What is a prepaid credit card, and how to get one in the UK?

Ever wondered how to enjoy the convenience of a card without worrying about debt? Prepaid credit cards give you that exact freedom. By loading funds in advance, you can spend smartly, avoid unexpected charges, and stay in control.

In the UK, both individuals and businesses increasingly rely on them for safe, simple, and transparent payments. If you’re curious about flexible money management, this guide will help you understand how they work.

What is a prepaid credit card?

Prepaid credit cards are payment tools that allow you to load money upfront and spend only within that limit. In the UK business landscape, they’ve become popular for companies managing team purchases, travel costs, or subscription payments. Since they don’t rely on credit approval, they’re accessible even without a strong financial history.

You won’t face interest charges, making them safer than traditional cards. Business prepaid credit cards also streamline expense tracking while reducing risks of overspending or unauthorized transactions. Additionally, they’re accepted by most retailers and online platforms, giving you broad usage flexibility. Many also come with mobile apps for real-time monitoring.

How do prepaid credit cards work in the UK?

In the UK, prepaid credit cards function like standard debit or credit cards at payment terminals and online platforms. You preload funds, and each transaction deducts directly from the available balance. Once the balance runs out, you must top it up before using it again.

You can manage card activity through mobile apps, check balances instantly, and even restrict spending categories. This ensures transparency, allowing you to track expenses in real time while maintaining complete financial control.

Many cards also support contactless payments, making everyday transactions quicker. They can be ordered online or through banks with minimal documentation. Businesses often use them to assign limits to employees, reducing misuse.

Types of prepaid credit cards for businesses in the UK

1. Open-loop cards

With open-loop prepaid credit cards, you can make payments anywhere major card networks are accepted. These cards give your business flexibility for purchases across different vendors.

They’re especially helpful if your team requires spending freedom beyond specific retailers or services.

2. Closed-loop cards

Closed-loop cards restrict spending to a single store or a partnered group of merchants. If you want tighter control, these cards are perfect for managing purchases within predefined vendors.

They’re cost-effective for employee benefits, business promotions, or dedicated company partnerships.

3. Reloadable cards

Reloadable prepaid credit cards allow you to add funds repeatedly as needed. You can use them for ongoing business expenses like subscriptions, travel, or recurring vendor payments.They’re ideal if you prefer a sustainable, long-term solution for managing transactions.

4. Non-reloadable cards

Non-reloadable cards are single-use prepaid options that expire once the loaded balance is spent. They work well for one-time purchases, employee bonuses, or controlled projects. You’ll appreciate the simplicity of having a fixed limit without any additional top-ups.

5. Payroll cards

Payroll cards let you pay employees directly without relying on traditional bank accounts. They’re convenient for contractors, temporary staff, or team members without standard banking access. These cards help you reduce paperwork while ensuring timely and secure wage disbursement.

6. Travel cards

Travel cards are designed for employees who frequently travel abroad for business. They support multiple currencies, helping you avoid high foreign transaction fees.

With them, you can monitor spending and ensure better control over international business travel expenses.

7. Departmental cards

Departmental cards allow you to allocate budgets to specific teams like marketing, operations, or sales.

By distributing prepaid funds, you make expense management simpler and more transparent. This helps your departments work independently while you retain oversight on spending.

8. Virtual cards

Virtual cards are digital versions of prepaid credit cards for business, created instantly through online platforms.

They’re useful for managing subscriptions, online purchases, or vendor payments. With them, you enhance security since card details can be updated or replaced anytime.

Why prepaid credit cards matter for UK businesses

Simplified employee expense management

Managing multiple receipts and reimbursements can be overwhelming. With prepaid solutions, you simply allocate funds to each employee card, making it easier to track and control spending.

If you’ve ever asked yourself what is a prepaid credit card, it’s essentially a tool that simplifies this process effectively.

Greater control over business spending

With prepaid options, you can set spending limits in advance, ensuring employees only use the allocated budget. This prevents overspending and improves financial discipline.

By monitoring transactions in real time, you gain stronger oversight while reducing risks, making business finances more predictable, transparent, and easier to manage across all departments consistently.

Transparency and reduced misuse of funds

Prepaid systems give you complete visibility of where money is going. Every transaction is logged and available for review instantly. This helps reduce unauthorized expenses and potential fraud.

By assigning individual cards, you build accountability, empowering employees to spend responsibly while ensuring company resources are always used for the intended purposes only.

Eliminating petty cash risks in offices

Handling physical petty cash exposes your business to risks of misplacement or misuse. With prepaid cards, you eliminate that vulnerability completely. You can distribute digital funds securely while monitoring spending activity.

This shift not only improves accountability but also creates efficiency, helping your office operate smoothly without reliance on outdated cash processes.

Streamlining travel and entertainment expenses

Business trips and client entertainment often involve unpredictable costs. By giving employees prepaid cards, you can define budgets while enabling flexible use during travel.

Expenses are recorded automatically, making reporting easier. This eliminates manual paperwork, ensures timely tracking, and gives you real-time visibility into where and how business funds are spent daily.

Supporting remote and hybrid workforce needs

With distributed teams, managing reimbursements can be complicated. Reloadable prepaid credit cards offer an efficient solution by allowing you to fund employees directly, regardless of location.

This empowers them to handle purchases while keeping spending transparent. For hybrid workplaces, it ensures seamless financial operations without delays, making remote work management far simpler.

Common features of business prepaid credit cards

Physical and virtual card options

With prepaid credit cards, you can issue both physical and virtual versions depending on your business needs. Physical cards work for in-store purchases, while virtual ones are ideal for secure online transactions.

Having both options ensures flexibility, convenience, and stronger control over how and where your company's funds are spent.

Spending limits and controls per cardholder

Business prepaid credit cards allow you to assign specific spending limits for each employee or department. You can restrict usage to certain merchants, categories, or transaction amounts.

This feature helps you maintain tight financial control, prevent overspending, and align expenses with budgets, giving your company better predictability across all financial operations.

Multi-user access for employees and departments

With prepaid solutions, you can issue multiple cards to employees or entire departments, each linked to a central account. This makes it easier to distribute budgets while monitoring usage individually.

It also simplifies collaboration between teams, giving you greater visibility and accountability without compromising efficiency or requiring complicated manual reimbursement processes.

Real-time reporting dashboards

Prepaid platforms provide dashboards that update instantly with every transaction. You can see where funds are being spent, track usage by department, and generate detailed expense summaries.

This feature supports proactive financial decision-making, enabling you to spot irregularities quickly. Real-time data empowers you to maintain operational efficiency and budget accuracy seamlessly.

Integration with UK accounting software

What is a prepaid credit card without smooth bookkeeping support? Many solutions integrate directly with UK accounting systems like Xero, QuickBooks, or Sage. This reduces manual data entry, minimizes errors, and automates reconciliation.

With expenses synced instantly, you save time, increase accuracy, and streamline your financial management workflows across the organization effectively.

Fraud protection features like PINs and encryption

To safeguard business funds, prepaid platforms provide advanced fraud protection. Features like PIN authentication, data encryption, and secure login portals ensure transactions remain safe.

Many systems also offer instant card freezing if suspicious activity occurs. These measures protect your company’s finances while maintaining trust and reliability across every business transaction consistently.

Common fees and charges for UK prepaid credit cards

1. Annual or monthly card fees

Many providers charge annual or monthly fees to maintain prepaid credit cards for business. These costs vary depending on features like multi-user access or reporting tools.

You should compare providers carefully to ensure you’re only paying for services that truly add value to your company’s financial management and day-to-day operations.

2. Per-transaction or loading fees

Some cards apply small charges each time you make a purchase or add funds. While these may seem minor individually, they can add up over time.

Reloadable prepaid credit cards often include competitive fee structures, so reviewing terms upfront is essential. This ensures you balance convenience with long-term cost-effectiveness effectively.

3. ATM withdrawal costs in the UK and abroad

Withdrawing money using prepaid solutions can attract extra fees. In the UK, ATM providers may charge per withdrawal, while international use often incurs higher costs.

You’ll want to factor these charges into travel budgets, especially if your business frequently requires employees to withdraw funds locally or during overseas assignments.

4. Currency conversion and FX charges

When employees travel abroad, using prepaid cards in different currencies can trigger foreign exchange costs. Providers usually apply a percentage-based fee on each international purchase.

To minimize these expenses, consider cards designed for global use with competitive FX rates. This helps you control international spending while reducing unnecessary financial overhead consistently.

5. Replacement card fees

If a prepaid card is lost, stolen, or damaged, providers often charge for issuing a replacement. While some companies may waive this under specific conditions, others apply fixed fees.

You should review provider policies beforehand to avoid surprises, ensuring employees always have reliable access to business funds without interruption.

6. Inactivity or dormant account fees

Some prepaid providers impose charges if cards remain unused for extended periods. These inactivity fees are designed to encourage regular usage.

To avoid them, you should monitor card activity regularly, deactivate unused accounts, or redistribute funds. Staying proactive helps prevent unnecessary losses and ensures your business spends only when required.

Limitations of using prepaid credit cards for businesses

Reloading and balance caps in the UK

Prepaid credit cards usually come with restrictions on how much you can load or hold. Balance caps and reloading limits vary by provider.

For businesses managing high-value expenses, these restrictions may feel inconvenient, requiring additional planning or multiple cards to ensure smooth financial operations without unnecessary disruptions or administrative complications.

Transaction and FX fees that may apply

Although useful, prepaid options often carry transaction and foreign exchange charges. These fees add up quickly, especially for businesses operating internationally.

If your company relies heavily on overseas spending, such costs may reduce efficiency. Understanding the provider’s full fee structure upfront helps you make smarter choices while avoiding unexpected budget strain.

No improvement to company credit rating

Business prepaid credit cards don’t contribute toward improving your company’s credit profile. Since they aren’t linked to borrowing or repayments, they don’t impact credit history.

If building creditworthiness is important, you’ll need alternative financial products. These cards are best for managing expenses rather than developing long-term borrowing credibility for your business.

Limited acceptance at some merchants

Although widely recognized, prepaid cards may not be accepted everywhere. Certain merchants, service providers, or hotels might decline them due to specific payment rules.

This limitation can create inconvenience if your employees rely on these cards exclusively. To avoid disruptions, always confirm acceptance or keep alternative payment methods available during business operations.

Possible delays in card issuance or delivery

Sometimes businesses face delays in receiving new prepaid cards after applying. While many providers offer quick processing, others may take longer to verify details or ship physical cards.

These delays can disrupt planned expenses, especially if you urgently require cards for employees handling immediate travel or critical purchasing responsibilities.

Risk of losing access if the provider goes offline

If your prepaid card provider experiences outages or technical downtime, you could temporarily lose access to company funds. This risk highlights the importance of choosing a reliable provider.

Businesses should always have contingency plans to ensure employees can manage essential transactions without interruptions, even during unexpected platform service disruptions.

Prepaid credit vs debit cards: What businesses should know

Choosing between prepaid and debit cards can be challenging when managing company finances. Both options offer distinct advantages and limitations.

By understanding their differences in ownership, spending control, costs, and long-term impact, you can make the right choice for your company’s financial management and overall operational efficiency.

Ownership of funds (credit vs deposit)

With prepaid credit cards for business, you load funds in advance, and spending is limited to that balance. Debit cards, however, are tied directly to your bank account, withdrawing deposited funds instantly.

This distinction is key because prepaid options isolate budgets while debit cards link company cash directly, significantly impacting financial flexibility.

Prepaid options also allow you to safeguard your main business account from direct exposure. Debit cards, though convenient, carry higher risks if fraudulent charges occur, since funds come directly from company reserves.

Suitability for business vs personal expenses

Prepaid cards are excellent for controlling team budgets, travel costs, or departmental purchases. They’re particularly useful when you want precise business oversight. Debit cards, on the other hand, often fit personal or small-scale expenses better.

While both work effectively, prepaid solutions provide added accountability, security, and control specifically tailored for professional business use.

These features make prepaid options particularly attractive for growing businesses managing multiple employees. Debit cards, while simple, lack built-in tools to separate personal and corporate usage effectively.

Spending controls and flexibility

Reloadable prepaid credit cards allow you to top up balances repeatedly, giving you ongoing control over employee spending. Debit cards lack this separation, since they draw directly from your main account.

Prepaid options also offer configurable limits, category restrictions, and real-time tracking, giving you flexibility and security that standard debit cards cannot provide.

With prepaid solutions, you can easily suspend or cancel cards without affecting overall banking operations. Debit cards, however, leave less room for customization and expense segmentation.

Transaction acceptance in the UK and abroad

Both prepaid and debit cards are widely accepted across the UK and internationally. However, prepaid options may occasionally face restrictions with certain merchants or hotels.

Debit cards, being bank-issued, typically enjoy broader acceptance. Still, prepaid cards often come with multi-currency features, offering better control and visibility when employees travel overseas for work.

They can also help you minimize foreign transaction fees when configured properly. Debit cards, though versatile, don’t offer the same level of currency management flexibility.

Cost structure and hidden fees

Prepaid cards often carry costs like reload fees, ATM charges, or monthly maintenance. Debit cards usually have lower fees but may include overdraft penalties if overspending occurs.

Each option has trade-offs, so carefully reviewing terms ensures your business avoids hidden costs, maximizes efficiency, and selects the most cost-effective payment tool available.

Prepaid solutions provide better predictability since you know charges upfront. Debit cards, however, can surprise you with overdraft fees or penalties, adding financial strain unexpectedly.

Effect on business credit history

Prepaid options do not build or affect company credit history since they don’t involve borrowing. Debit cards, similarly, don’t influence business credit standing.

If improving creditworthiness is a goal, you’ll need other financial products. These cards are better suited for expense management rather than enhancing your company’s future borrowing capacity.

For long-term credit growth, consider corporate credit cards or loans instead. Prepaid and debit cards are short-term management tools, not credit-building strategies.

Qualification criteria for obtaining a prepaid credit card in the UK

1. Business registration requirements

To qualify for business prepaid credit cards, your company must be legally registered in the UK. Providers typically request incorporation details such as the company number and registered address.

Ensuring accurate registration records not only speeds up approval but also demonstrates compliance with financial regulations when applying for prepaid solutions effectively.

2. Verification of company directors

Most providers require identity verification of directors or key decision-makers before issuing cards. This step prevents fraud and ensures transparency.

You’ll likely need to submit proof of identity and address. Verification helps providers confirm accountability while ensuring only authorized personnel manage and control the company’s prepaid card usage responsibly.

3. Minimum operating history (if required)

Some issuers may request proof of minimum operating history before approving applications. This criterion helps them evaluate financial stability.

However, many prepaid solutions don’t require long histories, making them suitable for startups. If your business is new, prepaid cards provide flexibility without demanding lengthy records or traditional banking relationships.

4. KYC and AML checks

Like any financial product, prepaid card applications involve Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. These ensure compliance with UK regulations and protect against fraud.

You’ll need to provide accurate details about your company and stakeholders. Passing these checks is essential for securing approval and maintaining operational transparency.

5. Documentation SMEs need to provide

When applying, SMEs usually must provide incorporation documents, proof of registered address, and ID for directors. Depending on the provider, recent financial statements or tax records may also be requested.

Clear documentation helps speed up processing, ensuring your application moves smoothly and without unnecessary delays during the approval process.

6. Approval timelines for UK businesses

Approval times vary depending on provider policies and the submitted documentation quality. Many applications are processed within a few days, while others may take longer due to additional verification steps.

If you’re wondering what is a prepaid credit card timeline, expect efficiency, provided all documents are accurate and checks clear quickly.

Factors to consider when choosing a prepaid credit card in the UK

Fee transparency and pricing models

Before selecting a provider, review all associated costs, including loading, transaction, and withdrawal fees. Transparent pricing ensures you avoid hidden charges that could disrupt budgets.

Comparing multiple providers helps you choose an option that balances affordability with the features your business genuinely needs for smooth financial management and expense control.

Compatibility with existing financial systems

It’s essential to check whether the card integrates seamlessly with your current accounting or ERP software. Smooth compatibility reduces manual work and improves reporting accuracy.

By choosing a provider offering integration with popular UK financial platforms, you streamline processes, improve efficiency, and make daily financial operations far more manageable.

Customization options for multi-department use

If your company has multiple teams, choose cards that offer customizable features for departmental use. Options like assigning budgets, setting merchant categories, or providing unique card identifiers help streamline financial tracking.

These features make it easier to monitor spending across departments while giving every team flexibility without losing managerial oversight.

Spending control and approval features

Strong control features help you define exactly how funds are used. Look for options like pre-set spending limits, category restrictions, or real-time approval mechanisms.

These tools give you confidence that employees use company money appropriately. With precise controls, you reduce misuse, prevent overspending, and strengthen your business’s overall financial discipline.

Scalability for startups vs enterprises

Your card solution should scale with your company’s growth. Startups often need simple, low-cost options, while larger enterprises require advanced controls and reporting.

By choosing a scalable solution, you avoid switching providers later. This flexibility supports smooth transitions as your business evolves from early operations to enterprise-level management effectively.

Provider reputation and compliance credentials

Always evaluate a provider’s market reputation and compliance with UK regulations. Reliable providers protect your funds while offering robust fraud prevention.

Checking reviews, certifications, and compliance standards ensures you’re partnering with a trustworthy financial institution. This step helps safeguard your business from risks while supporting seamless and transparent card operations.

How to implement a prepaid card programme in your business

Choosing the right prepaid provider in the UK

Start by comparing providers based on fees, security features, and integration with your financial systems. Look for companies with strong reputations and transparent pricing.

By carefully evaluating options, you ensure your business selects a reliable solution that matches both immediate needs and long-term financial management goals effectively.

Setting company policies and approval workflows

Establish clear policies outlining how employees can use cards, including permitted expenses and spending limits. Define approval workflows to ensure accountability before purchases occur.

By formalizing rules, you create consistency, prevent misuse, and strengthen oversight, allowing employees to understand expectations clearly while keeping company finances secure at all times.

Issuing virtual or physical cards to employees

Decide whether employees require physical cards for in-store transactions or virtual ones for online payments. Virtual cards are especially useful for subscriptions and vendor purchases.

Issuing the right type ensures employees operate efficiently while you maintain flexibility. This choice gives you greater control and visibility across various company expense categories.

Educating staff on usage rules

Once cards are issued, educate employees on policies, security practices, and spending limits. Provide training on accessing balances, reporting issues, and complying with approval workflows.

When staff clearly understand usage rules, you minimize risks, encourage responsible spending, and create a culture of transparency that supports your overall financial management goals.

Tracking and reconciling expenses regularly

Use reporting tools to monitor transactions in real time and reconcile expenses against budgets. Regular tracking prevents errors, highlights overspending, and strengthens financial accuracy.

By reviewing data consistently, you gain actionable insights that help optimize workflows, improve resource allocation, and ensure company funds are used appropriately across all operations.

Scaling the programme across multiple teams

As your business grows, expand the prepaid card programme to include additional teams or departments. Set departmental budgets, customize features, and adapt workflows as necessary.

Scaling this way ensures consistency and visibility across the organization while maintaining flexibility, making prepaid solutions an integral part of your long-term financial strategy.

How to reload a prepaid credit card in the UK

1. Bank transfer reloading from business accounts

You can transfer funds directly from your company’s business account into prepaid cards. This method ensures secure, traceable, and convenient reloading.

By linking accounts, you simplify the funding process while maintaining accurate records. It’s one of the most widely used and reliable ways to manage corporate card balances effectively.

2. Direct debit or standing orders

Setting up direct debit or standing orders allows automatic reloading at fixed intervals.

This ensures cards remain funded without manual effort. It’s ideal for recurring expenses like subscriptions or travel allowances.

By scheduling payments, you streamline operations while ensuring employees always have access to the funds they need.

3. Mobile wallet integrations in the UK

Some prepaid cards connect with mobile wallets such as Apple Pay or Google Pay. This lets you reload balances instantly from linked accounts or payment methods.

Mobile wallet integration gives employees flexibility, reduces administrative effort, and enhances convenience. It’s especially useful for businesses seeking modern, tech-enabled financial management solutions.

4. Employer-controlled bulk top-ups

Employers can distribute funds to multiple prepaid cards simultaneously through bulk top-up features. This is useful for managing departmental budgets or paying employees quickly.

By handling top-ups centrally, you save time and maintain better control. Bulk reloading also helps ensure consistent funding across different teams without unnecessary administrative complexity.

5. Instant top-up vs delayed transfer options

When reloading, some providers offer instant top-ups, while others process transfers with delays. Instant reloads are valuable during urgent needs, ensuring uninterrupted spending power.

Delayed transfers may be less convenient but can sometimes reduce fees. Understanding these options helps you choose the right funding method to match your company’s priorities.

Use cases of prepaid credit cards for UK businesses

Managing petty cash digitally

Prepaid cards replace the need for physical petty cash, making small expenses easier to track. Employees use cards for minor purchases while you monitor transactions in real time.

This improves accountability, prevents cash misuse, and reduces paperwork. Digital petty cash management streamlines operations while maintaining strong oversight across everyday office expenditures.

Covering employee travel expenses

When employees travel for work, prepaid cards simplify expense management. You can set limits, monitor spending, and reload funds instantly if needed.

Employees gain flexibility for transport, meals, or accommodation, while you retain oversight. This approach minimizes paperwork and ensures accurate, real-time tracking of all travel-related business expenses efficiently.

Paying for office supplies and subscriptions

Businesses can use prepaid cards to cover office essentials like software subscriptions or supplies. You allocate specific budgets for these purchases, preventing overspending.

Since every transaction is recorded, reconciliation becomes simpler. This method also adds accountability, ensuring company funds are used exclusively for legitimate operational needs without unnecessary financial risks.

Marketing and project-based budgets

Prepaid cards are effective for project-specific or marketing budgets. You can issue cards with set limits for campaigns, contractors, or event expenses. This ensures spending remains within allocated amounts.

By isolating funds per project, you create clearer financial tracking and avoid overspending, making project management more structured and transparent overall.

Employee perks and allowances

You can provide employees with perks like meal allowances, travel stipends, or wellness benefits through prepaid cards. This simplifies distribution and ensures funds are used only for intended purposes.

Employees enjoy flexibility and convenience, while you gain transparency. Such allowances also enhance engagement and morale without adding administrative burden.

Managing contractor or freelancer payments

Prepaid cards help you manage payments for contractors or freelancers efficiently. Instead of traditional bank transfers, you can allocate funds quickly through cards.

This reduces delays and improves flexibility, especially for short-term projects. Contractors benefit from instant access to funds, while you maintain oversight and streamline financial operations significantly.

Legal and compliance considerations in the UK

HMRC rules for expense reporting

HMRC requires businesses to maintain accurate records of expenses made using prepaid cards. You must document receipts and justify business-related transactions for tax compliance.

Clear reporting not only ensures regulatory adherence but also simplifies auditing. Following HMRC rules protects your company from penalties while keeping financial operations transparent and accountable.

FCA regulations on prepaid cards

In the UK, prepaid cards are regulated by the Financial Conduct Authority (FCA). Providers must comply with licensing and operational standards to safeguard customer funds.

As a business, you should choose FCA-regulated issuers to ensure protection. This guarantees reliability, minimizes risks, and helps you maintain compliance with financial service rules.

Anti-money laundering (AML) obligations

Businesses using prepaid cards must adhere to AML regulations to prevent illegal financial activities. Providers conduct due diligence and monitor unusual transactions. You’re expected to cooperate by providing accurate information.

These checks safeguard your business and ensure funds are not misused for fraudulent or unlawful purposes, protecting long-term operational integrity.

Identity verification standards in the UK

Before issuing prepaid cards, providers must verify the identities of directors and stakeholders. This helps prevent fraud and financial crime. You’ll be asked for documents like passports, driver’s licenses, or utility bills.

Following these standards ensures transparency, compliance, and trust while maintaining the safety of business-related financial transactions consistently.

Data privacy compliance under UK GDPR

When using prepaid solutions, your business must comply with UK GDPR requirements. Cardholder data must be collected, stored, and processed securely. Providers should implement encryption and strong access controls.

You’re responsible for choosing partners that respect privacy regulations, ensuring sensitive employee or financial data is always handled appropriately and lawfully.

Audit requirements for UK businesses

Prepaid card usage must be auditable for compliance and accountability. Regular internal and external audits help confirm transactions are legitimate and align with policies.

You should maintain accurate records, use reporting dashboards, and prepare documentation when requested. Auditing strengthens financial control, enhances trust, and ensures your business meets UK standards.

Security tips for using prepaid credit cards in business

1. Setting smart usage rules

Define clear rules for how employees can use prepaid cards. Establish limits, restrict categories, and specify approved vendors. Clear policies reduce misuse and set expectations.

By implementing structured guidelines, you give employees confidence while protecting company funds, ensuring money is always used for appropriate and approved business purposes only.

2. Real-time fraud detection and alerts

Enable real-time alerts to track every transaction as it happens. Fraud detection systems monitor unusual activity and notify you instantly. By acting quickly, you minimize risks and prevent losses.

These alerts empower you to identify suspicious behavior, giving your business greater protection and financial security across all prepaid card usage.

3. Role-based access and approval chains

Assign cards and permissions based on employee roles. For high-value purchases, implement approval chains requiring management authorization. This system reduces unauthorized spending and creates accountability.

Role-based access ensures that employees only use cards within their responsibilities, giving you tighter control and reinforcing security across all company spending activities consistently.

4. Encryption and tokenization of transactions

Choose providers that secure every transaction with encryption and tokenization. These technologies protect sensitive card details from being intercepted or misused.

By adopting advanced security layers, you reduce fraud risks and maintain compliance. Encryption safeguards financial data, ensuring your business transactions remain private and secure during processing at all times.

5. Secure mobile app access for employees

Most providers offer mobile apps for managing prepaid cards. Ensure access requires strong authentication, such as biometrics or two-factor verification. Educating staff on secure logins further reduces risks.

By securing mobile access, you empower employees to manage funds conveniently while keeping company data and financial activity well-protected from threats.

6. Regular audits of prepaid usage

Conduct regular audits to review prepaid card activity. Analyzing patterns helps you detect irregularities and reinforce compliance. These reviews strengthen trust, prevent misuse, and support policy updates.

By auditing consistently, you create a culture of transparency and accountability, ensuring prepaid card usage remains secure and aligned with company goals.

Best practices for using prepaid credit cards effectively

Defining clear expense policies

You should establish written guidelines on how prepaid cards may be used. Define spending categories, limits, and approval requirements. These policies prevent misuse and set consistent expectations.

Documenting rules also helps employees understand responsibilities, making card usage smoother. Clear policies ultimately reduce risks, streamline processes, and protect company finances effectively.

Ongoing expense monitoring

Monitoring expenses in real time helps you maintain financial control. Use dashboards and alerts to track spending patterns. Continuous oversight prevents overspending and ensures compliance with policies.

This approach enables quick corrective actions, supports budgeting accuracy, and strengthens overall accountability. By monitoring regularly, you stay ahead of potential risks.

Training employees on usage and compliance

Educating staff on prepaid card rules minimizes errors and misuse. Offer regular training sessions covering expense policies, security practices, and reporting requirements. Empowered employees use cards responsibly and confidently.

Training also reinforces accountability, ensuring compliance with business policies. Well-trained staff can prevent unnecessary mistakes and support smoother financial operations overall.

Automating receipt collection with apps

Integrating mobile apps for receipt capture simplifies reporting. Employees can upload images instantly, reducing paperwork and delays. Automation ensures expense records remain accurate and complete.

You save time, improve compliance, and enhance auditing. By streamlining receipt collection, you reduce administrative burden while ensuring transparent, organized financial documentation across departments.

Adjusting budgets dynamically

Prepaid cards allow you to adapt budgets as business needs evolve. Adjust limits instantly based on project demands or seasonal spending. This flexibility ensures funds are allocated effectively.

Real-time adjustments enhance control, prevent bottlenecks, and support growth. By dynamically managing budgets, you maximize efficiency and maintain financial stability consistently.

Linking cards with accounting tools

Integrating prepaid cards with accounting software automates reconciliation. Transactions flow directly into systems, reducing manual errors. This saves time and improves accuracy.

You also gain clearer financial visibility, making reporting easier. Linking cards to tools ensures smoother workflows, reduces workload, and enhances compliance while supporting faster decision-making for management.

Future trends in business prepaid credit cards

Rise of virtual-only prepaid cards

Virtual prepaid cards are becoming increasingly popular. They eliminate plastic issuance, reduce costs, and improve security. You can issue cards instantly for online purchases or subscriptions.

This trend supports remote teams, making financial management more agile. Virtual-only cards will continue shaping modern business payments with convenience and cost efficiency.

Contactless payment adoption in the UK

Contactless payments are rapidly growing in the UK, influencing prepaid card use. Businesses now benefit from faster transactions and improved efficiency. Employees can make quick purchases securely without needing PINs.

This trend offers convenience, reduces friction, and enhances productivity. Adopting contactless solutions positions your company at the forefront of innovation.

Multi-currency and cross-border use cases

Prepaid cards increasingly support multi-currency transactions, ideal for international operations. You can pay vendors or employees abroad without conversion complexities. This feature reduces costs and improves financial control.

Cross-border flexibility benefits global businesses, freelancers, and distributed teams. By adopting multi-currency options, you streamline operations and expand international financial capabilities.

AI-powered fraud prevention

Artificial intelligence is transforming fraud detection in prepaid cards. Systems analyze spending patterns and flag suspicious activity instantly. You benefit from stronger protection and reduced losses.

AI-driven monitoring reduces reliance on manual oversight. This proactive approach gives businesses enhanced security, ensuring prepaid card programs remain safe and trustworthy long-term.

Growth of prepaid card adoption among SMEs

Small and medium-sized businesses increasingly turn to prepaid cards for flexibility. These tools provide better control, cost management, and transparency. As solutions scale affordably, SMEs adopt them to simplify payments.

You gain budgeting power, security, and adaptability. Prepaid cards are becoming essential tools supporting SME growth and competitiveness.

Integration with spend management platforms

Prepaid cards are now integrated with advanced spend management platforms. This creates unified oversight of expenses, approvals, and reporting. You gain real-time visibility into budgets and compliance.

Integration reduces errors, simplifies workflows, and boosts efficiency. By linking prepaid cards to these platforms, you future-proof your company’s financial management practices.

Why choose Volopay prepaid cards for your business

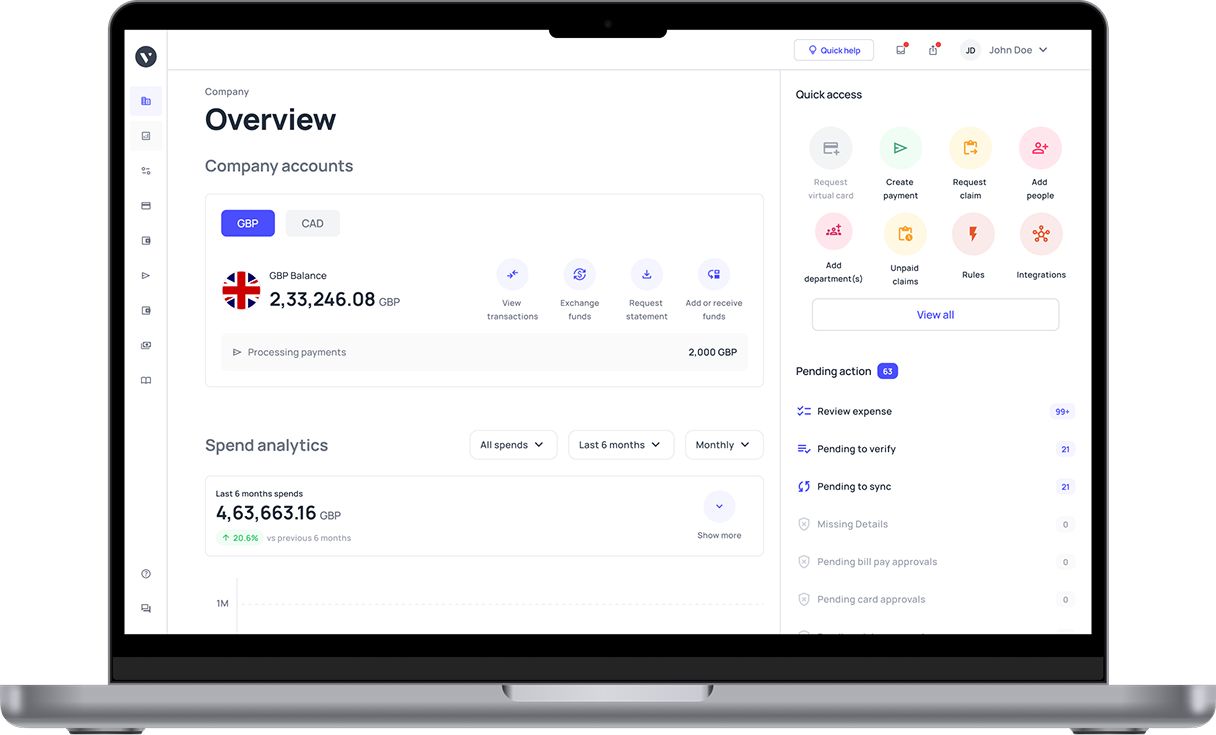

If you are looking for smarter ways to manage company expenses, Volopay's prepaid business cards offer unmatched flexibility and control. From fraud protection to seamless integrations, these cards empower your team to spend responsibly.

With real-time visibility, automated reconciliation, and HMRC-compliant records, you gain efficiency, transparency, and financial confidence across every department.

Enhanced fraud protection with PINs and card limits

You can set custom PINs, spending limits, and merchant restrictions to prevent unauthorized transactions. Volopay prepaid cards help safeguard company funds against misuse while maintaining accountability.

These features reduce financial risk and encourage responsible spending across teams. By controlling every card’s access, you establish secure frameworks that protect assets and simplify financial governance effectively.

Real-time expense tracking with dashboards

Volopay’s platform allows you to track expenses instantly with clear, user-friendly dashboards. You gain visibility into spending across departments and projects in real time.

This transparency ensures quick decision-making and tighter budget control. Monitoring on demand also helps identify irregularities faster, empowering you to keep company finances optimized, accurate, and free from compliance risks.

Automated receipt collection and reconciliation

Employees can capture and upload receipts instantly through Volopay’s intuitive mobile app. Transactions are automatically matched with receipts, minimizing manual work and errors.

This automation saves time, reduces paperwork, and ensures consistent compliance. You maintain complete financial clarity, while reconciliation processes become faster and more reliable, strengthening the efficiency of expense management practices.

HMRC-compliant transaction logs

Every card transaction is automatically logged in HMRC-compliant formats, simplifying tax preparation and audits with accounting automation. You no longer need to worry about missing records or disorganized data.

These logs enhance transparency, accuracy, and compliance with UK standards. With organized records, you reduce risks, avoid penalties, and streamline reporting processes for smoother financial operations year-round.

Seamless integration with leading accounting tools

Volopay integrates seamlessly with leading accounting tools such as Xero, NetSuite, and QuickBooks. This connectivity ensures every expense syncs automatically into your systems.

You eliminate duplication, reduce manual entries, and maintain accuracy. Such integrations streamline workflows and boost productivity, ensuring financial processes align perfectly with existing systems and deliver consistent reliability for your business.

Scalable for multi-department UK businesses

Reloadable prepaid cards from Volopay scale easily as your organization grows. Whether managing startup budgets or enterprise-level departments, you can assign cards with tailored controls.

Scalability ensures each team has secure, customized access to funds. This adaptability empowers you to support company expansion while maintaining oversight, compliance, and efficiency across multiple business units.

Dedicated customer support

Volopay provides dedicated customer support to assist with onboarding, troubleshooting, and ongoing queries. You receive timely help whenever needed, ensuring seamless usage of prepaid cards.

With proactive guidance, your business can resolve issues quickly, minimize disruptions, and maximize value. This hands-on support strengthens trust, enabling your teams to focus on growth without administrative setbacks.

FAQs about prepaid credit cards in the UK

Prepaid credit cards are widely accepted across the UK, especially for online transactions and retail payments. However, certain merchants or recurring services may prefer traditional credit cards. Always confirm acceptance before completing payments.

Yes, prepaid cards provide effective control over employee expenses by assigning budgets to individuals or teams. You can monitor transactions in real time, prevent overspending, and simplify reimbursement processes with accurate reporting.

No, prepaid business credit cards do not impact company credit scores because they are not linked to credit facilities. Since spending is limited to preloaded funds, there’s no borrowing or repayment.

Volopay prepaid cards come with features like automated receipt collection, real-time dashboards, and HMRC-compliant logs. Unlike traditional prepaid cards, you gain advanced expense controls, integrations, and scalability tailored for business needs.

Yes, Volopay prepaid cards integrate seamlessly with major UK accounting tools such as Xero, NetSuite, and QuickBooks. This allows you to sync transactions automatically, reduce manual entries, and ensure accurate reporting.

Absolutely, Volopay prepaid cards can be assigned to various departments or teams with customized controls. You can set budgets, define usage rules, and track spending independently while maintaining centralized oversight effectively.

Volopay prepaid cards include advanced security features such as PIN protection, spending limits, merchant restrictions, and real-time fraud alerts. These measures ensure safe transactions and minimize risks of unauthorized usage.