.

When evaluating what is a purchasing card international cost impact, consider your organization's global spending patterns and supplier relationships. Frequent international transactions can significantly increase program costs through accumulated FX charges and foreign transaction fees.

Some P-card providers offer preferential exchange rates for high-volume international spending or multi-currency card options that reduce foreign transaction costs for organizations with substantial overseas procurement activities.

3. Inactivity and late payment penalties

Your P-card program may include monthly inactivity fees ranging from £2–5 for cards with no transactions during specified periods. These charges encourage active card usage while penalizing dormant accounts that provide no program value.

Late payment penalties on outstanding P-card balances typically range from 1–3% monthly, significantly impacting program costs if payment schedules aren't properly managed. Your procurement card program requires disciplined payment processes to avoid these unnecessary charges.

Additional penalty fees may include overlimit charges, declined transaction fees, and expedited card replacement costs that can accumulate quickly without proper program management and user education.

Common pitfalls to avoid with P-cards

Successful purchasing card implementation requires avoiding critical mistakes that undermine program effectiveness and control. Your P-card program's success depends on proactive planning and systematic attention to common implementation challenges.

Using P-cards without a clear policy

Your P-card program requires comprehensive written policies defining authorized spending categories, transaction limits, and approval procedures. Without clear guidelines, employees may misuse their purchasing cards for unauthorized expenses, creating compliance issues and budget overruns.

Establish specific merchant restrictions, spending limits, and approval hierarchies before card activation. Your policy should address personal use prohibitions, receipt requirements, and consequences for policy violations to ensure proper P-card usage across your organization.

Overlooking real-time monitoring

What is a purchasing card's greatest risk? Inadequate transaction monitoring that allows unauthorized spending to accumulate before detection. Your P-card system should include automated alerts for unusual spending patterns, policy violations, and approaching spending limits.

Implement daily transaction reviews and exception reporting to identify problems immediately rather than discovering issues during monthly reconciliation. Real-time monitoring prevents small problems from becoming significant financial exposures.

Issuing identical card permissions

Your purchasing card controls should reflect individual roles and responsibilities rather than applying uniform settings across all users. Senior managers require different spending limits and merchant access than junior employees or temporary staff.

Customize P-card permissions based on job functions, departmental budgets, and spending authority levels. This role-based approach prevents inappropriate access while ensuring legitimate business needs are met efficiently.

Not integrating with accounting tools

Your corporate purchasing card program loses significant value without proper integration with existing accounting systems. Manual data entry increases processing costs and introduces errors that undermine program benefits.

Establish automated data feeds between your P-card system and accounting software to ensure seamless transaction processing and accurate financial reporting.

Skipping employee training

Inadequate user training leads to policy violations, declined transactions, and poor adoption rates that reduce program effectiveness. Your purchasing card training should cover authorized usage, receipt management, and policy compliance requirements.

Provide ongoing education updates when policies change or new features become available to maintain program performance and user satisfaction.

Who should use P-cards?

Your purchasing card program delivers maximum value when deployed to specific user groups who benefit most from streamlined procurement processes and spending controls.

Understanding optimal P-card user profiles ensures successful program implementation and adoption.

1. Finance and procurement teams

Your finance and procurement professionals gain significant efficiency improvements through P-card implementation. These teams typically manage numerous vendor relationships, process purchase orders, and handle routine business expenses that benefit from automated controls and real-time visibility.

Finance teams use purchasing cards for accounting software subscriptions, professional services, and office supplies while maintaining complete spending oversight. Procurement professionals leverage P-cards for supplier payments, sample purchases, and market research activities that require immediate access to funds.

2. Department managers

Your department managers benefit from P-card programs through enhanced budget control and reduced administrative overhead. Managers can authorize routine departmental purchases without complex approval workflows while maintaining spending oversight through real-time reporting.

What is a purchasing card's advantage for managers? Direct access to departmental budgets combined with automated compliance monitoring that ensures policy adherence without micromanagement. Your corporate purchasing card enables managers to focus on strategic activities rather than routine procurement administration.

3. Remote and on-field teams

Your remote employees and field staff gain significant advantages from P-card access, eliminating reimbursement delays and out-of-pocket expenses. Sales teams, field service technicians, and remote workers can make authorized purchases immediately without submitting expense claims.

Remote teams use purchasing cards for travel expenses, client entertainment, and equipment purchases while providing complete transaction visibility to home office finance teams.

4. Small businesses and startups

Your small business benefits from P-card programs through improved cash flow management and spending controls without requiring dedicated procurement staff. Startups use purchasing cards to manage supplier relationships, equipment purchases, and operational expenses while maintaining founder oversight.

Small businesses leverage procurement card benefits, including extended payment terms, automated expense tracking, and simplified accounting integration that support growth without increasing administrative complexity.

Use cases for purchasing cards

Your purchasing card program delivers measurable value across diverse business scenarios and industry applications. Understanding specific use cases helps identify optimal deployment opportunities within your organization.

Marketing subscriptions and software spend

Your marketing team benefits significantly from P-card implementation for managing recurring SaaS subscriptions, advertising platforms, and digital marketing tools. Marketing professionals can activate new software trials, adjust advertising spend, and purchase creative assets without lengthy approval processes.

What is a purchasing card's advantage for marketing? Immediate access to funds for time-sensitive campaigns and promotional opportunities while maintaining budget controls through automated spending limits. Your corporate purchasing card enables marketing agility without compromising financial oversight.

Field teams and urgent supplies

Your field service teams and remote workers gain operational efficiency through P-card access for urgent equipment purchases, emergency repairs, and local supplier payments. Construction managers, maintenance technicians, and sales representatives can respond immediately to customer needs without waiting for purchase order approvals.

Field teams use purchasing cards for replacement parts, safety equipment, and client hospitality while providing complete transaction visibility to headquarters finance teams through real-time reporting and mobile expense management.

Travel and hospitality expenses

Your traveling employees benefit from P-card programs through streamlined expense management and improved cash flow. Travel-specific purchasing cards can include merchant restrictions limiting usage to airlines, hotels, and ground transportation while providing appropriate daily spending limits.

Role-based travel cards ensure executives receive higher limits than junior staff while maintaining policy compliance across all user levels.

Freelance and one-time vendor payments

Your procurement card simplifies payments to freelancers, consultants, and occasional suppliers without requiring formal vendor onboarding processes. Marketing agencies, graphic designers, and specialized contractors can receive immediate payment through P-card transactions rather than waiting for traditional invoice processing cycles.

This capability proves particularly valuable for urgent projects or small-value services where traditional procurement processes create unnecessary delays and administrative overhead.

How to measure the ROI of your P-card program

Demonstrating purchasing card program value requires quantifying specific financial benefits and operational improvements.

Your P-card ROI calculation should encompass both direct cost savings and indirect efficiency gains that impact organizational performance.

1. Admin time saved on reimbursements

Your P-card program eliminates manual reimbursement processing that typically costs £15–25 per expense claim. Finance teams spend 30-45 minutes processing each reimbursement, including receipt verification, approval routing, and payment processing.

Calculate savings by multiplying eliminated reimbursement volumes by processing costs. Organizations processing 500 monthly reimbursements save approximately £7,500–12,500 monthly through P-card implementation. Your purchasing card transforms these administrative costs into automated processing with minimal human intervention.

2. Faster month-end closing cycles

What is a purchasing card's impact on financial reporting? Accelerated month-end closing through real-time transaction data and automated reconciliation. Traditional expense processing requires 3-5 additional days for receipt collection and approval completion.

Your corporate purchasing card provides immediate transaction visibility with automated expense coding, reducing closing cycles by 20-30%. This acceleration enables faster financial reporting and improved decision-making capabilities for management teams.

3. Visibility into spending trends

Your P-card system delivers comprehensive spending analytics that identify cost-saving opportunities and policy violations. Enhanced visibility enables renegotiation of supplier contracts, elimination of duplicate subscriptions, and identification of maverick spending that undermines negotiated rates.

Organizations typically achieve 5-10% spending reductions through improved visibility and control enabled by purchasing card programs.

4. Improved vendor relationships

Your procurement card ensures consistent, timely vendor payments that strengthen supplier relationships and negotiating positions. Reliable payment terms often result in improved pricing, priority service delivery, and extended payment terms that enhance cash flow management.

Quantify relationship improvements through documented cost reductions, service level improvements, and preferential terms negotiated based on reliable P-card payment history.

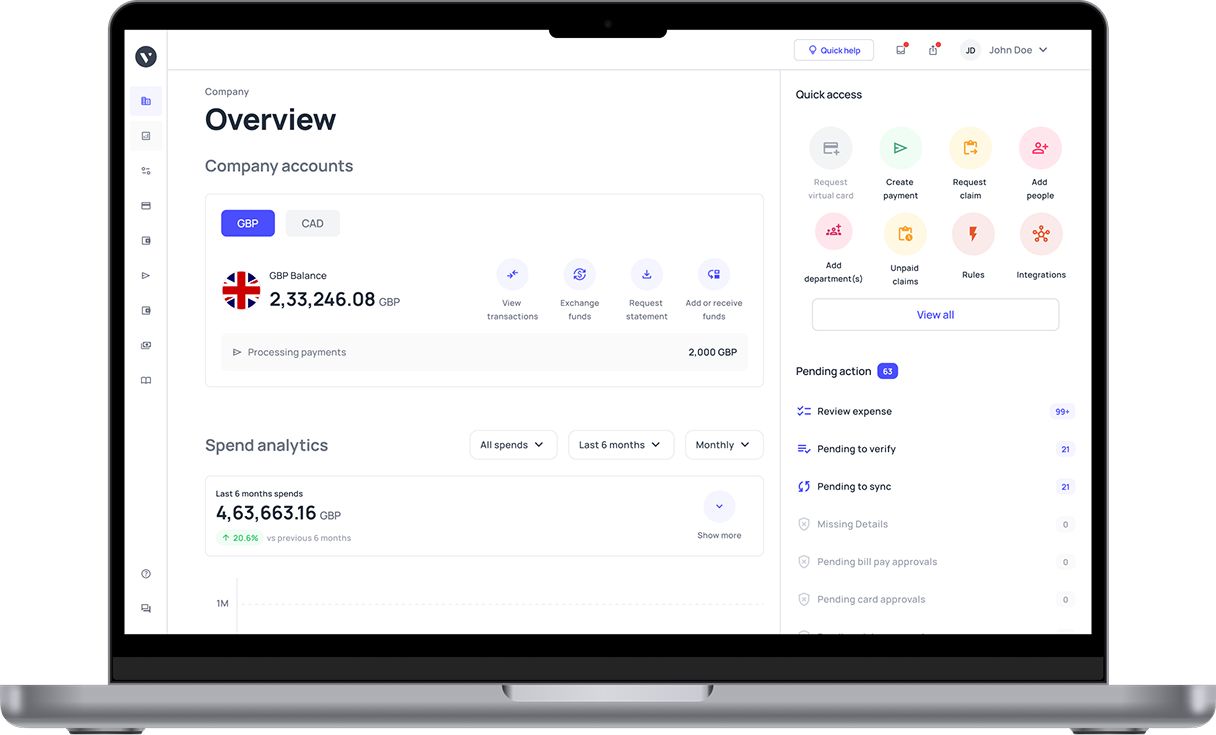

How can Volopay's corporate cards help your business?

Volopay's corporate cards address the specific needs of UK businesses seeking comprehensive spend management solutions.

Your organization gains access to enterprise-grade P-card capabilities through an intuitive platform designed for modern business requirements.

Instant card issuance and management

Volopay's platform enables immediate virtual card creation directly from your dashboard, eliminating traditional waiting periods for card delivery. Your finance team can generate cards within minutes, assign specific controls, and activate cards for immediate use across your organization.

The centralized management dashboard provides complete oversight of all issued cards, including spending activity, transaction history, and real-time balance monitoring. Your administrators can instantly freeze, modify, or cancel cards as business needs change, ensuring complete control over your corporate purchasing card program.

What is a purchasing card's greatest administrative advantage? Volopay's streamlined card management eliminates manual processes and provides instant visibility into all card activities across your organization.

Policy-based spend controls

Volopay helps implement sophisticated policy engines that automatically enforce spending rules at the transaction level. Your card controls include customizable merchant restrictions, spending limits, and time-based controls that prevent unauthorized usage while enabling efficient procurement.

The system supports role-based permissions that align spending authority with organizational hierarchies. Department managers receive different card controls than junior employees, ensuring appropriate spending oversight without limiting operational efficiency.

Integrations with top UK tools

Volopay integrates seamlessly with popular UK accounting software. These integrations eliminate manual data entry while ensuring accurate expense coding and automated reconciliation processes.

Your card transactions flow directly into existing financial systems, maintaining complete audit trails and supporting regulatory compliance requirements. The platform's API capabilities enable custom integrations with specialized business applications and ERP systems.

Multi-currency and global support

Volopay's platform supports international business operations through multi-currency P-card capabilities and global payment processing. Your cards work seamlessly across international markets while providing competitive foreign exchange rates and transparent fee structures. This global capability proves essential for UK businesses with international suppliers, remote teams, or overseas operations requiring efficient payment solutions.

PCI DSS and GDPR compliance

Volopay maintains comprehensive regulatory compliance, including PCI DSS certification and data protection adherence that meets UK financial services requirements.

Your procurement card program benefits from enterprise-grade security measures, including data encryption, fraud monitoring, and access controls that protect sensitive financial information while ensuring regulatory compliance throughout your card implementation.

FAQs

Your P-card program should target employees who regularly make business purchases, including department managers, procurement staff, field teams, and remote workers. Finance professionals, marketing teams managing software subscriptions, and traveling employees benefit most from purchasing card access.

Your purchasing card works optimally for routine business expenses, including office supplies, software subscriptions, travel bookings, equipment purchases, and vendor payments. Low-value, high-frequency transactions that don't require complex approval workflows represent ideal P-card usage scenarios.

P-Cards streamline procurement and expense management through the elimination of purchase orders, invoice processing, and reimbursement claims through direct payment capabilities. Your P-card system automates expense coding, receipt matching, and reconciliation processes while providing real-time spending visibility.

Your corporate purchasing card supports comprehensive customization, including daily, weekly, and monthly spending limits, merchant category restrictions, and geographical usage boundaries. Role-based controls ensure appropriate spending authority alignment with organizational hierarchies.

Modern P-card platforms support international transactions with competitive foreign exchange rates and multi-currency capabilities. Your purchasing card enables global business operations while maintaining spending controls and transaction visibility across international markets.

Your P-card system provides automated integration with accounting software, including Xero, Sage, and QuickBooks. Transactions flow directly into financial systems with proper expense coding, eliminating manual data entry and supporting real-time reconciliation.

Immediately freeze the affected purchasing card through your management dashboard, review recent transactions for unauthorized activity, and issue replacement cards as needed. Modern platforms enable instant card suspension and virtual replacement card generation.

Your procurement card maintains comprehensive audit trails with detailed transaction records, receipt management, and approval documentation. Automated compliance monitoring ensures policy adherence while supporting regulatory requirements and internal audit processes.

Volopay provides instant card issuance, policy-based spending controls, accounting software integrations, multi-currency support, and comprehensive regulatory compliance, including PCI DSS and data protection adherence for UK businesses.