How to build business credit in Indonesia?

When a company is able to buy things now and pay them later, the organization is known to have business credit. Businesses can obtain credit from various providers like banks or corporate credit programs. To obtain business credit, the company must open and maintain commercial credit accounts.

But to get access to this credit in the first place, your financial standing should be positive. This means a positive cash flow. Credit providers will only lend your business money when they see our financial statements and can verify that giving you credit is a safe option. Profitably running your business is more important. Only after that should you try to opt for company credit and scale operations further.

Why startups should build business credit?

Most big corporations already utilize credit to carry out all their financial operations. But small businesses are hesitant to build business credit. Eventually, business owners realize how important it is to get access to credit. Business credit cards or corporate credit cards work similarly to personal credit cards. Without it, you won’t be able to establish a business credit score.

As your startup keeps scaling, you will have no option but to build your business credit in order to carry out any business purchases daily which is not ideal through debit accounts.

How to build business credit in Indonesia?

The first step to build your small business credit line is to establish your business as a legal entity within your country of operations. For Indonesia this process involves the following three steps:

Types of entities available in Indonesia

PT(Perseroan Terbatas): A PT company is the equivalent of an LLC in Indonesia. It is one of the most common types of business incorporation that foreign citizens can establish within the country. A PT company can be small-sized, medium-sized, or large-sized.

PMA: A company registered as a PMA (Penanaman Modal Asing) can be owned partly or completely foreign-owned. This type of business is incorporated under the rules and regulations of the Foreign Capital Investment Law and approved by the Capital Coordinating Board of Indonesia. A PMA business is also capable of turning into a public company in the later stages.

KPPA: A KPPA business entity is one that is suited for investors who wish to understand the Indonesian market better and for development purposes. It is a foreign representative office that takes approximately 3-4 weeks to get registered. But, a KPPA entity is not allowed to be established for sectors like services, trading, mining, banking, and gas and oil. This type of business is not allowed to carry out operations to sell or trade and gain profits, but rather only exist for market research.

KP3A: A KP3A business is one that is a version of the KPPA business where it is allowed to carry out trading.

Apply for a business license

A SIUP is a trading business license that you must get to carry out trading operations within the country. Getting a business license is important for your company as it legalizes your operations within Indonesia. Else, your business activities can be closed by the government.

Open a separate business bank account

Building business credit starts when you build a separate bank account for it. If you keep utilizing your personal account for business expenses, the lines between the identity of your business as a separate legal entity become blurred.

Business credit cards offer much more in terms of the perks you get when using them but usually don’t have the high level of security to it as personal credit cards. This makes business owners opt for personal credit cards for business purposes thinking it is the less risky option but actually ends up harming their business in the long run due to the limitations on usage.

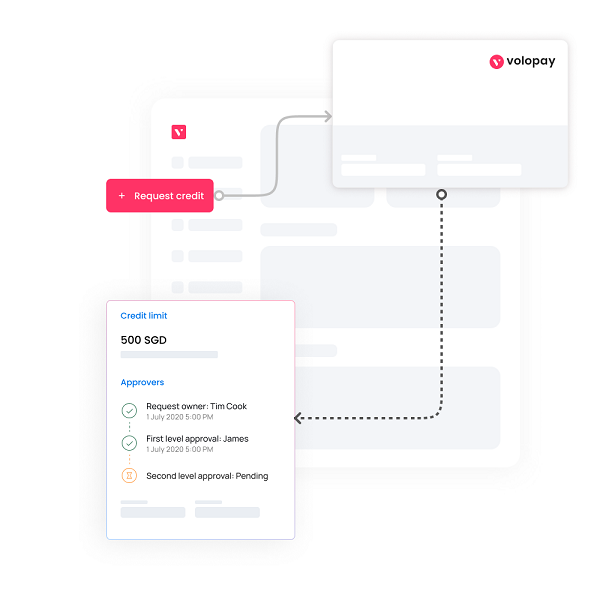

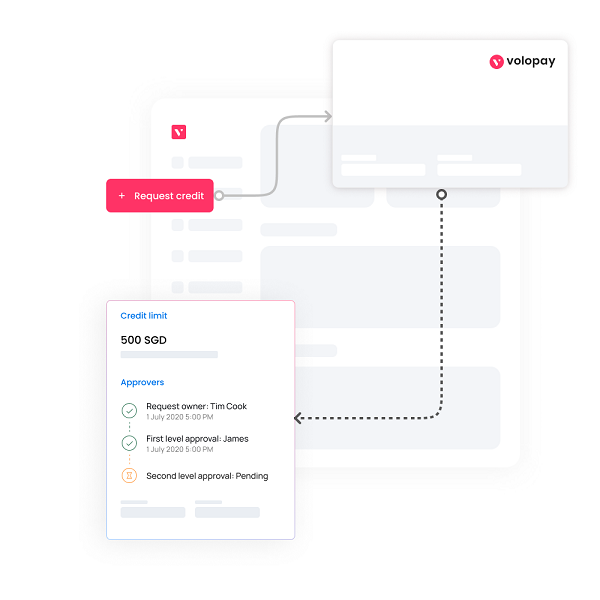

Avail interest free credit line with Volopay

How to maintain your company credit?

Make payments on time

Once you have access to the credit line, you must ensure that you make all your payments on time, It is timely paid back to the borrower who has issued the credit. This will help develop a high credit score and become a reliable and trustworthy prospect for lenders in the future. Slow, partial, or no payments leave can negatively affect the financial health of your company and lower the chances for you to avail of loans with good terms.

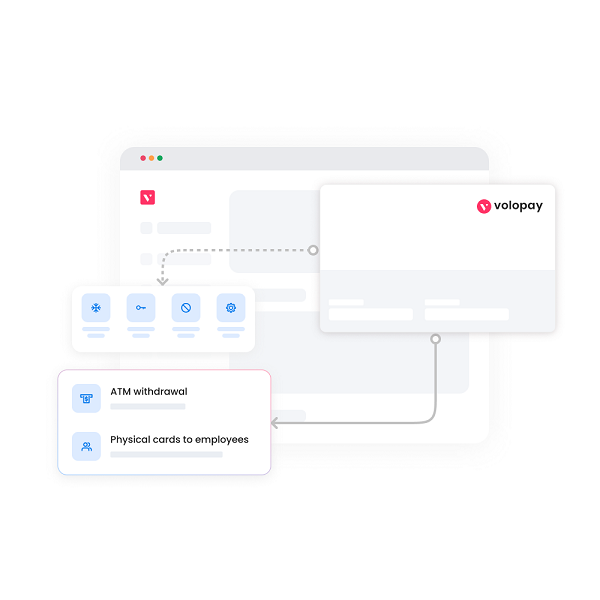

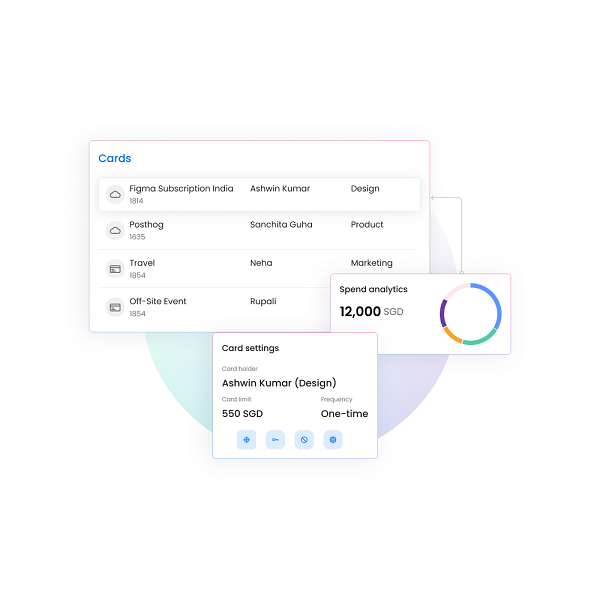

Procuring corporate credit card

Every business should use a corporate credit card or a business credit card for all its purchases. The benefit of doing this is of course that the founder’s personal finances are not mixed up with that of the company as well as helping the business establish its creditworthiness. Many corporate credit programs even offer physical and virtual credit cards to all your employees that can be used to easily carry out expenses and improve the cash flow of the business.

Maintain credit utilization below 30 percent

Having access to a certain amount of credit and using all of it within the refresh period is not a good sign of financial stability. Only when your income is more than your expenses will you be able to consistently pay off credit bills without any late payments.

Monitoring business credit scores and ratings

There are many credit reporting agencies available online that can help you check and report your credit score and ratings daily. This is done mainly to ensure that there are no problems or errors created in the name of the company.

What are the benefits of building business credit?

More opportunities to grow the business

Maintaining positive financial statements is a mark of a profitable business. But in the future, if you have to expand in a way that your own budget cannot cover all the expenses, then you will have to take a loan. And using credit cards beforehand builds your credit score helping loan providers trust you more and giving you access to a credit line.

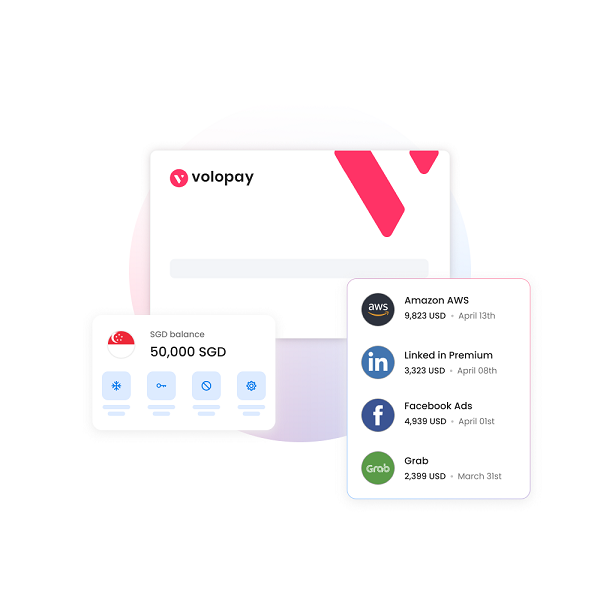

Better visibility for the finance team

It’s not just the business owner who has to make business expenses. Many teams within a company require constant access to funds in order to execute their tasks. In such instances, adopting and implementing an expense management system that provides corporate credit as well helps the finance team allocate budgets to every employee, keep track of spending, and maintain full control over it.

Easier loan qualification

Having past credit statements that you pay on a regular basis shows that you are reliable and trustworthy. A credit history allows banks and financial institutions who lend you money to see this and have faith in your ability to repay loans, which gives you access to them more easily. You might even get better terms and conditions of a loan, such as the interest rates and repayment schedules.

You can separate your personal and business financial

Issuing company credit is also a good idea to separate your personal finances and not let them be affected by business expenses. This won’t affect your personal credit score, but at the same time build the score for your business entity.

Improve business cash flow

Even as a business that is not large, you can opt for a small business credit card and use it to improve the cash flow of your company. Doing this helps you carry out operations smoothly without worrying too much about the finances. You can make quicker and better decisions to purchase equipment, stock up on inventory, etc.

More rewards, cashback, and other perks

Credit providers often give their users many perks for using their services. This includes cashback, discounts on flights and hotels, and other rewards like free trips to certain destinations. Maintaining and using your credit in a proper manner will give you access to all these perks.

FAQs

A foreigner cannot directly set up a local business in Indonesia, but they can partner with a PT owner through a Nominee Company Agreement. This will allow the foreigner to invest and run the company while still following all the local government laws.

The minimum capital required to establish a PT PMA company is $1 million. Although the cost of incorporation is quite high, it comes with many advantages over the other types of businesses that you can set up.

Yes, it is possible to obtain a business license with OSS(Online Single Submission). Before you use the OSS system, you must first obtain your Company Registration Certificate or Ministry of Human Rights Approval through the AHU online system which is a system that provides legal services.

Starting a business in Indonesia can take anywhere from 1 to 3 months depending on the type of business you want to start and the time taken for you to provide all the necessary legal documents to fulfill the process.

To start a business in Indonesia, you require a NIB(Business Identification Number) locally known as ‘Nomor Induk Berusaha’. This registration number consists of 13 digits which act as the business owner’s identification to legally conduct business.

Bring Volopay to your business

Get started free