What is a corporate card? Everything UK businesses need to know

In today’s fast-paced digital economy, managing business expenses efficiently is crucial for success. Corporate cards have become vital tools for UK businesses looking to streamline spending, maintain financial control, and improve transparency.

Unlike personal credit or debit cards, corporate cards are issued specifically for business use and are directly linked to your company’s accounts, making expense tracking and management much simpler.

What are corporate cards?

Corporate cards are payment cards provided to employees to cover business-related expenses such as travel, supplies, or client entertainment.

These cards give your team the flexibility to make purchases without needing upfront reimbursements, while giving your finance department real-time visibility into spending.

Since they are connected to your company accounts, you can easily monitor transactions, enforce spending limits, and reconcile expenses accurately.

Why are corporate cards essential for your business?

Using corporate cards helps you streamline payments by reducing reliance on petty cash or manual reimbursement processes, which can be slow and error-prone. They also support compliance with UK tax authorities like HMRC and CRA by providing clear, auditable records of business expenses.

Plus, corporate cards reduce administrative effort by automating expense tracking and reporting, freeing up your finance team to focus on strategic tasks. Overall, corporate cards empower your business with better cash flow management, enhanced control, and improved financial transparency—key advantages in a competitive market.

Corporate cards in UK’s payment landscape

Corporate cards are integral to the UK’s evolving payment ecosystem, helping you streamline business finances. They integrate seamlessly with digital trends, enhancing efficiency across industries.

Growth of digital payments

The UK’s payment landscape is shifting toward digital solutions, with contactless and mobile payments surging. Corporate cards offer tap-to-pay convenience, seamless online spending, and real-time tracking. They eliminate the need for cash or manual reimbursements.

With digital-first features, companies can streamline finance operations and improve control. You can process transactions swiftly, whether for office supplies in Manchester or client meetings in London, keeping pace with the digital economy.

Role in business transactions

Corporate cards enable seamless payments across platforms, from online subscriptions to in-person purchases. You can use cards for vendor payments, travel bookings, or software licenses, with accounting integrations ensuring real-time tracking.

This simplifies expense management for your business, ensuring compliance with FCA and HMRC regulations while supporting transactions in cities all over the UK.

Adoption across sectors

From SMEs to large enterprises, corporate cards are widely adopted for expense control. For instance, startups in Bristol can use cards to manage cloud service costs, while hospitality firms in Edinburgh can streamline event expenses.

Enterprises in Cardiff can leverage cards for multi-employee spending, with tools like Volopay offering custom limits and analytics. This versatility makes corporate cards essential across retail, tech, and professional services, driving efficiency and scalability in the UK’s payment ecosystem.

Who benefits from corporate cards?

Corporate cards offer tailored advantages for various UK businesses, helping you streamline finances and optimize operations. Whether you run a small startup or a large enterprise, these cards can transform how you manage expenses.

SMEs and startups

As a small or growing business, managing your cash flow is critical. Corporate cards in the UK allow you to monitor every pound spent, set spending limits for employees, and automate expense tracking.

Corporate cards help you manage cash flow by providing flexible payment terms, allowing you to cover expenses without depleting reserves.

They also simplify expense tracking with detailed statements, saving you time on bookkeeping and ensuring accurate records for tax season.

Large enterprises

If you manage a large organisation with multiple departments and hundreds of employees, corporate cards simplify centralized expense control.

With customizable limits and real-time tracking, you can monitor expenditures, prevent overspending, and streamline approvals.

This scalability ensures efficiency and accuracy in managing business expenses, whether your team is in London, Edinburgh, or beyond.

Freelancers and contractors

Even as a solo professional, a corporate card can help you keep your business and personal expenses separate—something HMRC will appreciate come tax season.

A corporate card keeps your transactions distinct, simplifying deductions and compliance with CRA regulations.

Plus, rewards like cashback or travel points can add value to your business spending.

Industry-specific users

Corporate cards benefit diverse industries like tech, retail, and hospitality. For example, tech firms can use cards for software subscriptions, while retailers cover inventory costs.

In hospitality, cards streamline event expenses, offering rewards that align with your industry’s needs.

From travel expenses to software subscriptions, these cards support dynamic spending needs.

Modern corporate cards to streamline business expense management

The evolution of corporate cards in UK

Early corporate cards

Corporate cards in the UK have transformed from niche tools to versatile financial solutions, adapting to your business needs. The early corporate card in the UK was limited to basic expense tracking, often issued by traditional banks. These corporate cards lacked customization, real-time control, or integration with financial systems.

Fintech innovations

Fintech companies revolutionized the corporate card landscape in the UK by offering digital-first corporate cards with smart controls, automation, and enhanced visibility—enabling better financial governance for growing businesses.

Modern features

Today’s UK corporate cards come equipped with real-time tracking, spend limits, automated accounting, and multi-user controls. These modern corporate card solutions simplify expense management while ensuring compliance and scalability.

Regulatory impact

HMRC and FCA regulations have shaped corporate cards in the UK. You must ensure compliance with tax reporting for employee expenses, while FCA rules enforce secure transactions. These regulations push providers to offer transparent, compliant tools tailored to your business.

Future outlook

Corporate card adoption is growing across UK sectors, from tech in Cambridge to retail in Birmingham. You can expect more AI enhancements, sustainability-focused rewards, and flexible financing, making cards indispensable for your business growth.

Regulatory framework for corporate cards in the UK

Navigating the regulatory landscape for corporate cards in the UK ensures your business stays compliant while maximizing card benefits. Understanding these rules helps you manage finances confidently.

HMRC compliance

As a UK business owner, you must align with HM Revenue and Customs (HMRC) regulations. Corporate card transactions, especially employee expenses, require accurate reporting for tax purposes.

You need to track taxable benefits, like personal use of cards, to avoid penalties. Detailed records and clear expense policies ensure compliance with HMRC’s tax guidelines.

FCA oversight

The Financial Conduct Authority (FCA) regulates corporate card providers in the UK. You benefit from their oversight, which mandates secure payment systems and transparent fee structures.

FCA rules, under the Payment Services Regulations 2017, require providers to protect your funds and provide clear terms, ensuring trust in card providers.

BoE standards

The Bank of England (BoE) sets broader financial standards impacting corporate cards. While not directly regulating cards, its monetary policies influence interest rates and credit availability. You should monitor BoE updates to understand how economic conditions affect card financing options, especially for SMEs in cities like London.

PCI DSS requirements

Payment Card Industry Data Security Standards (PCI DSS) are critical for your card security. You must ensure providers comply with these standards to protect cardholder data during transactions, reducing fraud risks for your business, whether in retail or tech.

AML/CTF compliance

To prevent financial crime and to verify transactions and report suspicious activities, you’ll also need to follow Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

Your card provider should carry out due diligence checks to ensure your transactions are legitimate and compliant with UK law.

Key eligibility requirements for corporate cards

Securing a corporate card in the UK can streamline your business finances, but you must meet specific criteria to qualify. Understanding these requirements helps you prepare and choose the right card for your needs.

Business registration

To obtain a corporate card, your business must be registered with Companies House in the UK. You’ll need a valid Companies House registration number to prove your business is legally recognized. This applies whether you’re a sole trader, a partnership, or a limited company operating in cities like London or Leeds. Providers verify this to ensure legitimacy.

Financial stability

Card providers assess your business’s financial health, focusing on revenue and credit history in the UK market. You may need to demonstrate consistent revenue or a strong credit score to qualify, especially for premium card providers. Some fintechs may offer more flexible criteria for startups with limited credit history.

Trading history

Most providers require your business to have a minimum trading history, typically 6–12 months in the UK. This shows operational stability and reduces risk for issuers. Newer businesses may face stricter terms or need personal guarantees, while established firms often qualify more easily.

Employee structure

Corporate cards are ideal for UK businesses with employees, as they simplify expense management for staff. Providers may require details about your team size or structure to tailor card limits and features. Even small businesses with a few employees can benefit, though freelancers may face stricter eligibility.

Documentation needs

You must provide documentation to meet UK regulations, including financial statements, proof of address, and ID verification for directors or owners. AML and KYC compliance require these to prevent fraud. Prepare bank statements, tax returns, or VAT registration details to streamline your application process.

Corporate cards vs. other payment methods

When managing business expenses in the UK, it's important to choose the right payment method. From speed to transparency, corporate cards in the UK offer distinct advantages over traditional options. Here’s how they compare.

Corporate vs. business cards

While both are issued to companies, business cards are typically designed for sole traders or small partnerships. Corporate cards, on the other hand, cater to larger organisations or startups with multiple employees.

They offer better spending controls, detailed reporting, and customisable limits—ideal if you’re managing a team.

Corporate vs. personal cards

Using a personal card for business expenses might seem convenient, but it quickly becomes messy. You risk mixing personal and professional costs, complicating tax filings and expense tracking.

Corporate cards eliminate this confusion, helping you maintain cleaner records and more accurate financial reporting.

Corporate cards vs. cash/cheques

Handling cash or issuing cheques is time-consuming and prone to error. There’s no built-in tracking, and reconciliation becomes a manual task.

With corporate cards, every transaction is digitally recorded in real time. You get instant visibility into who’s spending what, making audits and budgeting far more efficient.

Corporate cards vs. bank transfers

Bank transfers are secure, but they’re often slower, especially for urgent payments or international transactions.

Corporate cards provide instant access to funds, ideal for on-the-go purchases or employee travel expenses while streamlining business operations.

Benefits of corporate cards for UK Businesses

Corporate cards offer powerful tools for UK businesses, helping you manage expenses, enhance control, and drive efficiency. Whether you’re a startup in Bristol or a large firm in London, these cards deliver benefits that streamline operations and support growth.

Real-time spend visibility

With corporate cards, you gain instant insight into business spending. Fintech corporate card platforms provide dashboards showing transactions as they happen, whether for office supplies or client dinners. This real-time tracking helps you monitor budgets, spot overspending, and make informed decisions without waiting for monthly statements.

Streamlined tax reporting

Navigating HMRC requirements is simpler with corporate cards. You receive detailed transaction records, categorizing expenses like travel or software subscriptions. This reduces manual bookkeeping and ensures accurate VAT reporting. For instance, integrating cards with accounting tools like Xero automates tax preparation, saving you time during tax season.

Enhanced cash flow

Corporate cards improve your cash flow by offering flexible payment terms. You can cover expenses without depleting cash reserves, with grace periods of up to 30–60 days from some providers. This is vital for SMEs managing irregular income or large enterprises handling high-volume transactions across the UK.

Employee convenience

Your employees benefit from corporate cards, which eliminate the need for personal funds for business expenses. You can issue cards with preset limits, allowing staff to pay for travel or client meetings seamlessly. Mobile apps let them upload receipts instantly, reducing reimbursement delays and boosting productivity.

Rewards and cashback

One of the biggest advantages of using corporate cards is the potential to earn rewards or cashback on your everyday business purchases. Whether it’s office supplies, travel expenses, or software subscriptions, every transaction can bring value back to your company.

Over time, these rewards can significantly reduce operational costs or be reinvested into other areas of your business. Plus, many UK card providers tailor rewards programs to suit industry-specific spending patterns, giving you more relevant benefits.

Fraud prevention

Corporate cards come equipped with advanced fraud detection and security features that protect your business. You can set spending limits, restrict merchant categories, and even freeze cards instantly in case of suspicious activity.

Most cards also offer real-time alerts, allowing you to catch and respond to potential fraud quickly. By using a card instead of cash or personal accounts, you create a more secure and transparent system for company spending.

Scalability for growth

As your team grows, so do your financial responsibilities. Corporate cards help you scale with ease by allowing you to issue multiple cards to employees, each with custom controls and limits.

You no longer have to worry about manually tracking expenses or chasing down receipts. Whether you have a team of five or five hundred, corporate cards give you the infrastructure to grow without losing oversight or efficiency.

Simplified audits

Keeping your books clean is essential, especially during audits or tax season. Corporate cards streamline this process by automatically categorising transactions and syncing with your accounting software. You’ll have a clear digital trail for every expense, making it easier to prove compliance and identify discrepancies. This saves you hours of admin work and reduces the risk of costly errors.

Take charge of your business expenses with Volopay's all-in-one corporate cards!

Features of corporate cards for UK Businesses

You can set tailored spending limits for each card issued to employees, ensuring control over budgets.

Whether your team is purchasing software or travelling, corporate cards let you adjust limits in real time via apps, preventing overspending.

Approval workflows simplify expense oversight. You can configure cards to require manager approval for transactions above a threshold, ideal for businesses in the UK.

Card platforms offer automated workflows, ensuring compliance with your policies.

Corporate cards integrate seamlessly with accounting software like Xero or QuickBooks.

You can sync transactions automatically, cutting down on manual data entry. This feature saves time, ensuring accurate records for HMRC reporting and audits.

You can restrict card usage to specific merchant categories, such as travel or office supplies. This ensures employees spend only on approved vendors, reducing misuse.

Many card providers let you customize these controls via intuitive dashboards.

For businesses operating beyond the UK, multi-currency support is key.

Some corporate cards allow you to pay in foreign currencies with low fees, ideal for international deals or travel. This minimizes exchange rate losses for your business.

Receipt digitization simplifies expense tracking. Your employees can scan receipts using mobile apps from card providers, instantly uploading them to your system.

This reduces lost receipts and streamlines your bookkeeping.

How to choose the right corporate card?

Choosing the right corporate card in the UK can streamline your expense management, improve control, and support your company’s growth. But with so many options available, how do you find the best fit for your business?

Here's a step-by-step guide to help you make a smart decision.

1. Assess business size

Start by considering your company’s size and structure. If you run an SME or startup, you’ll benefit from flexible cards with easy approval processes and low maintenance requirements. Larger enterprises, on the other hand, should look for scalable solutions with support for multiple users, custom limits, and advanced reporting tools.

2. Evaluate spending patterns

Think about how your business spends money. Do you often cover travel expenses, software subscriptions, or inventory purchases? Choose a card that matches your typical spend categories to maximise rewards and track costs more accurately. Some providers even offer industry-specific benefits tailored to your needs.

3. Check eligibility criteria

Before applying, review the card provider’s eligibility requirements. Most UK issuers expect your business to be registered with Companies House and have verifiable financials. Make sure your company meets these conditions to avoid delays or rejections.

4. Prioritize features

Look for features that align with your operational needs. Do you need virtual cards for remote teams? Integration with accounting software like Xero or QuickBooks? Spending controls per employee? The right mix of features can save you time and reduce administrative headaches.

5. Compare rewards programs

Corporate cards often come with rewards or cashback offers, but it’s essential to weigh the benefits against the associated fees. A card with generous points might not be worth it if the annual fee outweighs your savings. Choose a program that delivers real value based on your spending habits.

6. Ensure robust security

Security is non-negotiable. Look for providers that are PCI DSS compliant and offer real-time fraud detection. If your business deals with cross-border or UK transactions, confirm that your provider has security protocols in place for international usage.

7. Review support services

Lastly, check what kind of customer support is available. A provider offering 24/7 assistance, fast onboarding, and dedicated account managers will be much easier to work with, especially when issues arise or you’re scaling quickly.

Applying for and activating corporate cards

Obtaining and activating a corporate card in the UK streamlines your business’s expense management. Follow these steps to secure and activate a card tailored to your needs, whether you’re in London or Leeds.

Research providers

Start by comparing UK corporate card providers. Traditional banks offer robust options, while fintechs provide flexibility for startups. Evaluate fees, rewards, and integrations to find the best fit for your SME or enterprise.

Verify eligibility

Confirm your business meets the provider's requirements. You’ll need a valid Companies House registration number and a trading history, typically 6–12 months. Providers also assess revenue and credit history.

Gather documentation

Prepare necessary documents to comply with UK regulations. You’ll need your Companies House registration number, financial statements, and ID verification for directors. Include proof of address and VAT registration if applicable to meet AML and KYC requirements.

Submit application

Apply through the provider’s online portal or in person at a bank branch. Fintechs offer quick online applications, while banks may require in-person visits. You’ll submit your documents and specify card types—such as physical or virtual—for your team.

Activate cards

Once approved, activate your cards via the provider’s app or online portal. For instance, mobile apps from some corporate card providers let you activate cards instantly by verifying your account.

Get the best corporate card program for your business

Automation tools for corporate card efficiency

To get the most out of your corporate cards, integrating automation is essential. In the UK, where compliance and control are critical, automation tools can save you time, reduce errors, and enhance financial visibility. Here’s how you can streamline operations using smart features built around your corporate card usage.

Real-time dashboards

With real-time dashboards, you no longer have to wait for end-of-month reports to understand your company’s spending. You can instantly monitor transactions as they happen, by department, employee, or vendor.

This gives you a clear and immediate view of budget usage, helping you make faster financial decisions.

Expense category

Manually sorting expenses is time-consuming and error-prone. Automated expense categorization classifies each transaction based on predefined rules—travel, subscriptions, meals, and more.

This makes HMRC tax reporting much easier, as all relevant expenses are properly labelled and ready for review or submission.

Approval automation

If your business has multiple layers of financial oversight, approval automation can save hours of back-and-forth. You can set custom rules that trigger automatic approvals or escalate to the right manager.

Whether it's a £50 office supply or a £5,000 vendor payment, the process becomes seamless and accountable.

Fraud detection AI

Smart AI algorithms now scan corporate card activity to flag anything unusual—duplicate charges, high-risk merchants, or out-of-policy spending.

You’ll receive transaction alerts immediately, allowing you to act before any serious financial damage occurs. This level of protection is especially valuable for larger teams or cross-border card usage.

Receipt matching

Stop chasing your employees for receipts. With automation, you can link all digital or scanned receipts directly to their corresponding transactions in your corporate card platform.

Many modern tools are even able to extract essential data from the receipt automatically, saving your busy finance team the hassle of tedious and error-prone manual data entry processes.

Forex automation

If your business deals with international vendors or makes purchases in foreign currencies, forex automation helps manage exchange rates and payments with ease.

These tools automatically apply live conversion rates and record costs in your base currency, helping you reduce errors, avoid any overcharges, and improve your cross-border payment accuracy.

Cost management strategies with corporate cards

Using corporate cards effectively can optimize costs for your UK business, whether you’re a startup in Bristol or an enterprise in London. These strategies help you maximize value and maintain financial control.

Leverage rewards

Maximize rewards like cashback or travel points offered by some corporate card providers. You can redeem points for flights or hotel stays for business travel, or earn cashback on software subscriptions. Choose cards with rewards aligned to your spending patterns to boost savings.

Set budget limits

Prevent overspending by setting custom budget limits on each card. Corporate cards let you assign limits for employees, ensuring controlled spending on categories like office supplies or client dinners. Adjust these limits in real time via apps to align with your budget, whether in Glasgow or Cardiff.

Monitor hidden fees

Avoid unexpected costs by reviewing transactions and annual fees. Some providers charge foreign transaction fees or high interest on late payments. Scrutinize terms from banks or fintechs to select low-fee options, saving your business money on every purchase.

Optimize FX rates

For international payments, choose cards with competitive foreign exchange (FX) rates. Card providers offer low-fee multi-currency support, reducing costs for overseas transactions. This is crucial if you’re paying international suppliers or traveling abroad, minimizing exchange rate losses.

Regular audits

Conduct regular audits to identify inefficiencies or misuse. Use dashboards to analyze spending patterns across your team. Monthly reviews help you spot unauthorized transactions or redundant subscriptions, ensuring compliance and cost efficiency for your UK business operations.

Effective corporate card management

To get the full value from your corporate cards in the UK, it’s important to implement a structured management approach. By combining clear policies, automation, and regular oversight, you can maintain control, ensure compliance, and empower your team to spend responsibly. Here’s how to optimize your corporate card usage effectively.

1. Establish clear policies

Start by creating a formal spending policy that defines who can use the cards, what they can be used for, and the limits in place. This helps eliminate confusion and sets expectations across your business. Make sure the policy is accessible to all relevant employees.

2. Train employees thoroughly

Even the best policies fail without proper training. Educate your employees on how to use corporate cards responsibly, including what qualifies as an allowable expense, how to submit receipts, and how to avoid fraud. Ongoing training ensures your team stays informed as policies evolve.

3. Monitor transactions live

Use real-time dashboards to track transactions as they happen. Live monitoring helps you spot unusual activity, stay within budget, and keep your financial data up to date. It also allows finance teams to make quick, informed decisions when needed.

4. Automate expense reporting

Manual expense reporting is tedious and error-prone. Automating the process ensures faster submissions, accurate data entry, and seamless syncing with your accounting software. This not only saves time but also reduces the risk of non-compliance during HMRC audits.

5. Conduct regular reviews

Your card usage policies and limits shouldn’t be static. Conduct periodic reviews to assess employee usage patterns, adjust spending limits, and revise rules based on changing business needs. Regular check-ins ensure your program stays relevant and efficient.

6. Manage card lifecycle

Efficiently managing the lifecycle of your cards is essential. This includes issuing new cards to staff, cancelling unused or compromised cards, and replacing lost ones quickly. A centralised system can help you handle this without delays or errors.

7. Address non-compliance

Finally, put procedures in place to deal with misuse or violations. Whether it’s temporary suspension, retraining, or disciplinary action, having clear consequences helps maintain accountability and keeps your card program under control.

Case study: Corporate cards in action

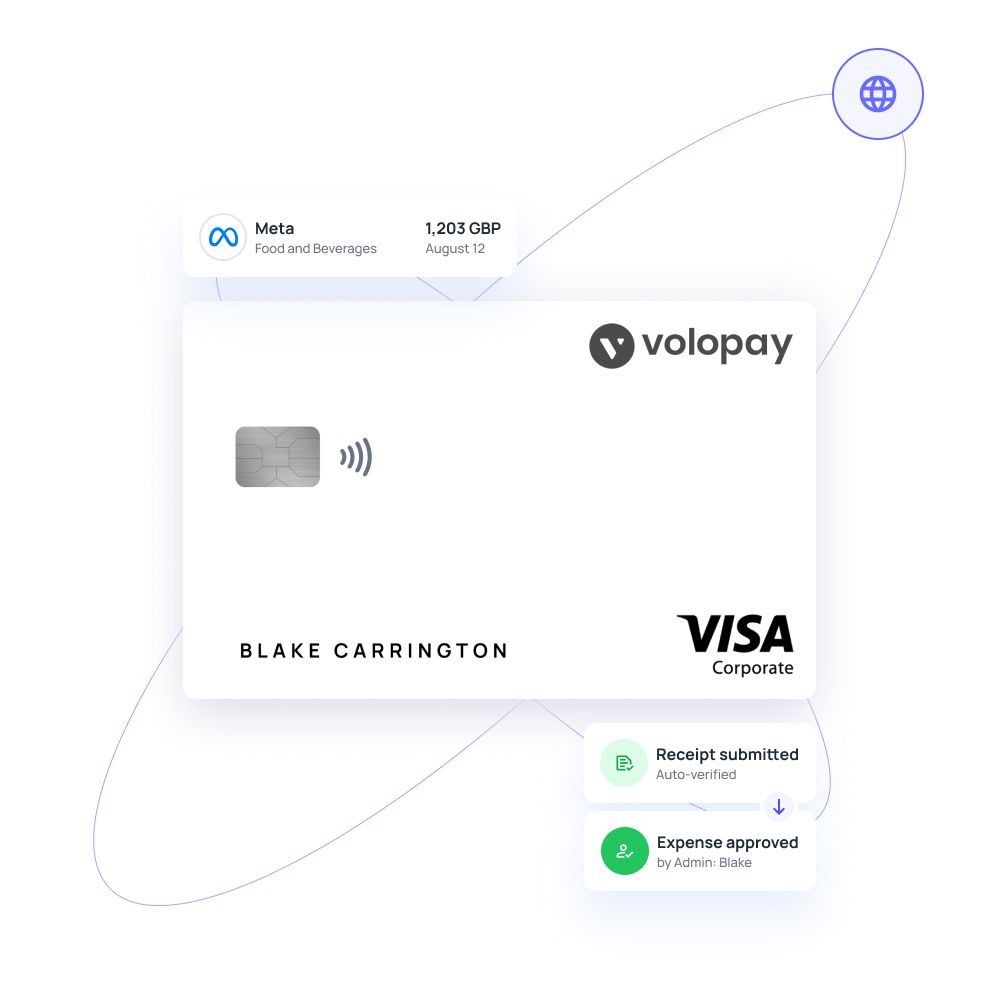

Volopay's corporate card solutions have empowered companies to streamline expense management, enhance financial visibility, and enforce spending controls. The following case study illustrates how a company overcame its expense management challenges with Volopay's assistance.

Customer: Lynx Analytics

Lynx Analytics, a data science and AI solutions provider, faced challenges in managing its SaaS subscriptions and departmental expenses. All subscriptions were paid via a single company card, making it difficult to track spending and assign costs to specific departments. This centralized approach posed a high concentration risk and complicated expense reconciliation processes.

Challenges

● Single card usage for all subscriptions led to difficulties in tracking departmental spending.

● High concentration risk due to reliance on one card; changes required to update billing information across all subscriptions.

● Difficulty in monitoring team-specific expenditures and enforcing budget limits.

● Manual processes for expense reconciliation and invoice collection.

How Volopay helped Lynx Analytics

Lynx Analytics adopted Volopay's platform, distributing virtual cards to employees. This allowed each department to have dedicated cards with assigned budgets, enabling clear tracking of expenses.

Managers could easily activate or deactivate cards, reducing dependency on a single card and mitigating associated risks. The integration with accounting software automated expense reporting and reconciliation, saving time and reducing errors.

By implementing Volopay's solutions, Lynx Analytics achieved greater expense awareness, streamlined its subscription payments, and enhanced control over departmental budgets. The automation of financial processes allowed their finance team to focus on strategic tasks, improving overall operational efficiency.

To explore the full impact Volopay had on Lynx Analytics financial operations, read the full case study on How Volopay helped Lynx Analytics.

Streamline your spend with UK’s top corporate card provider

Industry applications of corporate cards

Corporate cards offer versatile solutions for UK businesses across industries, helping you manage expenses efficiently. From startups to established firms, these cards streamline payments and enhance control.

1. Technology startups

As a tech startup in the UK, you can use corporate cards to manage recurring expenses like software subscriptions and cloud services (e.g., AWS or Google Cloud). Card providers allow you to set limits for each team, ensuring budget control while earning rewards on high-frequency payments.

2. Retail and e-commerce

Running a retail or e-commerce business in the UK? Corporate cards simplify inventory purchases and marketing costs, such as ad spend on platforms like Google or Meta. With virtual cards, you can secure online transactions and track expenses in real time, optimizing cash flow during peak seasons.

3. Tourism and hospitality

In the UK’s tourism and hospitality sector, corporate cards cover hotel bookings, event expenses, and staff travel. Whether you’re managing a hotel or a tour agency, corporate cards offer travel rewards and multi-currency support, reducing costs for international bookings while simplifying expense reconciliation.

4. Construction

For construction firms, corporate cards streamline the procurement of materials and equipment. You can issue cards to site managers with category-specific limits, ensuring spending aligns with project budgets. Real-time tracking prevents overspending and aids in accurate cost reporting.

5. Healthcare

If you operate a healthcare practice, corporate cards fund medical equipment, staff training, and certifications. Cards with accounting integrations simplify expense tracking for HMRC compliance, while rewards can offset costs for frequent purchases like supplies.

6. Professional services

As a consultant or lawyer, you can use corporate cards to manage client entertainment and travel expenses. Providers offer detailed transaction reports, making it easy to bill clients accurately and maintain clear records for tax purposes, enhancing your firm’s efficiency.

7. Manufacturing

For manufacturers, corporate cards streamline supply chain payments, from raw materials to logistics. Multi-currency cards reduce FX fees for international suppliers, while dashboards help you monitor spending, ensuring cost efficiency across production cycles.

Corporate cards empower you to tailor expense management to your industry’s needs, driving efficiency and growth across the UK.

Future trends in corporate cards

Virtual cards are growing, offering single-use options for secure online payments. You can generate cards for one-off vendor payments, reducing fraud risks for your business.

AI-powered analytics are transforming expense management. Card providers help predict budgets and detect anomalies, helping you optimize spending and spot fraud early.

Corporate cards are introducing sustainability incentives, rewarding eco-friendly spending. You might earn points for green vendors or carbon-neutral travel, aligning with ESG goals.

Open banking is revolutionising financial data sharing by allowing businesses to connect their bank accounts directly with corporate card platforms.

This means you can enjoy faster reconciliations, real-time insights, and smoother accounting integrations.

For you, it translates to more accurate financial data at your fingertips, less manual work, and improved decision-making.

Blockchain technology is gaining traction in securing transaction records and ensuring transparency.

By using decentralised ledgers, corporate card transactions can become tamper-proof and fully auditable.

This added layer of security not only reduces fraud risks but also simplifies compliance with regulatory requirements like those set by the FCA and HMRC.

Why choose Volopay corporate cards?

If you're looking for a smarter, more efficient way to manage your business expenses in the UK, Volopay corporate cards offer a comprehensive solution built for modern finance teams. Designed to give you control, visibility, and flexibility, our cards come with powerful features tailored for businesses of all sizes.

All-in-one spend platform

Volopay is more than just a corporate card—it's a complete expense management platform. You can manage card issuance, set spending limits, automate expense reports, and track all transactions from a single dashboard. This means no more juggling spreadsheets or chasing receipts.

Unlimited virtual cards

Need to make secure online purchases or set up recurring subscriptions? Volopay lets you generate unlimited virtual cards with custom limits and expiration dates. Create single-use cards to reduce fraud risks or assign cards to specific vendors for better tracking.

Seamless accounting integrations

Volopay integrates smoothly with top accounting software like Xero, MYOB, QuickBooks, and NetSuite. Your expenses and receipts sync automatically, cutting down manual data entry and reducing errors. Month-end reconciliation becomes faster and stress-free.

Real-time analytics

With real-time dashboards, you can monitor spending as it happens. Gain instant insights into employee expenses, department budgets, and vendor payments. This level of visibility helps you make smarter financial decisions on the go.

Robust security

Volopay is built with enterprise-grade security. Our platform complies with PCI DSS standards, and our cards come with built-in fraud detection, transaction controls, and secure data encryption, giving you complete peace of mind.

Multi-currency transactions

Whether you’re paying in pounds, euros, or dollars, Volopay supports seamless multi-currency transactions. This is ideal for UK businesses working with international clients or suppliers, helping you save on FX fees and streamline global payments.

Bring Volopay to your business

Get started now