How to apply for a prepaid credit card for businesses in the UK

When you're managing business expenses, prepaid credit cards offer secure, controlled financial management tools. Understanding how to apply for a prepaid credit card can transform your business operations, providing greater control than traditional payment methods. Learning to apply for prepaid credit card online gives you immediate access to modern financial solutions, with a prepaid credit card for business serving as your gateway to manageable expense control.

Card overview

Your prepaid business card operates simply: you load money before making purchases, ensuring controlled spending within your budget. When you apply for a prepaid credit card, you create a secure spending account that is accepted everywhere. Your prepaid credit card for business integrates with expense management systems, enabling real-time tracking and detailed reporting.

Why prepaid credit cards

Prepaid cards eliminate debt risk entirely you only spend loaded funds, avoiding credit card debt. When you apply for prepaid credit card online, approval is faster with minimal credit checks, making them accessible for newer businesses. You gain superior expense control through spending limits and instant reloading capabilities.

Digital trends

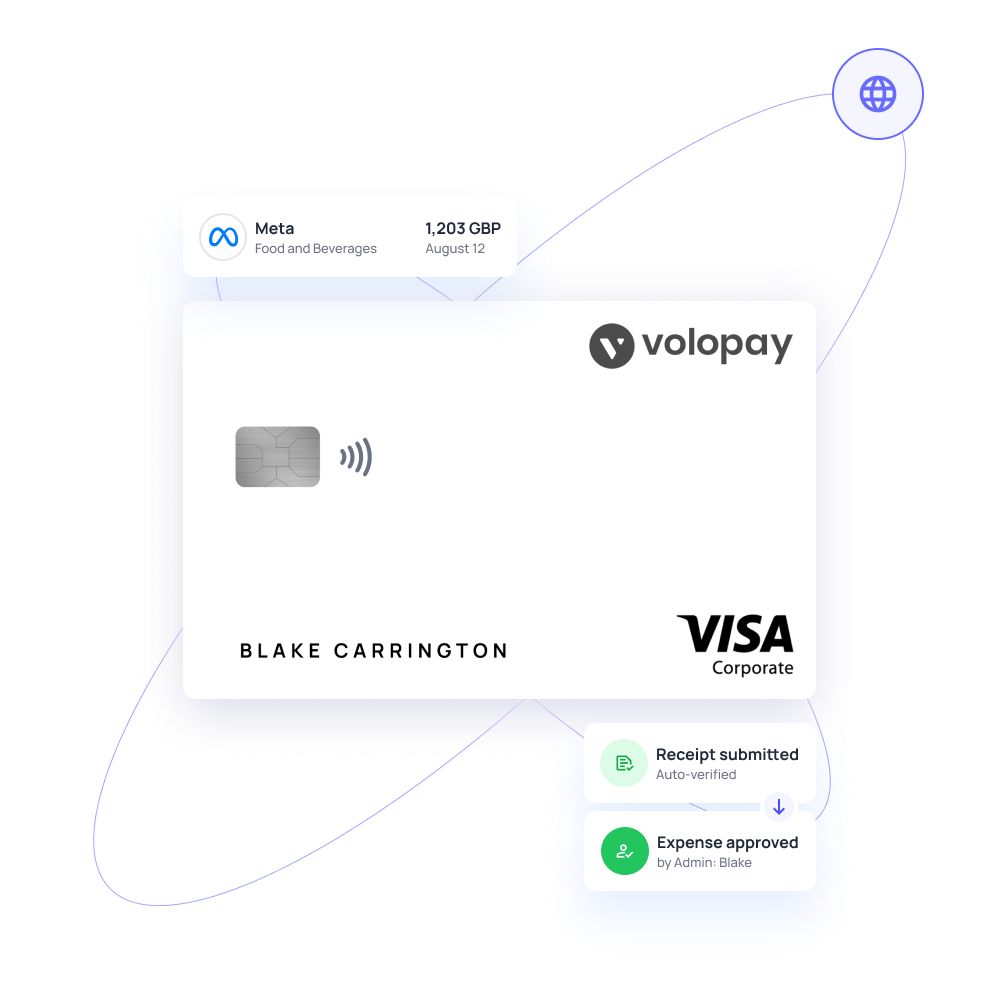

The UK's payment ecosystem embraces innovation through Faster Payments integration, enabling instant card funding. Your prepaid credit card for business includes contactless functionality for faster transactions. Mobile apps provide comprehensive management when you apply for a prepaid credit card, offering spending monitoring and accounting software integration.

Is there a difference between prepaid credit cards and prepaid business cards?

While both share the fundamental preloading principle, prepaid business cards offer significantly enhanced features tailored for commercial operations. When you apply for prepaid credit card online for business purposes, you gain access to sophisticated expense management tools, employee spending controls, and comprehensive reporting capabilities that personal prepaid cards simply don't provide.

Your prepaid credit card for business includes accounting software integration, multi-user management, receipt tracking, and budget allocation features specifically designed to streamline business financial operations.

Benefits of prepaid credit cards

When you're running an SME or startup, understanding how to apply for a prepaid credit card can revolutionise your expense management approach. These financial tools offer unique advantages that traditional credit arrangements simply cannot match, making them particularly suitable for growing businesses that need precise financial control without the complexities of conventional credit products.

Budget control

Setting spending limits becomes effortless when you apply for prepaid credit card online solutions. Your prepaid credit card for business allows you to establish predetermined spending thresholds for individual cards, departments, or specific expense categories. This functionality prevents overspending entirely once the loaded funds are exhausted, transactions are automatically declined.

You can adjust these limits in real time through mobile apps or online platforms, ensuring your business maintains strict financial discipline while adapting to changing operational needs.

No credit checks

Accessibility represents a major advantage when you choose prepaid solutions. Unlike traditional business credit cards, when you apply for a prepaid credit card, extensive credit history checks aren't required. This simplified approval process makes these cards ideal for startups, new businesses, or companies rebuilding their credit profile.

Your prepaid credit card for business application focuses on identity verification rather than credit scoring, ensuring faster approval and immediate access to payment solutions regardless of your business's credit history.

Fraud protection

Limited fund exposure significantly reduces your fraud risk profile. Since your prepaid credit card for business only contains preloaded amounts, potential losses from fraudulent activity are capped at the card balance. Advanced encryption technology protects every transaction, while real-time monitoring systems alert you to suspicious activity immediately.

When you apply for prepaid credit card online, you typically receive additional security features like transaction alerts, spending location restrictions, and instant card freezing capabilities through mobile applications.

Expense tracking

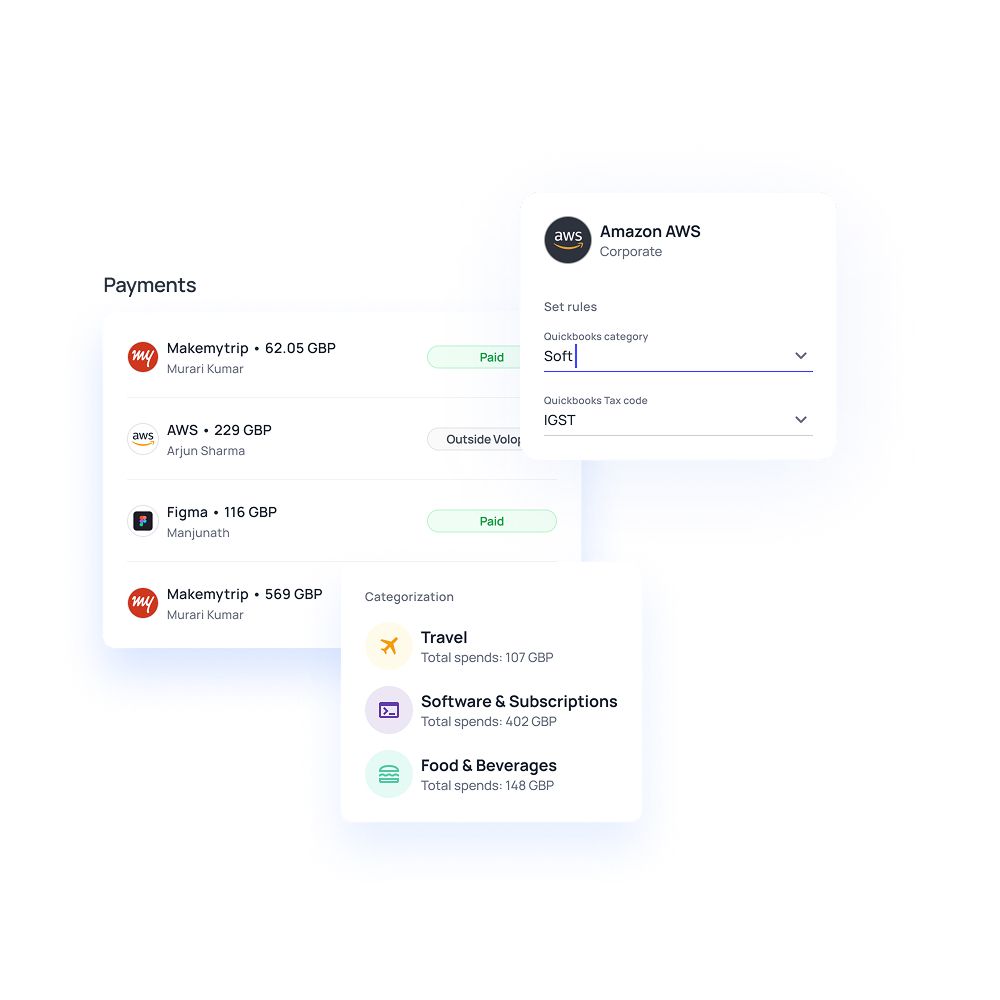

Real-time expense monitoring transforms your bookkeeping processes. Your prepaid credit card for business automatically categorises transactions, generates detailed spending reports, and integrates seamlessly with popular accounting software like Xero and Sage.

This integration eliminates manual data entry, reduces accounting errors, and provides instant visibility into your business expenses. When you apply for a prepaid credit card with these features, you streamline your entire financial management workflow from transaction to final accounts.

Eligibility requirements for prepaid credit cards

Understanding eligibility requirements is crucial when you decide how to apply for a prepaid credit card for your business. The application process varies significantly between providers, but most maintain relatively straightforward criteria designed to accommodate diverse business structures and operational models across the UK market.

1. Business types

Your business structure doesn't typically restrict access when you apply for prepaid credit card online solutions. Sole traders can access these cards just as easily as limited companies, partnerships, or large enterprises. SMEs and startups particularly benefit from the inclusive eligibility criteria, as providers generally accept businesses regardless of size or operational complexity.

Whether you're operating a single-person consultancy, a growing tech startup, or an established enterprise with multiple departments, your prepaid credit card for business application will be assessed on similar foundational criteria rather than business size or structure.

2. Documentation needs

When you apply for a prepaid credit card, you'll need to provide specific documentation for verification purposes. Your application typically requires valid photo identification (passport or driving license), proof of business address (utility bills or bank statements), and evidence of your business registration.

Limited companies must provide their Certificate of Incorporation, while VAT-registered businesses need their VAT registration certificate. Some providers may request additional documentation like business bank statements or proof of trading activity, but these requirements remain far less stringent than traditional business credit applications.

3. No credit history

The absence of credit history requirements makes prepaid cards exceptionally accessible. When you apply for prepaid credit card online, providers don't perform extensive credit checks on your business or personal credit profile.

This approach makes your prepaid credit card for business ideal if you're launching a new venture, have limited business credit history, or have experienced previous credit difficulties. The focus shifts from creditworthiness to identity verification and business legitimacy, opening opportunities for businesses that might struggle with conventional credit applications.

4. UK residency

UK residency requirements apply to business directors and key stakeholders when you apply for a prepaid credit card. Most providers require at least one director or business owner to maintain a UK address and provide corresponding proof of residency.

This requirement ensures compliance with UK financial regulations and enables effective communication throughout the application and ongoing management processes. Your prepaid credit card for business application will typically require UK utility bills, council tax statements, or tenancy agreements as residency verification.

5. Turnover thresholds

While many providers don't impose strict minimum turnover requirements, some may establish revenue thresholds for certain card types or enhanced features. When you apply for prepaid credit cards online, basic cards often have no minimum turnover expectations, making them accessible for new businesses or those with irregular income patterns.

However, premium business cards or those with higher loading limits might require evidence of consistent monthly or annual turnover. Your prepaid credit card for business providers will clearly outline any turnover expectations during the application process, ensuring transparency about eligibility criteria.

Choosing the right prepaid card provider

Selecting the right provider when you apply for a prepaid credit card requires careful evaluation of features, security standards, and support quality. Your choice significantly impacts your business's financial management efficiency and operational flexibility.

Feature comparison

When you apply for prepaid credit card online, compare loading limits, transaction fees, monthly charges, and ATM withdrawal costs across providers.

Evaluate integration capabilities with accounting software like Xero, QuickBooks, or Sage to streamline your bookkeeping processes.

Your prepaid credit card for business should offer mobile app functionality, real-time notifications, and spending controls that match your operational requirements.

Consider whether you need multiple-user access, expense categorization, and receipt management features before making your final decision regarding the provider.

Security standards

Choose FCA-regulated providers when you apply for a prepaid credit card to ensure compliance with UK financial standards.

Verify that your chosen provider offers robust encryption, two-factor authentication, and comprehensive fraud monitoring systems for greater transparency.

Your prepaid credit card for business should include automatic transaction alerts, card freezing capabilities, secure online portals for account management, mobile app access, customizable spending limits, multi-user controls, and real-time notifications.

FCA regulation provides additional consumer protection and ensures adherence to strict operational standards.

Customer support

Responsive customer support becomes crucial when managing business finances.

When you apply for a prepaid credit card online, ensure providers offer multiple contact channels such as phone, email, live chat, social media support, dedicated account managers, and quick response times.

Your prepaid credit card for business provider should maintain extended support hours to accommodate urgent business needs and provide dedicated business account management for complex queries or technical issues.

Timely assistance can prevent transaction delays and ensure uninterrupted employee travel or vendor payments.

Steps to apply online

Understanding how to apply for a prepaid credit card online streamlines your business setup process and ensures quick access to essential financial tools. The digital application process typically takes 24–48 hours from submission to card activation, making it significantly faster than traditional business credit applications.

Research providers

Begin by evaluating providers based on your specific business requirements when you plan to apply for prepaid credit card online. Compare fee structures, loading limits, and integration capabilities with your existing accounting software.

Verify FCA regulation status to ensure regulatory compliance and consumer protection. Your prepaid credit card for business should offer features like multi-user access, expense categorization, and real-time reporting that align with your operational needs.

Review customer testimonials, support quality, and mobile app functionality before shortlisting potential providers. Consider virtual card availability, international transaction capabilities, and any industry-specific features that might benefit your business operations.

Complete application

When you apply for a prepaid credit card, you'll complete secure online forms with comprehensive business information. Enter your company registration details, trading address, and director information accurately. Provide VAT registration numbers, business bank account details, and estimated monthly card usage volumes.

Your prepaid credit card application requires details about your business activities, anticipated spending patterns, and the number of cards required. Most providers offer progress-saving functionality, allowing you to complete applications across multiple sessions if needed.

Verify identity

KYC (Know Your Customer) procedures require uploading specific documentation for identity verification. Submit clear copies of director identification, business incorporation certificates, and VAT registration documents. Your prepaid credit card for business provider will verify business addresses through utility bills or bank statements.

Some providers may request additional documentation, like business insurance certificates or trading licenses, depending on your industry sector. Digital document upload systems typically provide instant confirmation of successful submissions.

Fund card

Initial funding methods vary between providers when you apply for prepaid credit card online. Most accept bank transfers, debit card payments, or direct debits for initial and ongoing funding.

Your prepaid credit card for business can typically be loaded immediately after approval through online banking integration or secure card payments. Establish automatic funding schedules to maintain consistent card balances for operational continuity.

Activate card

Card activation occurs through secure online portals or mobile applications once you receive your physical cards. Virtual cards can be activated immediately upon approval, enabling instant online purchasing capabilities.

The activation process for your prepaid credit card for business includes setting PINs, configuring spending limits, and downloading mobile management applications for ongoing card administration.

Common use cases for prepaid credit cards

Discovering practical applications helps you maximize value when you apply for a prepaid credit card for your business operations. These versatile financial tools address various expense categories while maintaining strict budgetary control.

Travel expenses

Your prepaid credit card for business excels at managing travel-related costs with predetermined budgets. Load specific amounts for flights, accommodation, and employee expenses, ensuring travel spending stays within allocated limits.

When you apply for prepaid credit card online, you can create separate cards for different trips or team members, providing individual spending controls. This approach eliminates expense report complications and prevents travel budget overruns while maintaining detailed transaction records for accounting purposes.

Online subscriptions

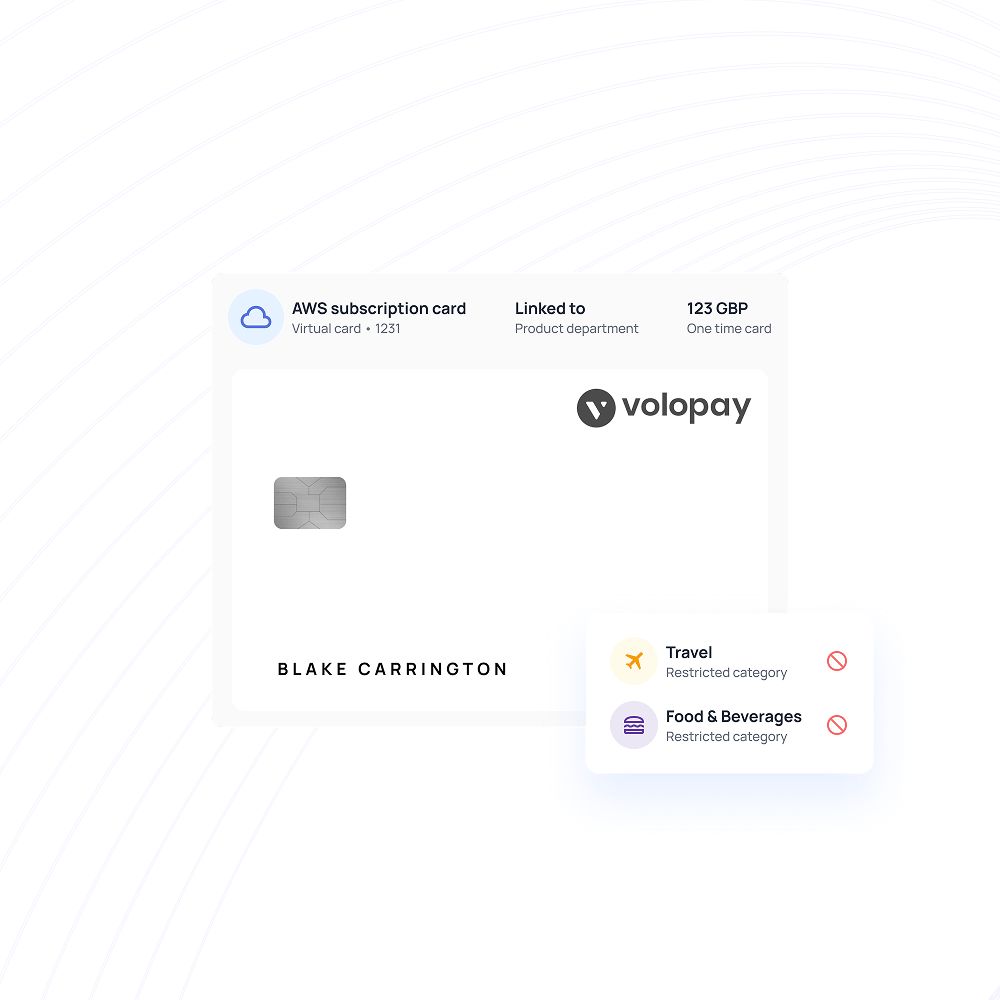

Managing recurring software, marketing, and operational subscriptions becomes streamlined with virtual prepaid cards. Your prepaid credit card for business provides secure payment methods for online services without exposing primary business accounts.

Create dedicated virtual cards for different subscription categories, enabling precise budget allocation and simplified cancellation processes. This method protects against unauthorized charges and provides clear visibility into subscription spending across your business operations.

Vendor payments

Paying suppliers, freelancers, and service providers gains efficiency when you apply for a prepaid credit card system. Load specific amounts for vendor payments, ensuring controlled spending while maintaining professional payment methods.

Your prepaid credit card for business enables immediate payments without traditional banking delays, improving supplier relationships and potentially securing early payment discounts. This approach also provides detailed transaction records for improved bookkeeping and vendor management processes.

Get the perfect prepaid card for your business!

Managing prepaid cards online

Effective online management transforms how you control business expenses when you apply for a prepaid credit card system. Digital platforms provide comprehensive oversight tools that streamline financial operations and enhance spending visibility across your organization.

Set limits

When you apply for prepaid credit card online, you gain access to granular control systems that allow daily, weekly, or monthly spending restrictions.

Your prepaid credit card for business enables merchant category restrictions, preventing purchases at unauthorized retailers while maintaining operational flexibility.

Adjust limits instantly based on project requirements or employee responsibilities, ensuring spending remains aligned with your budgetary constraints.

Monitor spending

Real-time dashboards provide instant visibility into all card transactions and spending patterns.

Your prepaid credit card for business management platform displays detailed analytics, spending trends, and budget utilization across multiple cards and users.

Set up automatic alerts for unusual spending patterns, limit breaches, or specific transaction types. This monitoring capability enables proactive budget management and helps identify issues before they impact your business operations.

Reload funds

Top up cards instantly through secure online platforms or mobile applications when you apply for prepaid credit card solutions.

Schedule automatic reloads to maintain consistent card balances, or manually add funds as needed for specific expenses or projects.

Your prepaid credit card for business accepts various funding methods, including bank transfers, debit cards, and direct debits for operational convenience.

Integrate accounting

Seamless integration with accounting software like Xero, Sage, and QuickBooks eliminates manual data entry and reduces bookkeeping errors.

Your prepaid credit card for business automatically categorizes transactions, generates expense reports, and synchronizes with your existing financial systems.

This integration streamlines reconciliation processes and provides comprehensive financial visibility for improved business decision-making.

Compliance and security considerations

Maintaining regulatory compliance and robust security becomes essential when you apply for a prepaid credit card for business operations. Understanding UK-specific requirements ensures your financial management remains compliant while protecting sensitive business data.

FCA regulations

Choose FCA-regulated providers when you apply for prepaid credit card online to ensure compliance with UK financial conduct standards. Your prepaid credit card for business must maintain transparent fee structures, clear terms of service, and regulated dispute resolution processes.

FCA compliance guarantees consumer protection measures, including safeguarded funds and standardized complaint procedures. Ensure your chosen provider maintains appropriate regulatory permissions and adheres to the conduct of business rules that protect your business interests and financial security.

VAT reporting

Accurate expense tracking becomes crucial for VAT submissions and HMRC compliance requirements. Your prepaid credit card for business automatically generates detailed transaction records with merchant information, dates, and amounts necessary for VAT reporting.

Digital receipts and expense categorization features streamline the preparation of VAT returns and provide comprehensive audit trails for HMRC inspections. Integration with accounting software ensures seamless VAT calculation and reporting processes.

Security features

Advanced security measures protect your business when you apply for a prepaid credit card system. Two-factor authentication, end-to-end encryption, and secure tokenization protect online transactions and sensitive financial data.

Your prepaid credit card for business includes real-time fraud monitoring, transaction alerts, and instant card freezing capabilities. These security features minimize fraud risks while maintaining operational flexibility for legitimate business transactions and financial management activities.

Why choose Volopay prepaid cards

Volopay offers comprehensive solutions that surpass traditional business credit arrangements through innovative technology and streamlined financial management capabilities. The platform addresses modern business needs with advanced features designed for operational efficiency.

Unified platform

Volopay's centralized expense management system consolidates all your financial operations when you apply for a prepaid corporate card online through the platform. Your prepaid card for business integrates with expense management, vendor payments, and budget allocation tools within a single interface.

This unified approach eliminates the need for multiple financial platforms, reducing administrative overhead while providing comprehensive oversight of all business spending activities. The centralized dashboard enables managers to control your Volopay corporate cards, including card limits, expense approvals, and spending patterns across departments from one location.

Both physical and virtual cards

Access both physical cards for in-person transactions and virtual cards for secure online purchases. This dual-card approach ensures you have appropriate payment methods for every business transaction scenario.

When you apply for a prepaid card through Volopay, you receive instant virtual card generation capabilities for immediate online spending needs. Single-use virtual cards provide enhanced security for recurring subscriptions and one-time purchases, protecting your business from potential fraud while maintaining operational flexibility.

Real-time analytics

Comprehensive dashboards deliver instant spending insights that transform how you manage business finances. Your prepaid card for business provides detailed analytics showing spending trends, budget utilization, and department-wise expense patterns.

These real-time insights enable proactive budget management and help identify cost-saving opportunities before they impact your bottom line. Advanced reporting features support strategic financial planning and improved operational decision-making.

Accounting integration

Seamless synchronization with popular accounting software eliminates manual data entry when you apply for prepaid card solutions from Volopay.

Your prepaid card for business automatically exports transaction data to Xero, Sage, and QuickBooks, ensuring accurate financial records and streamlined reconciliation processes. This integration reduces bookkeeping errors, saves administrative time, and provides comprehensive audit trails for improved financial compliance and reporting accuracy.

Bring Volopay to your business

Get started now