What is a payroll card and how does it work in the UK?

What is a payroll card?

A payroll card is a prepaid debit card that allows employees to receive their wages electronically without needing a traditional bank account. Instead of issuing paper checks or bank transfers, employers load wages directly onto these cards each payday.

Designed for ease and efficiency, payroll cards offer a secure and fast way to access earnings. With the rise of cashless payments and flexible financial tools, the question “What is a payroll card?” has become increasingly relevant. Especially in the UK, where digital payment adoption is soaring, payroll cards are emerging as a smart solution for modern wage distribution.

Why UK businesses are adopting them

As digital transformation reshapes how companies operate, UK employers are turning to business payroll cards to streamline wage disbursement. These cards cut administrative costs tied to paper checks and bank processing. More importantly, they offer employees quicker, hassle-free access to their earnings, particularly helpful for those without bank accounts.

With employee payroll cards, staff can shop, withdraw cash, and manage finances more easily. Employers benefit from improved efficiency and reduced errors. In today’s fast-paced economy, payroll cards are proving to be a practical, cost-effective upgrade for companies looking to stay ahead and keep their workforce financially empowered.

How they differ from traditional methods

Payroll cards offer a modern alternative to direct deposits, bank transfers, and paper checks. Unlike direct deposit, they don’t require a bank account, making them ideal for unbanked employees. Bank transfers may involve fees or delays, while paper checks risk getting lost or stolen.

In contrast, pay is instantly loaded onto the card, providing quicker and more secure access to wages. Pay cards for employees also reduce administrative work and costs for employers. With added convenience, lower risk, and better accessibility, payroll cards stand out as a more efficient and inclusive method of wage distribution in today’s digital workplace.

How payroll cards work for UK businesses

1. Loading employee salaries onto cards

Employers transfer wages onto payroll cards through their company’s payroll system. Funds are moved from the employer’s business bank account directly to each employee’s card on payday. This process is managed electronically, using secure platforms that automate salary distribution.

Business payroll cards are often issued in partnership with financial service providers, ensuring compliance and transaction security. Employers can set up recurring payment schedules or make one-time payments when needed.

This eliminates the need for printing checks or processing traditional bank deposits. The result is a fast, efficient, and cost-saving method for paying employees—especially those without access to conventional banking.

2. How employees use the cards

Once salaries are loaded, employees can use their payroll cards just like a debit card. They can withdraw cash from ATMs, make in-store purchases at point-of-sale (POS) terminals, or shop online.

Many cards allow balance inquiries and transaction tracking via mobile apps or websites. Employees don’t need a personal bank account, making access to wages quicker and more convenient. Since the cards are widely accepted, users enjoy the flexibility to spend or save as they choose.

This simple and secure setup makes business payroll cards a reliable solution for both employers and their teams in today’s digital-first economy.

3. Real-time tracking and controls

Employee payroll cards provide real-time visibility into wage distribution and spending. Employers can monitor payment statuses instantly, reducing errors and ensuring timely disbursements. For employees, digital dashboards and mobile apps offer live updates on card balances, transactions, and spending habits.

This helps them budget more effectively and detect unauthorized use. Employers also gain control features, such as spending limits or card deactivation options when needed. These controls enhance security and streamline financial management for both parties.

As a result, employee payroll cards are not just convenient they offer transparency and control that traditional payroll systems often lack.

4. Recurring payments and balance rollover

Pay cards for employees support automated recurring payments, making payroll distribution seamless for businesses. Once set up, wages are deposited on a consistent schedule without manual processing. Employees benefit from predictable access to their earnings, improving financial stability.

Unused balances automatically carry over each pay cycle, eliminating the need for separate savings or transfers. This rollover feature ensures funds remain accessible anytime. Businesses can also track ongoing payouts and ensure compliance with wage policies.

With automated scheduling and balance retention, pay cards for employees simplify payroll tasks while offering employees a more flexible and secure way to manage their income.

Benefits of payroll cards for employers

Faster payroll processing

Payroll cards speed up payroll operations by automating fund transfers. Employers can schedule bulk payments that are instantly loaded onto cards, removing delays tied to printing checks or clearing bank transfers.

This reduces manual tasks for HR and finance teams, enabling them to focus on strategic priorities. With quicker execution and fewer errors, businesses benefit from a more efficient and dependable payroll process overall.

Lower risk of payment fraud

Replacing paper checks with secure digital methods lowers the chances of forgery, theft, or unauthorized alterations. Payroll cards use encrypted systems that track each transaction, allowing for early fraud detection.

Employers can monitor card activity in real time, increasing visibility and control. This enhanced security framework minimizes financial exposure and strengthens internal compliance across payroll operations, benefiting businesses of all sizes.

Easier onboarding of contractors and freelancers

Payroll cards simplify the payment process for short-term staff and freelance workers. Companies can quickly issue cards without needing employees’ bank details, making onboarding faster and more secure.

Since these cards don’t require bank account integration, businesses avoid setup complications. This ease of use ensures timely compensation, boosts contractor satisfaction, and makes managing a flexible workforce more practical and scalable.

Safer for unbanked employees

For workers without access to banking services, pay cards for employees offer a safer, more reliable way to get paid. Instead of handling cash or relying on costly check-cashing services, wages are delivered directly to a secure card.

Employees can access funds through ATMs, stores, or online platforms. This reduces financial risk and ensures consistent access to income regardless of banking status.

Scalable with business growth

Payroll cards can easily adapt to expanding teams and evolving payroll needs. As companies hire more staff or contract workers, new cards can be issued quickly without major changes to payroll systems.

This flexibility supports smooth operations during periods of rapid growth. Businesses can scale efficiently without increasing administrative burden. It ensures payment systems stay reliable as the organization grows.

Eco-friendly and paperless

Using payroll cards eliminates the need for printing paper checks or physical pay stubs. Digital payroll reduces paper waste and energy usage tied to mailing and handling documents. This eco-conscious approach supports sustainability goals and improves operational efficiency.

It also reflects a company’s commitment to responsible practices. Reducing paper use helps cut costs and environmental impact simultaneously.

Better employee satisfaction

When employees receive timely, secure access to wages, overall satisfaction improves. Payroll cards offer convenience, flexibility, and control over personal finances. Features like mobile access and spending insights empower users to manage their money more effectively.

These benefits lead to stronger engagement and trust. Happier employees are more productive and loyal to the company.

Reduced dependency on banking infrastructure

Payroll cards reduce reliance on traditional bank accounts, which not all employees have. Employee payroll cards function independently of banking systems, offering a reliable alternative. This ensures all workers can be paid, regardless of their financial setup.

It simplifies operations in regions with limited banking access. Companies gain flexibility while supporting a diverse workforce.

Benefits of payroll cards for employees

No need for a traditional bank account

Payroll cards allow employees to receive wages without opening a bank account. This is especially convenient for unbanked individuals, newly hired staff, or those in transition. It removes barriers to payment and simplifies onboarding.

With instant access to earnings, employees can manage money without delays. It creates a more inclusive and accessible payroll experience for everyone in the workforce.

Instant or early wage access

Employees often receive their wages instantly or even ahead of payday with payroll cards. This eliminates delays caused by bank processing times or weekends. It helps workers manage urgent expenses without waiting. Faster access to earnings means better financial flexibility.

This can be a lifeline during emergencies or unexpected bills. It empowers employees to take control of their financial timeline.

Budget control and financial tools

Many card providers offer mobile apps and dashboards that let users monitor their spending. Employees can track purchases, view balances, and set alerts for better budgeting. These tools help build financial awareness and discipline. Over time, users can develop smarter money habits.

With business payroll cards, even large teams can stay informed about their finances. Access to insights promotes responsible spending habits.

Lower financial stress

Payroll cards offer consistent and predictable payment schedules, which help reduce anxiety around finances. Employees no longer need to rely on payday loans or credit cards with high interest rates. This creates a more stable financial routine.

It also builds trust in the employer’s payment system. Lower stress leads to better focus and well-being at work. Financial peace of mind contributes to higher job satisfaction.

Costs and fees of payroll cards

1. Platform or issuance fees

Employers may incur monthly platform fees or per-card issuance costs when using payroll card services. These charges typically cover account setup, card production, and ongoing account maintenance. While fees vary by provider, most are tiered based on the number of employees or cards issued.

Some vendors offer flat-rate plans, while others use a pay-as-you-go model. It's important to assess these recurring costs upfront. Proper evaluation ensures the solution aligns with the company's budget goals.

2. Customisation or integration charges

Some providers charge additional fees for customizing the payroll card experience. This includes adding company branding, API access, or syncing with ERP and HR software systems. Businesses looking for advanced data reporting or custom workflows may also face integration charges.

These costs can be one-time or subscription-based, depending on the service scope. While optional, such features enhance user experience and streamline processes. Companies should confirm which services are bundled and which are premium.

3. Comparing total cost to traditional payroll

Compared to traditional payroll methods like BACS transfers, paper checks, or cash handling, payroll cards often reduce long-term operational costs. While there are platform and setup fees, employers save on printing, postage, and banking fees. Payroll cards also cut down on administrative time and payment delays.

When reviewing total cost, consider time saved, fewer errors, and reduced risk. Over time, these benefits can lead to measurable financial gains. They also help streamline compliance with payroll regulations.

Advanced features of modern payroll card platforms

Instant card creation and fund disbursement

Digital payroll cards can be issued within seconds through an online dashboard, eliminating the need for physical card distribution delays. Employers can push wages directly to these cards without going through banks or third-party processors.

This reduces the wait time for salary access significantly. Funds become available immediately, even outside regular banking hours. This real-time feature supports a more agile payroll process.

Role-based access and user permissions

Modern platforms let administrators define who can view, edit, or approve payroll activities. HR teams may be given access to employee details, while finance handles payment approvals and compliance tracking. Employees can only see their personal payroll data.

This separation of access helps reduce errors and data leaks. Granular permissions promote a secure and efficient workflow across departments. It also simplifies audits and regulatory compliance by maintaining clear access logs.

Real-time spend monitoring and alerts

Employers can track transactions the moment they occur, enabling immediate oversight. Alerts notify administrators of unusual or restricted spending, enhancing financial control. This helps detect fraud or policy violations early.

Employees also benefit from alerts that promote better budgeting. Real-time visibility builds trust and accountability between employer and employee. It empowers companies to respond quickly to potential misuse or overspending.

Seamless payroll and accounting integrations

Payroll card platforms connect easily with systems like Xero, QuickBooks, Sage, and BambooHR. This reduces the need for manual data entry and minimizes reconciliation errors. Real-time syncing improves payroll accuracy and reporting efficiency.

Updates made in one system reflect instantly across all others. The result is faster processing and fewer end-of-month surprises. Integration also enables consolidated reporting for better financial decision-making.

Multi-currency wallets and FX optimization

Payroll card providers often offer currency-specific wallets for international employees. This enables staff to receive and use wages in their local currency without high conversion fees. Businesses can take advantage of lower FX rates negotiated through the platform.

It reduces administrative work around cross-border payments. These tools make global payroll more efficient and cost-effective. Employees also benefit from greater clarity and control over their international earnings.

Transitioning from traditional payroll to payroll card

Audit your current payroll system

Begin by reviewing how your payroll is currently managed—identify bottlenecks, frequent errors, and time-consuming manual tasks. Look at the time taken for fund disbursement, employee complaints, and any recurring reconciliation issues.

Assess if your system handles remote employees, international teams, or last-minute payroll changes efficiently. Understanding these challenges will help you pinpoint where a digital payroll card system can add value. A detailed audit lays the groundwork for a smoother, goal-oriented transition to modern payroll tools.

Involving HR, finance, and IT teams in the audit ensures all operational angles are covered. This step helps create a shared understanding of current limitations and future opportunities.

Define your payroll objectives

Clearly outline what you want to achieve by switching to a payroll card platform. Whether it's speeding up payment cycles, lowering administrative costs, or improving employee satisfaction, your goals should guide the implementation process.

Be specific—are you aiming for instant disbursements, better budgeting tools, or reduced reliance on banking infrastructure? Setting measurable objectives ensures you choose a solution that fits your organizational needs.

It also provides a benchmark for tracking success after implementation. Well-defined objectives align internal teams and clarify what success looks like. They also simplify vendor selection by focusing on platforms that meet your priorities.

Choose a compliant, feature-rich provider

Select a UK-regulated payroll card provider that holds FCA registration and complies with high-level security standards such as PCI DSS. These credentials ensure your data and transactions are handled securely and meet legal obligations.

Look for platforms that offer instant card issuance, spend controls, and real-time reporting features. A provider with flexible pricing and responsive customer support can also ease the transition. Ensure the solution scales with your workforce and meets both employee and business needs.

Proper due diligence now prevents future compliance or integration issues. Partnering with the right provider sets the foundation for long-term payroll efficiency.

Align with your HR and finance systems

Verify that the payroll card system integrates smoothly with your current HR and accounting software, such as Xero, QuickBooks, or Sage. Integration allows for automatic data syncing, reducing manual entry and reconciliation errors.

It also improves the accuracy of reporting and ensures payroll compliance across all departments. Real-time data flow enhances visibility for finance teams and simplifies audits. Seamless alignment minimizes operational friction and supports end-to-end process automation.

Confirm whether the provider offers plug-and-play integrations or requires custom development. This compatibility ensures your digital payroll strategy is both efficient and future-proof.

Plan card issuance and onboarding

Determine whether your organization will distribute payroll cards in digital format, physical form, or both, depending on employee preferences and accessibility. Establish a smooth onboarding workflow that includes identity verification, Know Your Customer (KYC), and Anti-Money Laundering (AML) checks to ensure regulatory compliance.

Choose a provider that offers automated onboarding tools to speed up the process and reduce manual errors. Clearly communicate the activation process and card usage policies to new users. Plan timelines to align issuance with payroll cycles for minimal disruption.

A well-structured rollout ensures quicker adoption and a seamless employee experience from day one.

Educate internal teams and employees

Organize training sessions for HR, payroll teams, and employees to explain how the new payroll card system functions. Cover topics such as card activation, fund access, transaction monitoring, and security best practices. Ensure that team members understand their responsibilities regarding data handling and compliance.

Use guides, FAQs, and short videos to make the learning process simple and engaging. Provide ongoing support channels to resolve questions after launch. Well-informed users are more likely to embrace the system and use it effectively.

Education also reduces errors and support requests, making the transition smoother for all stakeholders.

Monitor, iterate, and scale

Start by analyzing initial card usage, focusing on transaction patterns, employee adoption rates, and any operational friction. Gather feedback from both employees and payroll administrators to identify pain points or areas needing improvement.

Use this input to fine-tune policies, adjust training materials, and enhance system settings. Monitor compliance metrics and fund distribution accuracy to ensure payroll standards are met. Set performance benchmarks to track the platform’s effectiveness over time.

Once the system is stable and meets expectations, gradually expand usage across departments or locations. A phased, feedback-driven approach ensures smooth scaling and long-term program success.

Compliance and security for payroll cards in the UK

FCA and GDPR obligations

UK payroll card providers must be authorized by the Financial Conduct Authority (FCA) to ensure secure and lawful disbursement of wages. They are also required to comply with GDPR, protecting personal employee data at all stages.

This includes clear data usage policies and consent management. Meeting these regulations builds trust with employees and regulators. Non-compliance can result in legal penalties and reputational harm.

KYC and AML checks

Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are mandatory before activating payroll cards. Providers often offer automated verification systems to streamline onboarding.

These checks confirm the identity of users while flagging suspicious behavior. By maintaining regulatory integrity, businesses reduce the risk of fraud. It also ensures that only legitimate recipients gain access to payroll funds. Ongoing monitoring further strengthens the system against financial crime and misuse.

Secure employee data storage

All sensitive payroll data must be stored using a PCI DSS-compliant infrastructure. This includes encrypted cardholder details and secure access protocols. Regular system audits and breach detection tools add extra layers of protection.

These practices ensure the safety of employee information. High-standard data security reinforces overall compliance and user confidence. Providers should also offer role-based access control to limit data visibility only to authorized personnel.

Simplify smart payroll for your business

Common mistakes to avoid with payroll cards

Overlooking employee onboarding and training

Failing to provide clear instructions on how to activate and use payroll cards can lead to confusion and reduced adoption. Employees may misuse the cards or avoid them entirely if they don’t understand the benefits.

Proper training reduces support requests and errors. Without it, the system's effectiveness is compromised. Always plan onboarding as part of your rollout strategy.

Ignoring employee feedback

Dismissing employee concerns or suggestions can cause dissatisfaction and reduce trust in the payroll system. Feedback helps identify issues with usability, access, or delays. Regularly collecting input leads to valuable improvements.

Engaged users are more likely to embrace the program. Make feedback channels easy and accessible. Consistently acting on feedback shows employees that their input matters and drives continuous system enhancement.

Failing to integrate with payroll or HR systems

Running payroll cards separately from your core HR and finance systems creates manual work and increases the chance of errors. Integration enables seamless data syncing and reduces administrative burden.

Without it, payroll becomes fragmented and inefficient. Real-time updates and reporting are also compromised. Always prioritize system compatibility from the start.

Delaying internal policy updates

Neglecting to revise policies around payroll disbursement, usage guidelines, and data access can lead to compliance gaps. Clear documentation ensures all stakeholders know their roles.

Outdated policies can create legal and operational risks. Timely updates align practices with your new digital tools. Make policy reviews a formal part of your transition plan.

Assuming one card type fits all

Offering the same payroll card setup to all employees may not suit varied needs across roles or regions. Different workers may prefer physical or virtual cards or require multi-currency features. Customization supports wider adoption and satisfaction.

Failing to offer options can limit the system’s effectiveness. Tailor card features to employee groups when possible.

Payroll cards for global and remote teams

1. Pay overseas or freelance teams

Payroll cards simplify payments to international freelancers and contractors without relying on traditional wire transfers. Funds can be loaded instantly, reducing wait times and banking complications. Cards can be issued digitally, making onboarding remote workers faster and more efficient.

This method also provides transparency through real-time transaction tracking. Employers gain better control over global payouts while minimizing administrative burden. It’s a scalable solution for growing international teams.

2. Currency flexibility and FX management

Modern payroll cards support multiple currencies, allowing employers to pay in local denominations. Integrated FX tools offer competitive exchange rates with lower conversion fees than banks. This reduces overall costs for global businesses and enhances convenience for employees.

Users can switch between currencies or withdraw in local cash without hassle. It streamlines international payroll with greater financial efficiency. Flexible currency handling improves satisfaction for globally distributed teams.

3. Global payroll compliance support

Providers of payroll cards often include built-in compliance with local labor and tax regulations. They help ensure wages meet jurisdiction-specific rules, including minimum pay and reporting obligations. Automated recordkeeping and audit trails simplify cross-border payroll audits.

This reduces legal risks while enhancing transparency. Businesses operating internationally benefit from a consistent, compliant disbursement method. It also helps avoid fines, penalties, or reputational issues.

Volopay for payroll card management in the UK

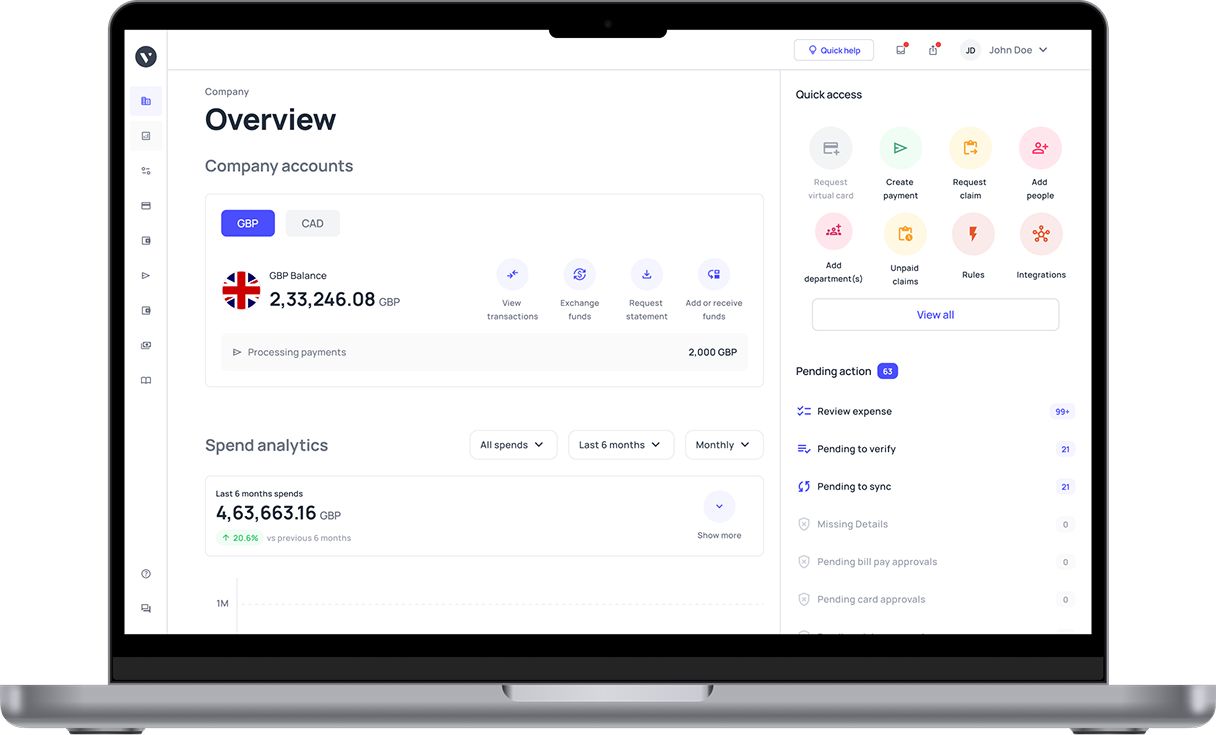

Full automation of payroll disbursement

Volopay enables businesses to automate salary transfers with scheduled payouts and smart approval workflows. Employers can load payroll cards in bulk, cutting down manual tasks and errors. This speeds up disbursement cycles and ensures timely payments.

Notifications and audit trails are generated automatically. It streamlines compliance while reducing reliance on traditional banking infrastructure. Volopay's accounting automation reduces human error and saves hours during payroll runs.

Issue cards instantly from your dashboard

With Volopay, you can create and distribute unlimited virtual cards or physical cards for employees in seconds. There’s no need to wait for third-party processing or manual setup. Card issuance is integrated into your payroll workflow, making onboarding seamless.

Employees receive activation instructions instantly. You maintain full control from one centralized interface. This immediate access to Volopay's corporate cards helps new hires start using their cards without delay.

Seamless Xero, QuickBooks, and NetSuite integrations

Volopay integrates directly with leading accounting tools, ensuring real-time payroll syncing. Transactions are auto-categorized and reconciled for faster month-end close. You can eliminate redundant data entry across platforms. This boosts accuracy and saves valuable time.

Finance teams gain full visibility into payroll-related expenses. These integrations also support audit preparation and budget reporting effortlessly. Setup is simple, with minimal disruption to your existing workflows.

Advanced analytics and fraud prevention

Volopay offers live dashboards that monitor card activity, flagging unusual transactions or limit breaches. AI-powered alerts help catch potential fraud before it escalates. You can set spend limits, freeze cards, or restrict vendors in real time. Granular reporting supports smarter decision-making.

This level of control strengthens financial security across the organization. It also builds confidence among finance leaders in high-risk environments.

Enterprise-grade compliance

Volopay is fully FCA-registered and adheres to GDPR and PCI DSS standards. The platform provides secure storage, encrypted transfers, and detailed access logs. Audit-ready records and automatic policy enforcement support legal requirements.

You’re protected from data breaches and regulatory fines. Trust and compliance come built into every transaction. The system is continuously updated to reflect evolving regulatory needs.

Multi-currency and global payroll support

Volopay’s cards support payments in GBP, EUR, USD, and other major currencies with minimal FX fees. You can assign currency-specific cards to global employees. Real-time exchange tracking ensures transparent conversions.

This payroll software capability is ideal for distributed teams and freelance workforces. It simplifies global payroll without the headaches of traditional banking. Your finance team can manage international payments from a single platform.

Streamline global payroll in one platform

FAQs

No, employees do not need a traditional bank account to receive wages. Payroll cards work independently and can be used just like a debit card. This makes them ideal for unbanked or underbanked workers.

Some cards may include withdrawal fees, balance inquiry charges, or daily limits. Employers should review terms before rollout to ensure transparency and compliance. Clear communication of these fees is essential to avoid confusion.

Employers transfer funds directly from their business accounts to each employee’s payroll card. Reloads are automated for recurring salary cycles or can be done manually if needed. The process ensures timely and accurate payments.

The lost card can be frozen immediately via the platform dashboard. A replacement is then issued, and the balance is transferred securely to the new card. Support teams can assist with any access concerns.

Yes, many payroll cards support international usage with currency conversion. Employees should check for potential foreign transaction fees before using abroad. Usage abroad may also be subject to regional restrictions.

Yes, payroll cards have expiration dates like regular debit cards. A new card is issued in advance to avoid disruptions in employee access. Renewal reminders are sent to ensure continuity.

Volopay supports unlimited card issuance, making it scalable for teams of all sizes. Cards can be assigned to full-time, part-time, or contract staff. Growth-stage companies benefit from this flexibility.

Volopay adheres to strict PCI DSS and GDPR standards. The system includes encryption, two-factor authentication, and real-time monitoring to ensure cardholder security. Security protocols are regularly updated and audited.

Cards can be issued digitally through the dashboard or shipped physically. Activation instructions are sent automatically, and cards are ready to use upon loading. The setup process is quick and user-friendly.

Volopay integrates with Xero, QuickBooks, NetSuite, and other major systems. These connections streamline disbursements, reporting, and compliance across HR and finance functions. Custom APIs are available for enterprise needs.