Key benefits of prepaid cards for managing UK employee travel expenses

Managing employee travel expenses efficiently remains a critical challenge for businesses. Traditional methods often create administrative burdens, compliance issues, and budget control problems.

Modern organisations are increasingly turning to innovative solutions that streamline expense management while maintaining strict financial oversight. The evolution of digital payment solutions has revolutionized how companies handle travel-related expenditures, offering unprecedented control and transparency.

What are prepaid travel cards?

Prepaid travel cards are digital payment solutions that allow you to load funds in advance for employee travel expenses.

These cards function like debit cards but with predetermined spending limits and enhanced control features. Unlike traditional credit cards, they prevent overspending by restricting access to pre-loaded amounts only.

You can issue both physical and virtual versions to employees, enabling secure transactions across global merchants, hotels, and airlines.

Challenges in employee travel spending

Businesses face significant obstacles when managing employee travel expenses through conventional methods. These challenges create financial risks, administrative inefficiencies, and compliance complications that impact overall business operations. Understanding these pain points helps organisations recognize the need for more sophisticated solutions.

Travel challenges

Cash-based travel payments expose your business to substantial security risks and tracking difficulties.

Credit card usage creates potential overspending scenarios, leading to unauthorized expenses that exceed approved travel budgets.

Lost receipts and manual expense reporting introduce errors and delays in financial reconciliation.

These traditional methods lack real-time visibility, making it impossible to intervene when spending deviates from approved policies during active travel periods.

Expense oversight

Lack of real-time visibility into employee spending creates significant budget control complications for businesses.

You cannot monitor expenses as they occur, leading to budget overruns and unexpected financial surprises.

This delayed visibility makes it challenging to identify spending patterns, track policy violations, or implement corrective measures promptly.

Without instant oversight, you risk approving expenses that exceed departmental budgets or violate company policies, ultimately impacting your bottom line.

Reimbursement delays

Slow reimbursement processes create employee dissatisfaction and administrative burdens that affect workplace morale and productivity.

Your employees often wait weeks for expense approvals, impacting their personal cash flow and creating frustration.

Manual processing of receipts, expense reports, and approval workflows consumes significant administrative resources.

These administrative delays increase processing costs for your business while reducing employee satisfaction with travel assignments.

Policy violations

Ensuring employee travel spending aligns with company policies presents ongoing challenges for businesses. You struggle to enforce spending limits, approved vendor lists, and category restrictions when employees use personal payment methods.

Policy violations often go undetected until expense reports are submitted, making corrective action difficult.

These violations create compliance risks and budget discrepancies that require extensive investigation and correction, consuming valuable administrative time and resources.

VAT compliance

Tracking travel expenses for accurate VAT submissions and HMRC audits presents complex challenges for UK businesses. You must maintain detailed records of all travel-related expenditures, including receipts, VAT amounts, and business justifications.

Missing or incorrect VAT information can lead to penalties, reduced tax efficiency, and compliance issues with HMRC requirements.

The complexity of managing multiple currencies, international transactions, and varying VAT rates across different countries further complicates compliance efforts.

Digital trends in business travel expense payments

Modern payment solutions are transforming business travel expense management across the UK.

● Cloud-based platforms now offer integrated expense management, real-time reporting, and automated compliance features.

● Mobile applications enable instant expense capture, receipt scanning, and approval workflows.

● Artificial intelligence analyses spending patterns, identifies anomalies, and suggests policy improvements.

These digital innovations provide unprecedented control over travel expenses while reducing administrative overhead and improving employee satisfaction with streamlined processes.

Key benefits of prepaid cards for travel expense management

Prepaid cards for employee travel expenses offer comprehensive solutions that address traditional expense management challenges while providing enhanced control and visibility. These innovative payment tools transform how UK businesses manage travel expenditures, delivering measurable benefits across multiple operational areas.

1. Controlled spending

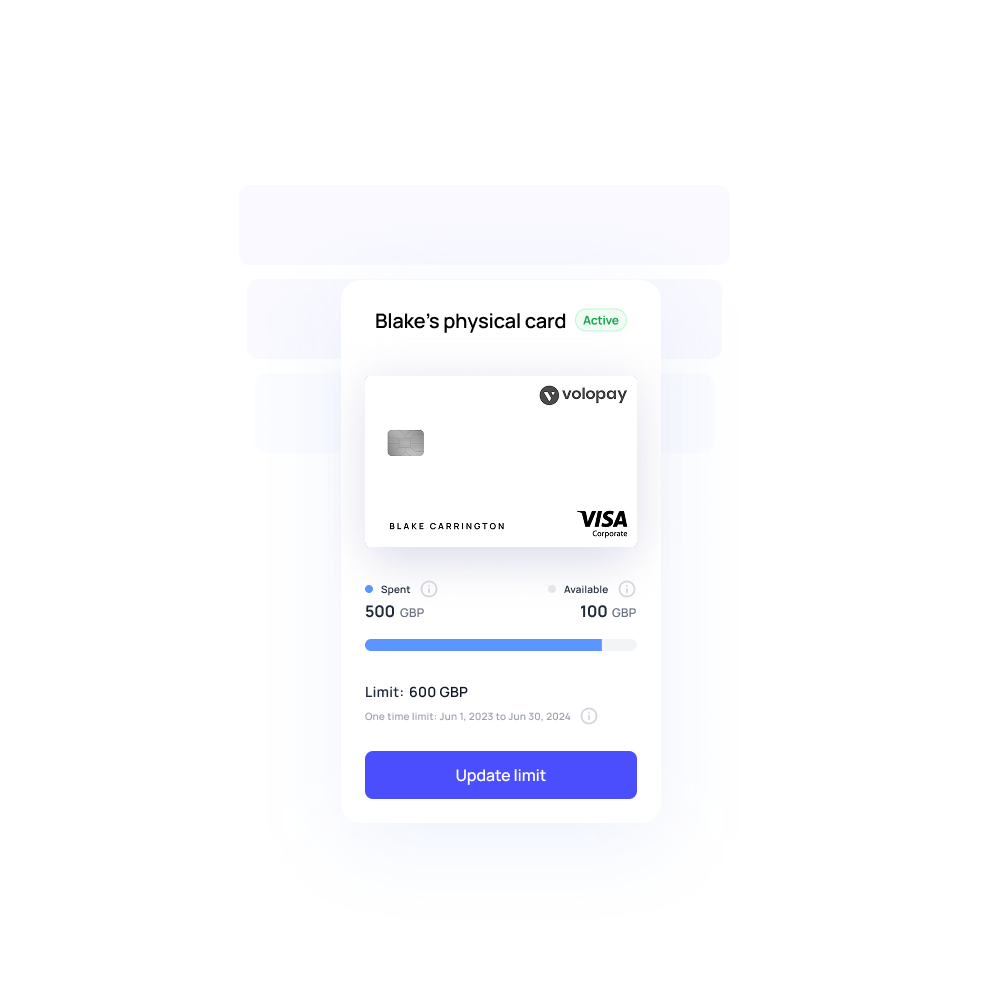

Setting spending limits ensures your employees adhere to approved travel budgets and company policies effectively.

You can configure individual card limits based on specific travel itineraries, destination costs, and departmental budgets. These predetermined limits prevent overspending while allowing necessary flexibility for legitimate travel expenses.

The system automatically declines transactions exceeding set limits, providing instant budget protection without requiring manual intervention. This controlled approach eliminates the risk of unauthorized expenses while maintaining employee autonomy within approved parameters, ensuring travel costs remain predictable and manageable.

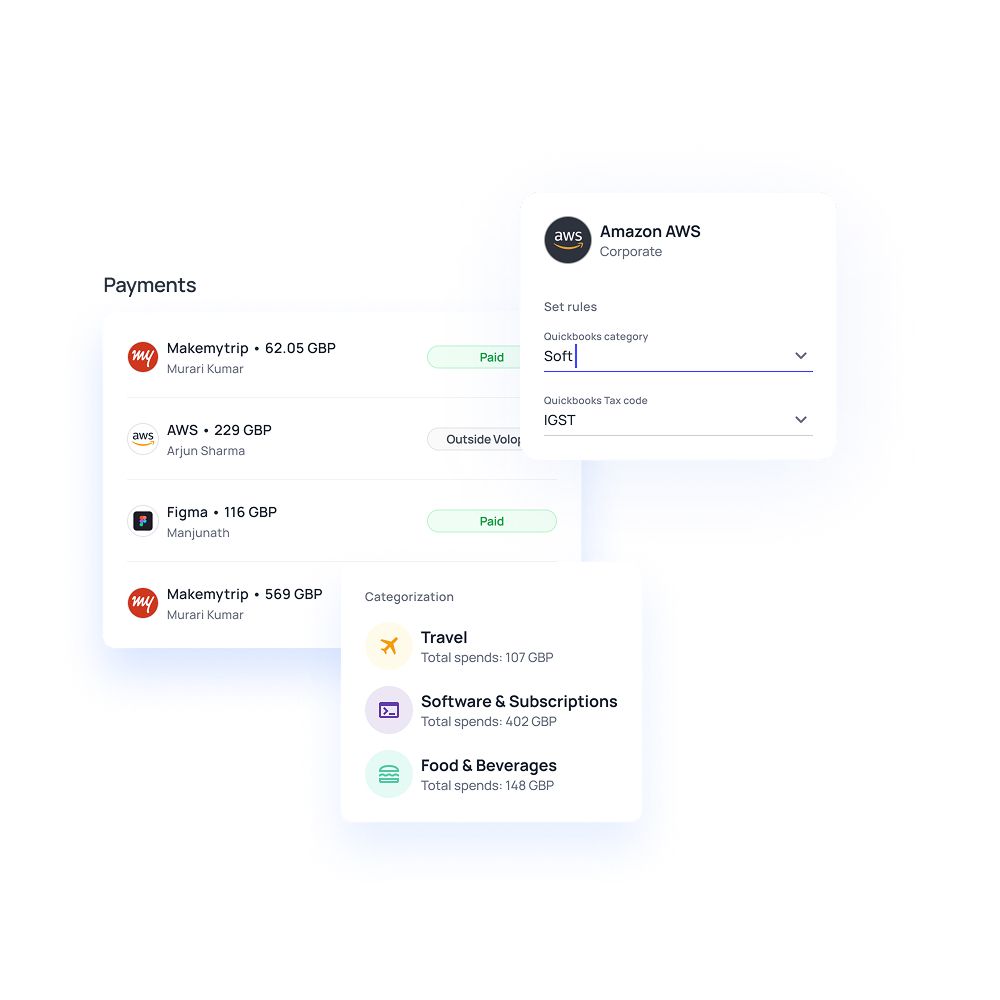

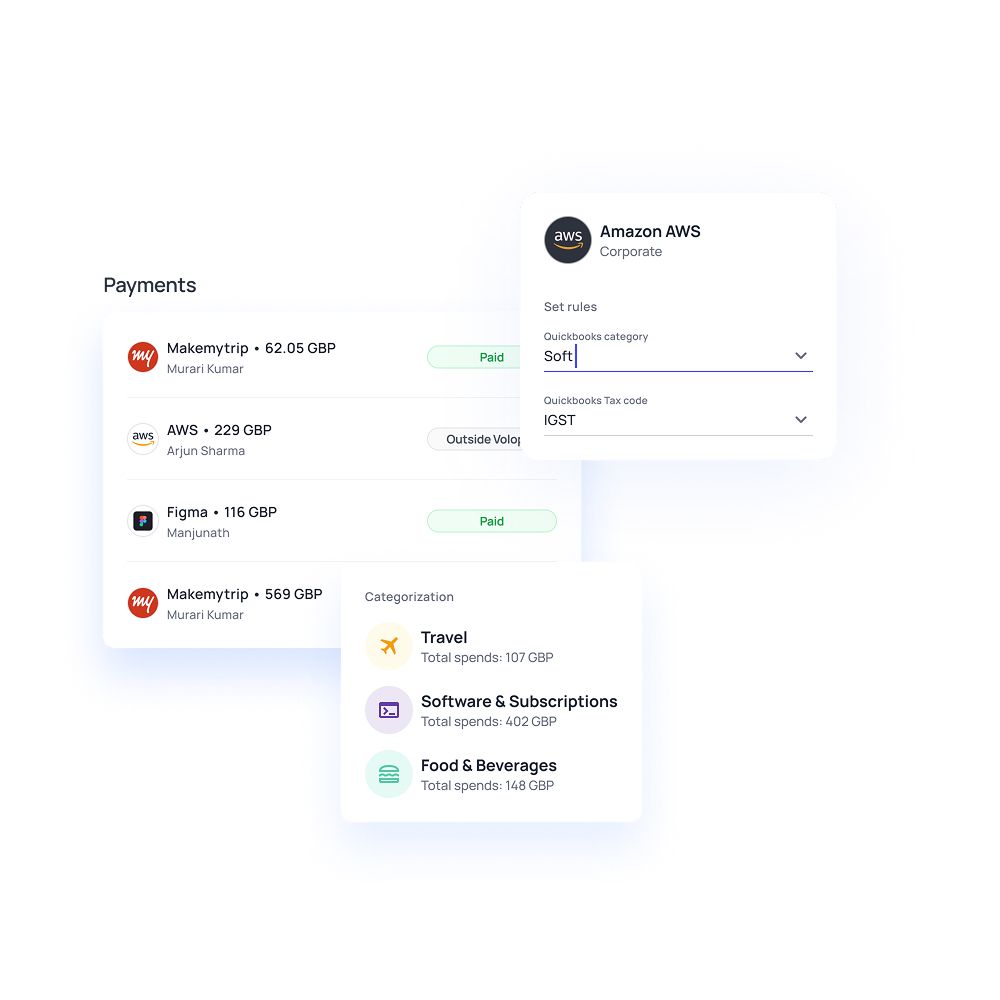

2. Real-time tracking

Instant transaction monitoring through comprehensive dashboards provides immediate expense oversight and compliance verification. You can view all travel transactions as they occur, enabling proactive budget management and policy enforcement.

Real-time alerts notify you of unusual spending patterns, policy violations, or budget thresholds being approached. This immediate visibility allows quick intervention when necessary, preventing costly overruns or unauthorized purchases.

The transparency provided by real-time tracking improves accountability while reducing the administrative burden of manual expense monitoring and reconciliation processes.

3. Fraud protection

Limited funds availability and advanced encryption significantly reduce risks during travel transactions and potential theft scenarios. Unlike credit cards with high limits, prepaid cards for employee travel expenses restrict access to pre-loaded amounts only, minimising potential fraud exposure.

Advanced security features, including chip technology, PIN protection, and transaction monitoring, provide multiple layers of defence against unauthorized usage. If cards are lost or stolen, you can instantly freeze accounts and issue replacements without affecting other company finances or credit facilities.

4. Easy reimbursement

Simplified processes for tracking and reimbursing employee travel costs improve efficiency and employee satisfaction significantly. Digital transaction records eliminate manual receipt collection and expense report compilation, reducing administrative burden for both employees and finance teams.

Automated expense categorisation and policy compliance checks streamline approval workflows. Integration with accounting systems enables seamless reimbursement processing, reducing processing time from weeks to days. This efficiency improvement enhances employee experience while reducing administrative costs and improving cash flow management for your organisation.

5. No credit risk

Prepaid cards eliminate debt risks for both businesses and employees, unlike traditional credit card arrangements. You maintain complete control over spending without extending credit facilities or assuming liability for employee debt. This approach protects your credit rating while preventing employees from accumulating personal debt through business travel.

The prepaid structure ensures expenses are covered by available funds only, eliminating the risk of unpaid balances or interest charges. This financial protection provides peace of mind while maintaining strict budget control and fiscal responsibility.

6. Global acceptance

Wide acceptance at hotels, airlines, and merchants worldwide ensures seamless travel experiences for your employees. Major card networks provide extensive global coverage, enabling transactions in virtually any destination.

You can confidently send employees to international locations knowing their payment method will be accepted for essential travel expenses. This universal acceptance eliminates the need for multiple payment methods or currency exchanges, simplifying travel logistics.

The convenience of global acceptance reduces travel complications while ensuring employees can access necessary services regardless of their location.

7. Currency flexibility

Multi-currency support reduces foreign exchange hassles and costs during international travel assignments. You can load cards with multiple currencies, enabling employees to pay in local denominations without conversion fees. This flexibility protects against unfavourable exchange rate fluctuations while providing cost certainty for international travel budgets.

Employees avoid the inconvenience of currency exchanges while you maintain control over foreign exchange costs. The ability to manage multiple currencies on a single platform simplifies international expense management and reduces associated administrative complexity.

8. Employee convenience

Easy card usage eliminates the need for personal funds or complex reimbursement processes, improving employee satisfaction. Your employees can focus on business objectives rather than managing personal cash flow for travel expenses. The convenience of dedicated travel cards reduces the administrative burden of expense reporting and approval processes.

Employees appreciate the simplicity of using company-provided payment methods without advancing personal funds or managing complex reimbursement procedures. This convenience improves the overall travel experience while reducing employee frustration with traditional expense management methods.

9. Policy compliance

Customizable controls ensure travel spending aligns with company policies through automated enforcement mechanisms. You can configure spending categories, merchant restrictions, and transaction limits that automatically enforce policy compliance. These automated controls prevent policy violations at the point of purchase rather than discovering issues during expense report review.

The system can restrict purchases to approved vendor categories, enforce meal allowances, and prevent unauthorized expenditures. This proactive approach to policy enforcement reduces compliance risks while minimising the administrative burden of manual policy monitoring.

10. Time savings

Reduced administrative time for expense approvals and manual reconciliations improves operational efficiency significantly. Automated transaction categorisation and policy compliance checks eliminate manual review processes for routine expenses. Digital records integrate seamlessly with accounting systems, reducing data entry and reconciliation time.

Finance teams can focus on strategic activities rather than processing routine travel expenses. The time savings achieved through automation improve productivity while reducing the administrative cost of expense management, delivering measurable operational benefits to your organisation.

Prepaid cards vs. traditional methods

Comparing prepaid cards for employee travel expenses with conventional payment methods reveals significant advantages in security, control, and administrative efficiency. Understanding these differences helps businesses make informed decisions about their travel expense management strategies.

Cash limitations

Cash payments create substantial security risks and tracking difficulties that prepaid cards effectively eliminate. Your employees face theft risks when carrying large amounts of cash, while you struggle to monitor actual spending versus budgeted amounts. Cash transactions lack digital records, making expense reporting complex and prone to errors.

Lost receipts create reconciliation problems and potential compliance issues. Prepaid cards provide secure digital transactions with complete spending visibility, eliminating these traditional cash-related challenges while maintaining spending control and security.

Credit card risks

Credit cards enable overspending and create debt risks that prepaid cards prevent through predetermined spending limits. Traditional credit cards offer high limits that can lead to unauthorized expenses exceeding approved budgets. Credit arrangements create liability for your business while potentially affecting credit ratings.

Prepaid cards eliminate these risks by restricting access to pre-loaded funds only, ensuring expenses remain within approved budgets. This controlled approach protects both your business and employees from debt accumulation while maintaining necessary spending flexibility.

Expense reporting

Prepaid cards provide comprehensive digital records that simplify expense reporting compared to manual cash and credit card tracking. Traditional methods require employees to collect receipts, categorize expenses, and compile reports manually. This process is time-consuming, error-prone, and administratively burdensome.

Prepaid cards automatically generate detailed transaction records with merchant information, categories, and spending details. These digital records integrate seamlessly with expense management systems, eliminating manual data entry and reducing processing time significantly.

Employee convenience

Prepaid cards offer superior convenience compared to cash handling requirements and credit approval processes. Employees avoid the inconvenience of obtaining cash advances, managing personal funds, or waiting for credit approvals.

The simplicity of prepaid cards eliminates complex reimbursement procedures while providing immediate access to approved travel funds. This convenience improves employee satisfaction while reducing administrative burden on both employees and finance teams, creating a more efficient travel expense management process.

Get the perfect prepaid card for your business!

Setting up prepaid cards for travel expense management

Choose a provider

Implementing prepaid cards for employee travel expenses requires careful planning and systematic execution to maximize benefits and ensure smooth operations. Selecting the right prepaid card provider is crucial for the successful implementation of your travel expense management system.

You should evaluate providers based on card acceptance networks, fee structures, reporting capabilities, and customer support quality. Consider providers offering multi-currency support, global acceptance, and integration with existing accounting systems.

Assess security features, fraud protection measures, and compliance with UK financial regulations. Compare pricing models including setup fees, transaction charges, and monthly maintenance costs. Choose providers with proven track records serving UK businesses and offering comprehensive support services.

Generate and assign cards

Issuing physical and virtual cards to employees requires careful consideration of travel requirements and security protocols. You should determine whether employees need physical cards for in-person transactions or virtual cards for online bookings.

Configure card activation processes, PIN assignment procedures, and security verification requirements. Establish naming conventions for easy identification and tracking of individual cards.

Create card assignment records linking specific cards to employees, departments, and travel purposes. Implement secure distribution procedures, ensuring cards reach intended recipients while maintaining security and accountability throughout the process.

Set budgets

Configuring spending limits based on travel itineraries and company policies ensures effective budget control and policy compliance. You should establish individual card limits reflecting specific travel requirements, destination costs, and approved expense categories.

Consider daily spending limits, transaction frequency restrictions, and merchant category limitations. Configure different limit structures for domestic versus international travel, senior executives versus junior staff, and short-term versus extended assignments.

Implement approval workflows for limit modifications and emergency increases. Regular review and adjustment of spending limits ensure they remain appropriate for changing travel requirements.

Fund cards

Loading funds through bank transfers and alternative payment methods ensures cards are ready for immediate travel use. You should establish automated funding procedures that maintain adequate balances while avoiding excess idle funds.

Configure funding schedules based on travel calendars, ensuring cards are loaded before departure dates. Implement approval processes for funding requests, including documentation requirements and authorisation levels.

Consider automated top-up features for frequent travellers and emergency funding procedures for unexpected requirements. Monitor funding efficiency to optimize cash flow management while ensuring employee travel needs are met.

Train employees

Educating staff on card usage and expense submission processes ensures successful adoption and compliance with company policies. You should develop comprehensive training materials covering card activation, transaction procedures, and security protocols.

Conduct training sessions explaining expense reporting requirements, receipt submission procedures, and policy compliance expectations. Provide ongoing support resources, including user guides, frequently asked questions, and contact information for assistance.

Establish feedback mechanisms to identify training gaps and improve user experience. Regular refresher training ensures continued compliance and optimal system utilisation.

How to manage travel expenses using prepaid cards

Mastering management of prepaid cards for employee travel expenses requires understanding the available tools and implementing systematic processes for effective oversight and control.

Monitor transactions

Comprehensive dashboards provide real-time tracking capabilities for all employee travel spending activities across your organisation. You can view transaction details, including merchant information, spending categories, amounts, and timestamps as they occur.

Monitor spending trends across different employees, departments, and travel destinations to identify optimization opportunities. The real-time visibility enables proactive intervention when necessary, preventing costly overruns and ensuring compliance with company policies throughout travel periods.

Adjust limits

Modifying spending budgets during travel accommodates unexpected expense needs while maintaining fiscal control and oversight. You can increase limits for legitimate requirements such as extended stays, emergency situations, or additional business activities.

Configure temporary limit increases with automatic reversion to standard limits after specified periods. This flexibility enables responsive support for employee needs while maintaining budget discipline and preventing unauthorized spending beyond approved parameters.

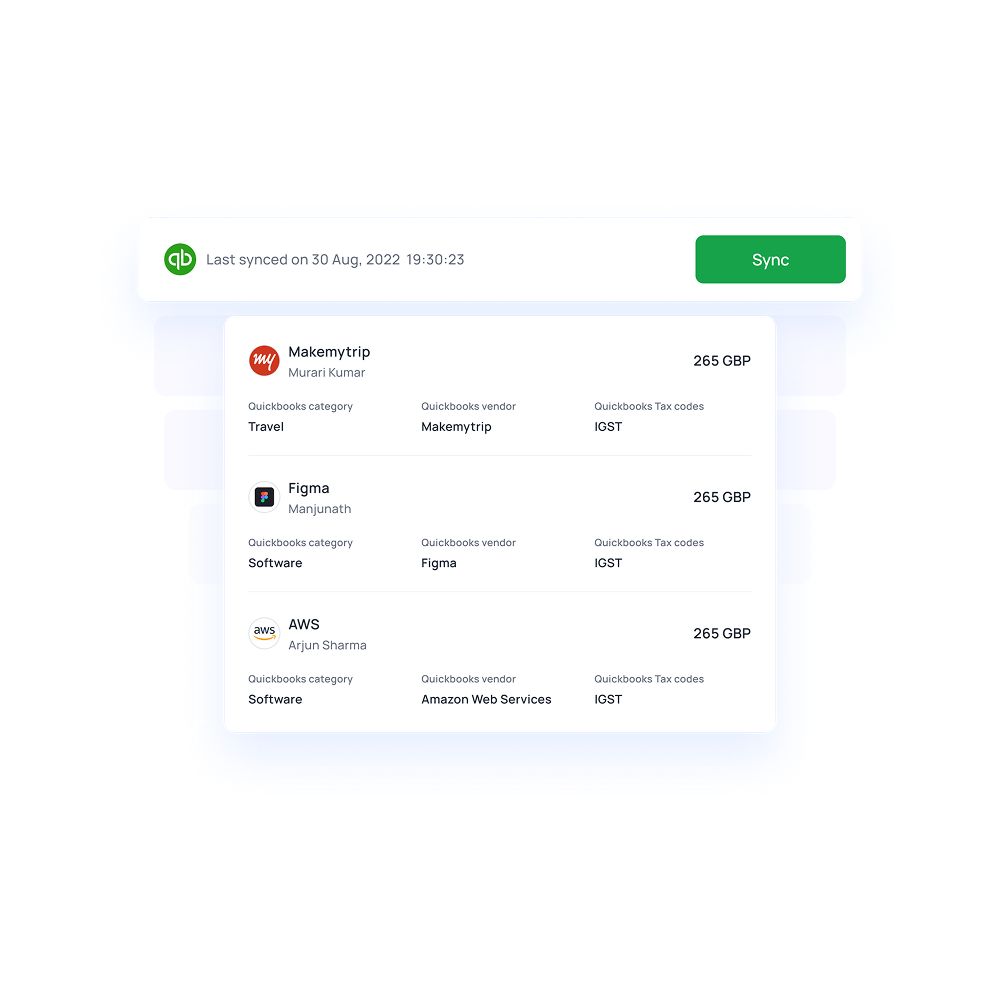

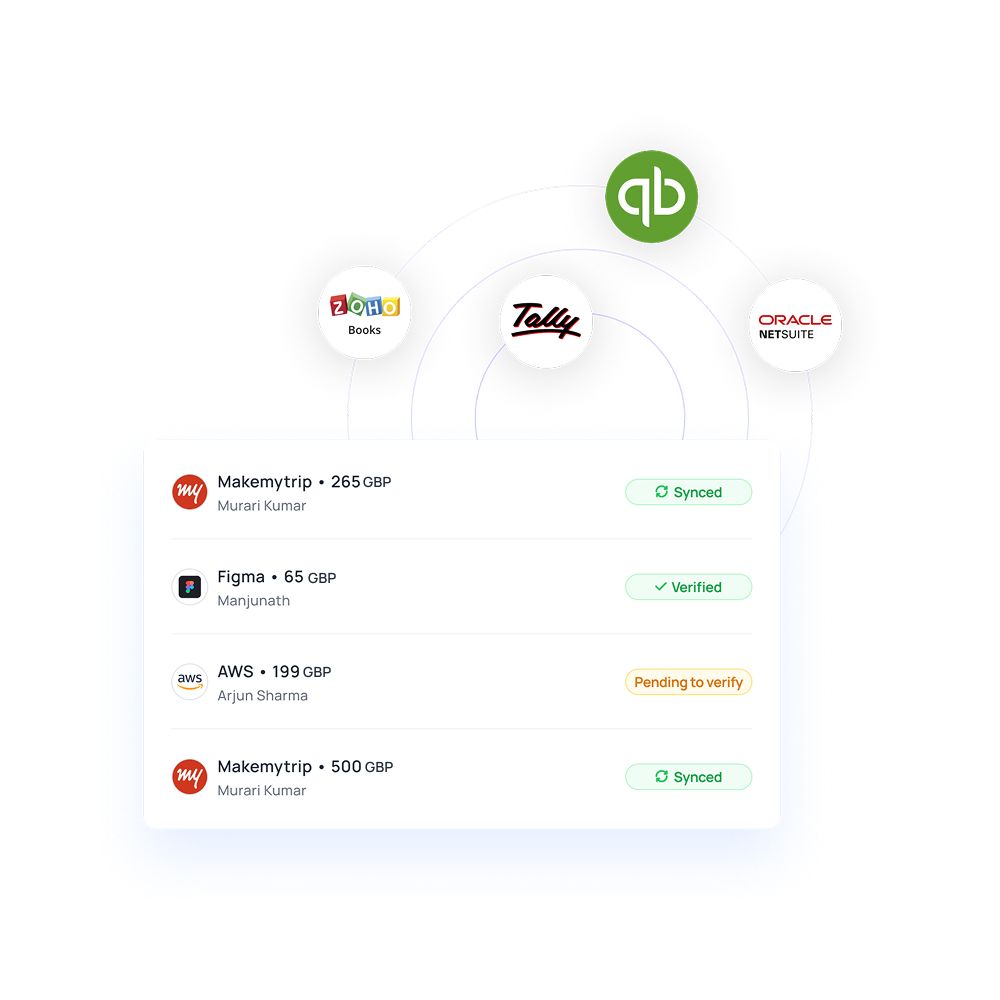

Integrate accounting

Seamless synchronization with accounting systems streamlines travel expense reporting and financial reconciliation processes. You can automatically import transaction data, eliminating manual data entry and reducing processing time significantly.

Establish automated reconciliation procedures that match card transactions with expense reports and supporting documentation. This integration improves accuracy while reducing administrative burden on finance teams and accelerating month-end closing procedures.

Generate reports

Creating comprehensive travel expense reports supports budgeting, compliance, and strategic decision-making across your organisation. You can generate reports by employee, department, travel destination, or expense category to identify spending patterns and optimisation opportunities.

Include variance analysis comparing actual spending against budgeted amounts and policy compliance metrics. These reports provide valuable insights for future travel planning and budget allocation decisions.

Ensuring compliance for prepaid card usage

Maintaining compliance with UK regulatory standards requires systematic attention to legal requirements and proper documentation procedures throughout your travel expense management processes.

1. FCA regulations

Compliance with Financial Conduct Authority (FCA) rules ensures your prepaid card usage meets legal requirements for business expense management. You must maintain accurate records of all card transactions, including business justifications and supporting documentation.

Implement procedures ensuring cards are used only for legitimate business purposes and comply with anti-money laundering requirements. Establish audit trails documenting card issuance, usage, and termination procedures.

Regular compliance reviews ensure ongoing adherence to FCA requirements while identifying potential improvement areas in your expense management processes.

2. VAT reporting

Accurate tracking of travel expenses supports proper VAT submissions and prepares your organisation for HMRC audits effectively. You should maintain detailed records of all VAT-eligible expenses, including receipts, VAT amounts, and business justifications.

Configure expense categorisation systems that separate VAT-eligible and non-eligible expenses for accurate reporting. Implement procedures for handling international transactions and varying VAT rates across different countries.

Regular VAT reconciliation ensures accurate reporting while maximising legitimate VAT recovery opportunities and minimising compliance risks.

3. Audit readiness

Maintaining comprehensive digital records supports tax compliance and audit preparation requirements across your organisation. You should establish document retention policies ensuring all transaction records, receipts, and supporting documentation are properly stored and easily accessible.

Implement audit trail procedures documenting all system changes, user access, and approval workflows. Configure automated backup procedures to protect against data loss while ensuring record integrity.

Regular audit preparation reviews ensure your documentation meets regulatory requirements and supports efficient audit processes when required.

Elevate your travel expense management with Volopay's prepaid cards

Volopay's comprehensive platform delivers superior prepaid cards for employee travel expenses, specifically designed for UK businesses seeking enhanced control and efficiency in travel expense management.

Unified platform

Volopay's centralized management system consolidates all travel expenses and card administration into a single, efficient platform.

You can manage multiple corporate cards, monitor spending across all employees, and generate comprehensive reports from one dashboard. The integrated approach eliminates the need for multiple systems while providing complete visibility into travel spending patterns.

Streamlined workflows reduce administrative complexity while improving control and oversight capabilities. This unified approach significantly improves operational efficiency while reducing the time and resources required for effective travel expense management.

Physical and virtual cards

Volopay offers both physical and virtual card options. You can issue physical cards for in-person transactions and virtual cards for specific online purchases, maximising security and control. Flexible-use virtual cards eliminate fraud risks for online bookings while providing complete transaction visibility.

The flexibility of multiple card types accommodates different travel requirements while maintaining security and compliance standards. This comprehensive card offering ensures optimal payment solutions for all travel scenarios.

Real-time analytics

Advanced dashboard analytics provide comprehensive travel spending insights and budget control capabilities that support strategic decision-making. You can analyse spending patterns, identify cost-saving opportunities, and optimize travel policies based on actual usage data.

Real-time reporting enables proactive budget management while detailed analytics support future planning and budget allocation decisions. The insights provided by comprehensive analytics help identify trends, control costs, and improve overall travel expense management efficiency across your organisation.

Accounting integration

Volopay's seamless integration with popular UK accounting systems streamlines expense processing and financial reconciliation procedures significantly. You can automatically synchronize transaction data with your existing accounting software, eliminating manual data entry and reducing processing time.

The integration ensures accurate financial reporting while maintaining compliance with accounting standards and audit requirements. This connectivity improves accuracy while reducing administrative burden on finance teams, enabling them to focus on strategic activities rather than routine data processing tasks.

Bring Volopay to your business

Get started now