27 key corporate card benefits for UK businesses

Corporate card benefits go far beyond simple expense coverage—they unlock smarter business spending, tighter financial control, and streamlined operations. From enabling real-time expense tracking to automating approvals and ensuring policy compliance, corporate cards bring structure and visibility to company-wide transactions.

Whether you're managing a startup or scaling an enterprise, understanding these advantages can directly impact your bottom line. This guide breaks down 27 essential perks into practical insights, helping you make informed decisions about corporate spending tools.

Discover how using the right card program can boost accountability, support growth, and simplify financial management across your organization—all in one powerful solution.

Key corporate card benefits for businesses

1. Centralised spend visibility and control

Corporate card programs provide finance teams with a consolidated view of company-wide spending. With centralized dashboards, managers can track expenses by department, employee, or project in real time. This increased visibility ensures better oversight and reduces the risk of overspending.

It also allows quicker adjustments to budgets when needed. Such corporate card benefits help maintain financial discipline while enabling smarter decision-making across the organization.

2. Automated expense reporting and reconciliation

Manual expense reports are time-consuming and error prone. Corporate cards simplify this by automatically generating detailed transaction records.

Employees no longer need to collect paper receipts or fill out spreadsheets and finance teams can quickly verify and reconcile expenses. This automation reduces administrative workload, minimizes human error, and speeds up month-end closing.

As a result, companies can operate with greater accuracy, ensuring compliance and saving both time and money.

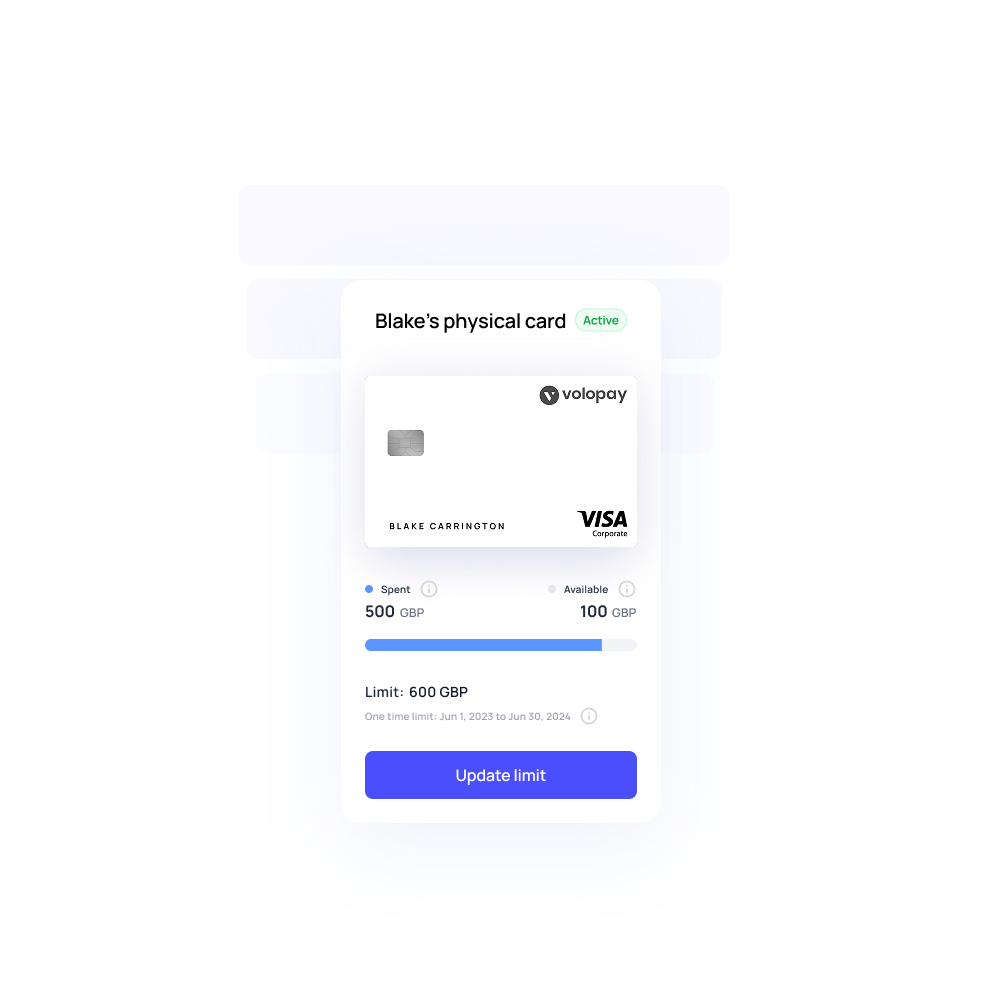

3. Customisable spending limits and policies

Corporate cards offer flexible controls to set specific limits based on roles, departments, or vendors. Businesses can customize policies to restrict certain purchases, set daily or monthly caps, and enforce compliance. This ensures funds are used appropriately and within budget.

Tailored spending rules empower companies to protect against misuse without slowing down operations. These advanced features make corporate cards especially valuable for businesses with distributed teams or dynamic spending requirements.

4. Real-time transaction notifications

With real-time alerts, companies can instantly monitor card usage across all employees. Each transaction generates a notification, providing immediate insight into where and how company funds are spent. This transparency allows finance teams to detect anomalies quickly and respond to any unauthorized charges.

Real-time notifications not only enhance security but also foster accountability among cardholders, helping businesses stay proactive in managing financial activity.

5. Simplified receipt capture and matching

Capturing and matching receipts is effortless with corporate card tools that support mobile uploads and automated tagging. Employees simply take a photo of their receipt, and the system links it to the correct transaction. This eliminates manual entry and helps ensure compliance with expense policies.

Finance teams benefit from reduced audit time and accurate recordkeeping. Simplified receipt management is one of the most practical corporate card benefits available today.

6. Seamless integration with accounting software

Corporate card solutions often integrate effortlessly with popular accounting systems like Xero, QuickBooks, or Sage. This eliminates the need for manual data entry, reducing errors and saving time.

Transactions flow directly into your general ledger with pre-mapped categories and tags. These integrations streamline financial workflows, enhance reporting accuracy, and simplify reconciliation.

Businesses can close books faster and maintain real-time financial visibility, all while improving operational efficiency.

7. Reduced administrative burden for finance teams

Corporate cards reduce the repetitive workload finance teams face by automating expense tracking, reporting, and reconciliation.

With real-time data and integrated tools, manual entry and receipt chasing become unnecessary. This allows finance professionals to focus on more strategic tasks like analysis and planning.

One of the key corporate card benefits is the ability to streamline financial processes, improving team productivity while ensuring compliance with internal controls and policies.

8. Improved cash flow management

Corporate cards provide better visibility into outgoing payments, enabling more accurate cash flow planning.

With detailed transaction records and real-time tracking, businesses can monitor spending trends and forecast upcoming obligations. This allows decision-makers to manage liquidity efficiently and avoid unexpected shortfalls.

By using corporate cards strategically, companies can maintain healthier cash positions, align expenses with revenue cycles, and make more informed financial decisions throughout the fiscal year.

9. Enhanced budgeting and forecasting

Using corporate cards with integrated analytics tools improves the precision of budgeting and forecasting.

Historical data is easily accessible, categorized, and exportable, allowing finance teams to identify patterns and adjust future budgets accordingly. This level of insight supports long-term planning and reduces budget variances.

Among the most valuable corporate card benefits is the ability to make forecasts based on real, real-time data, resulting in better strategic planning and smarter resource allocation.

10. Potential for cost savings

Corporate card programs can reduce costs through better vendor negotiations, cashback rewards, and the elimination of processing fees tied to traditional reimbursement methods.

Companies gain control over discretionary spending and reduce fraud-related losses with tighter oversight. These built-in controls and analytics tools contribute to lowering overall operational expenses.

As businesses grow, these cumulative savings can be substantial, making cost reduction one of the most tangible corporate card benefits for both small firms and large enterprises.

11. Elimination of employee out-of-pocket expenses

With corporate cards, employees no longer need to use personal funds for business purchases, removing reimbursement delays and frustration. It improves morale and ensures consistent adherence to company spending policies.

Finance teams benefit from cleaner records, while employees gain convenience and confidence in making approved transactions. Eliminating out-of-pocket spending is one of the more employee-friendly corporate card benefits that also enhances compliance and simplifies financial reporting across teams.

12. Robust fraud protection measures

Corporate card programs include advanced security features like virtual card numbers, spending limits, and real-time alerts to detect suspicious activity. These controls minimize the risk of unauthorized transactions and allow quick intervention when needed.

Additionally, some cards offer liability protection and instant card freezing capabilities. These security enhancements make fraud prevention a core benefit of corporate card use, helping companies safeguard financial assets and maintain trust in their internal systems.

13. Supporting digital transformation initiatives

Integrating corporate card systems with digital tools and financial platforms accelerates a company’s digital transformation journey.

Automation of expense management, real-time data capture, and seamless accounting integration improve operational efficiency. These technologies reduce manual workloads and enable faster financial close cycles.

By adopting modern payment solutions, businesses enhance their agility and competitiveness in today’s technology-driven market. This foundation also supports future innovations and scalable growth strategies.

14. Ensuring regulatory compliance

Corporate cards help businesses stay compliant with tax laws and internal policies by providing detailed, time-stamped transaction records. Automated tools categorize spending and flag policy violations instantly, reducing the chance of non-compliance.

Audit trails are readily available, making external audits smoother and more transparent. These features enhance accountability, support legal requirements, and reduce the administrative burden of compliance across departments. This proactive approach keeps companies prepared for regulatory changes and inspections.

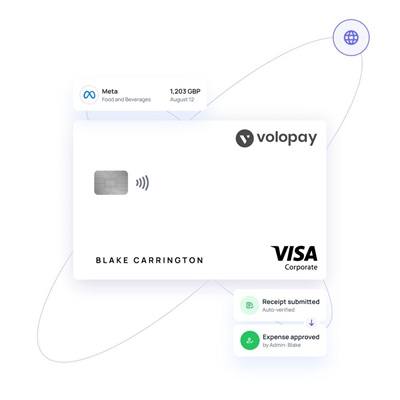

15. Virtual cards for secure online transactions

Virtual corporate cards enhance online payment security by generating unique numbers for one-time or vendor-specific use. This reduces exposure to fraud and allows precise control over digital transactions.

Cards can be instantly disabled or replaced without disrupting operations. These capabilities make it easier for companies to conduct online purchases confidently, with robust safeguards in place to protect company funds and sensitive data. Virtual cards also streamline vendor management and subscription billing processes.

16. No personal liability for employees

Corporate cards shift financial responsibility from employees to the business, eliminating the need for staff to front personal funds for work expenses. This removes financial stress, improves compliance, and fosters trust within teams.

Employees can spend confidently within company policies without worrying about personal financial risk or delayed reimbursements. This separation of liability also simplifies accounting and risk management for employers.

17. Improved employee experience

Employees benefit from quicker expense approvals, easier access to funds, and fewer reimbursement delays when using corporate cards. This streamlined process lets them focus more on their core responsibilities, improving productivity and job satisfaction.

Simplifying expense management enhances morale and supports better overall performance. It also encourages responsible spending by providing clear guidelines and transparency. Overall, this leads to a more engaged and motivated workforce.

18. Faster reimbursements

With corporate cards, employees no longer have to wait weeks for out-of-pocket reimbursements. Instead, expenses are charged directly to company accounts, streamlining the payment process. This eliminates delays and administrative bottlenecks.

In cases where reimbursements are still needed, the process is faster and more transparent, helping finance teams close expense reports quickly and giving employees a seamless financial experience. This speed improves cash flow management and reduces frustration for all parties involved.

19. Increased productivity and focus

Corporate cards reduce time spent on manual expense reporting and reimbursement processes, allowing employees to concentrate on their primary tasks.

Automating financial workflows eliminates distractions from administrative duties, leading to smoother operations. This efficiency boost enhances overall workforce productivity and helps teams meet deadlines more consistently.

Among the key corporate card benefits, improved employee focus directly supports better business outcomes and growth opportunities.

20. Empowering employees with autonomy

By providing corporate cards, businesses give employees more control over their spending within set limits, promoting independence and quicker decision-making. This autonomy reduces bottlenecks caused by waiting for approvals and increases operational agility.

When staff feel trusted with financial responsibility, motivation and engagement tend to rise. Empowering employees in this way is a notable corporate card benefit that fosters a proactive and accountable workplace culture.

21. Access to rewards and loyalty programmes

Many corporate card providers offer reward programs such as cashback, travel points, hotel loyalty perks, and exclusive discounts. This allows businesses to earn value back on everyday expenses turning regular spending into an opportunity for savings or travel benefits.

Whether reinvesting those rewards into company needs or using them to incentivize employees. These programs can be especially valuable for startups and SMEs looking to maximize return on spend without additional investment.

22. Travel benefits and insurance

Corporate cards often come with travel-related advantages like priority boarding, airport lounge access, and comprehensive travel insurance coverage. These perks improve employee comfort and safety during business trips.

Having built-in insurance reduces out-of-pocket expenses and provides peace of mind for both employers and travelers.

Travel benefits are a key component of corporate card benefits, helping companies support efficient and secure business travel. Additionally, these features can enhance employee satisfaction and encourage more productive trips.

23. Supplier management and discounts

Corporate cards facilitate smoother supplier payments by consolidating transactions and improving payment timeliness, which strengthens vendor relationships. Some card programs negotiate exclusive discounts or rebates with suppliers, lowering procurement costs.

Efficient supplier management through corporate cards helps optimize cash flow and enhances negotiating power. These financial advantages form an important part of the broad range of corporate card benefits.

24. Exclusive business perks and offers

Many corporate cards provide access to special business services, events, and exclusive offers tailored to the company's needs. These perks might include software discounts, priority customer support, or invitations to networking opportunities.

Leveraging these exclusive deals can improve operational efficiency and provide competitive advantages. Such unique benefits add to the overall appeal of corporate card benefits for companies aiming to maximize value from their financial tools.

25. Global acceptance and currency conversion

Corporate cards are widely accepted worldwide, allowing employees to make purchases seamlessly across different countries and currencies.

Built-in currency conversion features offer competitive exchange rates and transparent fees, simplifying international transactions. This global accessibility supports businesses with overseas operations or frequent travel needs.

By reducing the complexity and cost of cross-border payments, companies can expand their reach confidently and maintain smooth financial operations regardless of location.

26. Scalability for growing businesses

Corporate card programs easily scale alongside business growth, accommodating increased spending volumes and additional users without operational disruption.

Flexible account management and customizable controls adapt to evolving organizational structures and financial policies. This scalability ensures that expanding companies maintain strong oversight and spend control, even as complexity increases.

Investing in scalable payment solutions helps businesses remain agile and prepared for future growth challenges.

27. Enhanced data for strategic decision-making

Corporate card programs easily scale alongside business growth, accommodating increased spending volumes and additional users without operational disruption.

Flexible account management and customizable controls adapt to evolving organizational structures and financial policies. This scalability ensures that expanding companies maintain strong oversight and spend control, even as complexity increases.

Investing in scalable payment solutions helps businesses remain agile and prepared for future growth challenges.

Looking for corporate cards to manage your business expenses?

Choosing the right corporate card for your UK business

Key considerations for selection

When choosing a corporate card provider, evaluate factors such as annual fees, interest rates, and the availability of rewards programs that match your business spending.

Consider how well the card integrates with your current accounting and expense management software.

Also, review the provider’s customer service reputation and security protocols to ensure reliable support and protection against fraud.

Understanding your business needs

It’s crucial to analyze your company’s spending patterns, budget size, and future growth plans before selecting a corporate card.

Identifying specific operational needs and financial goals helps you choose a card that offers the right features, limits, and flexibility.

This tailored approach ensures the card supports your business efficiently as it evolves.

Eligibility criteria for getting a corporate credit card

Business registration and legal status

Most corporate credit card providers require your business to be a legally registered entity in the UK, such as a Limited Company or Limited Liability Partnership (LLP). This formal registration confirms the company’s legitimacy and allows the issuer to verify its existence and legal standing.

Unregistered or informal businesses typically do not qualify for corporate credit cards.

Financial stability and creditworthiness

Lenders carefully evaluate your business’s financial health by reviewing credit scores, debt-to-income ratios, and overall financial performance. A strong credit history demonstrates reliability and the ability to manage debt responsibly, which improves your chances of approval.

Poor financial records or high liabilities may lead to declined applications or less favorable credit terms. Maintaining good financial practices is critical for securing competitive rates and credit limits.

Business operating history

Many providers prefer businesses that have been operating for at least one to two years. This operating history shows stability and a track record of managing finances effectively.

Newer companies without this proven background may face higher scrutiny or additional requirements during the application process to reduce perceived risks for the card issuer.

A longer operating history can also boost lender confidence and ease approval.

Annual turnover or revenue

Corporate credit card issuers often set minimum annual turnover thresholds to ensure the business generates enough income to cover credit obligations. These requirements vary but typically reflect the card’s credit limit and intended usage.

Meeting these revenue benchmarks signals financial strength and repayment capacity to the provider. Businesses that fall short may need to consider alternative financing options or provide additional guarantees.

Director/shareholder information

Personal guarantees from directors or major shareholders are commonly requested, especially for startups or smaller businesses. This guarantee acts as additional security for the lender, holding individuals personally accountable if the business defaults.

Providing this information helps build trust and can improve approval odds. It also aligns the interests of business leaders with responsible financial management.

Industry-specific requirements

Certain industries, like finance, healthcare, or construction, may face unique application criteria due to regulatory concerns or higher risk profiles.

Providers might require extra documentation, compliance checks, or impose specific restrictions based on the sector’s nature. It’s important to understand these nuances before applying to avoid delays or rejections.

Being aware of industry-specific rules can help tailor your application for a smoother approval process.

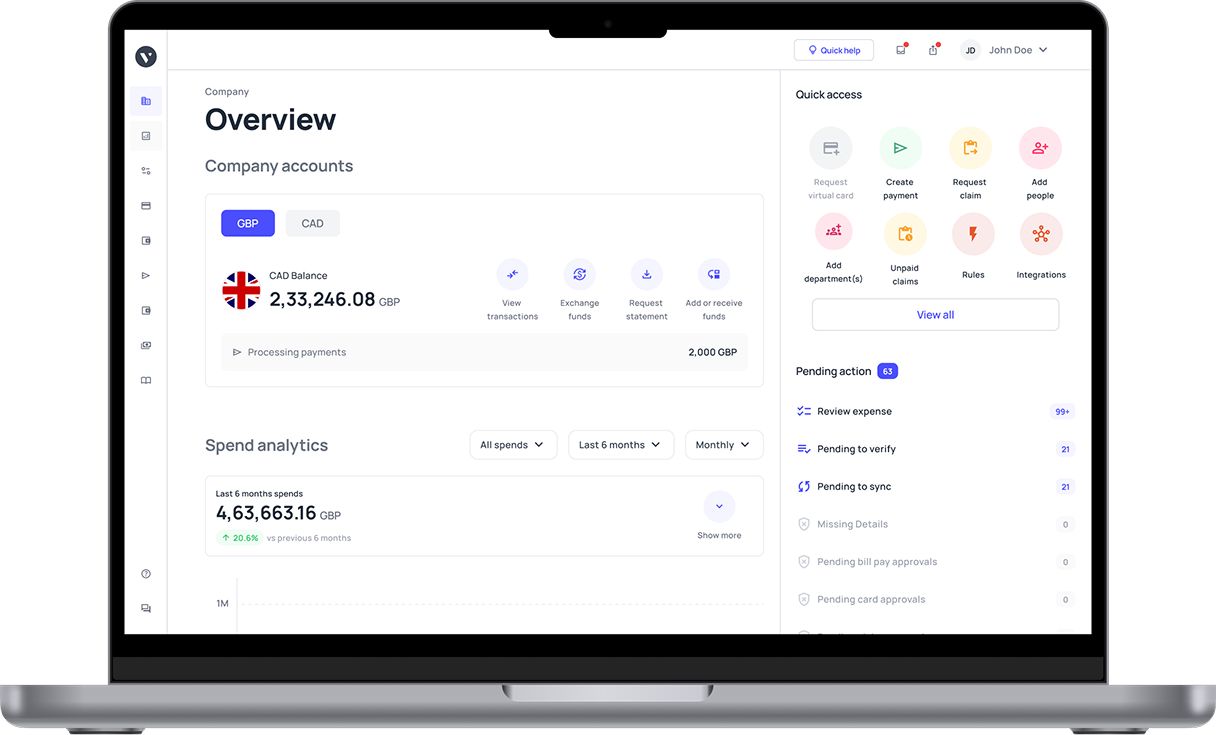

Experience the future of spend management with Volopay

Volopay offers businesses a streamlined way to control spending with real-time tracking, automated approvals, and customizable limits. Its intuitive platform reduces manual work and improves transparency across teams.

By simplifying expense management, Volopay helps companies save time, reduce errors, and maintain better financial oversight, making daily operations more efficient and secure.

Beyond just a card: A complete spend management platform

Volopay goes beyond corporate cards by providing a full spend management solution that integrates payments, expense tracking, and reporting in one platform. This all-in-one approach empowers businesses to automate workflows, gain actionable insights, and maintain tighter control over budgets.

Its scalability and user-friendly design make it ideal for companies aiming to modernize their financial processes.

Bring Volopay to your business

Get started now