Company-issued corporate cards for employees

There’s no reason to deal with the burden of reimbursements, cheques, and petty cash. Not when you have the option to equip your employees with corporate cards. These corporate cards come with proactive controls for every single card. Set them, load them, spend with them. Track expenses without worrying about having to reimburse.

Trusted by finance teams at startups to enterprises.

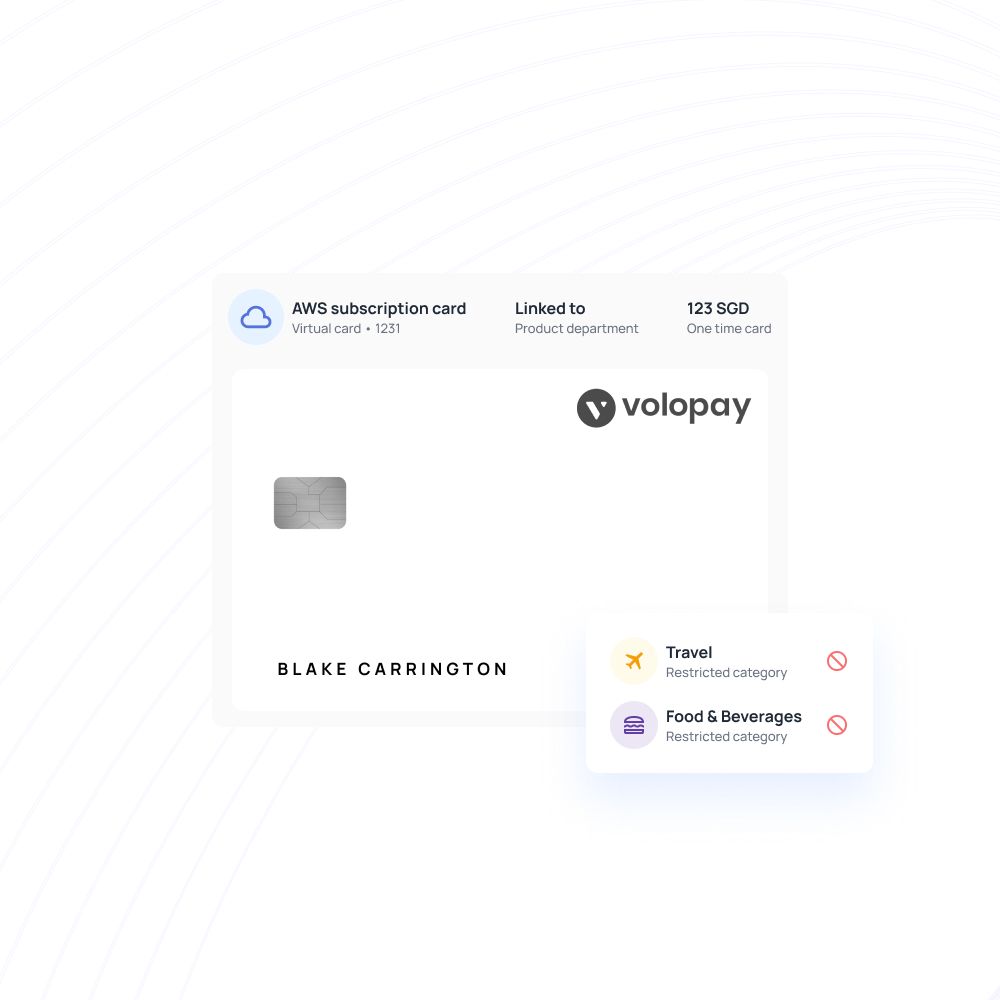

Virtual cards to manage subscriptions

Say you’ve got a remote team and don’t see the need for physical cards. That doesn’t mean your employees don’t still need access to funds. That’s where a corporate virtual card helps out.

Create unlimited cards for burner use or even recurring cards to manage online payments. You can even generate vendor-specific cards for better reporting!

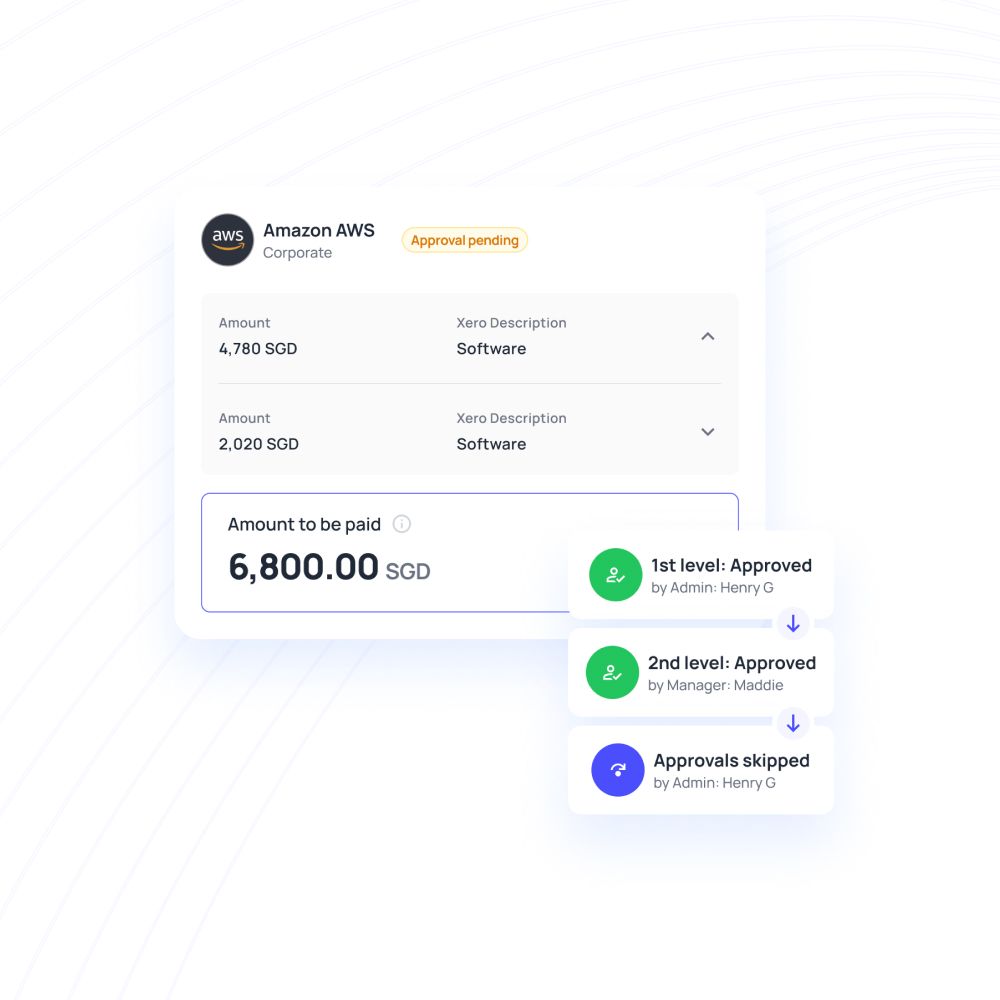

Proactive business expense controls

Multi-level approval policies make managing expenses a much more transparent and convenient process. Our corporate cards allow admins to assign approvers for fun reloads and spends.

Instead of reconciling expenses or running out of a credit limit, you can securely add funds to employee corporate cards and track them in real-time.

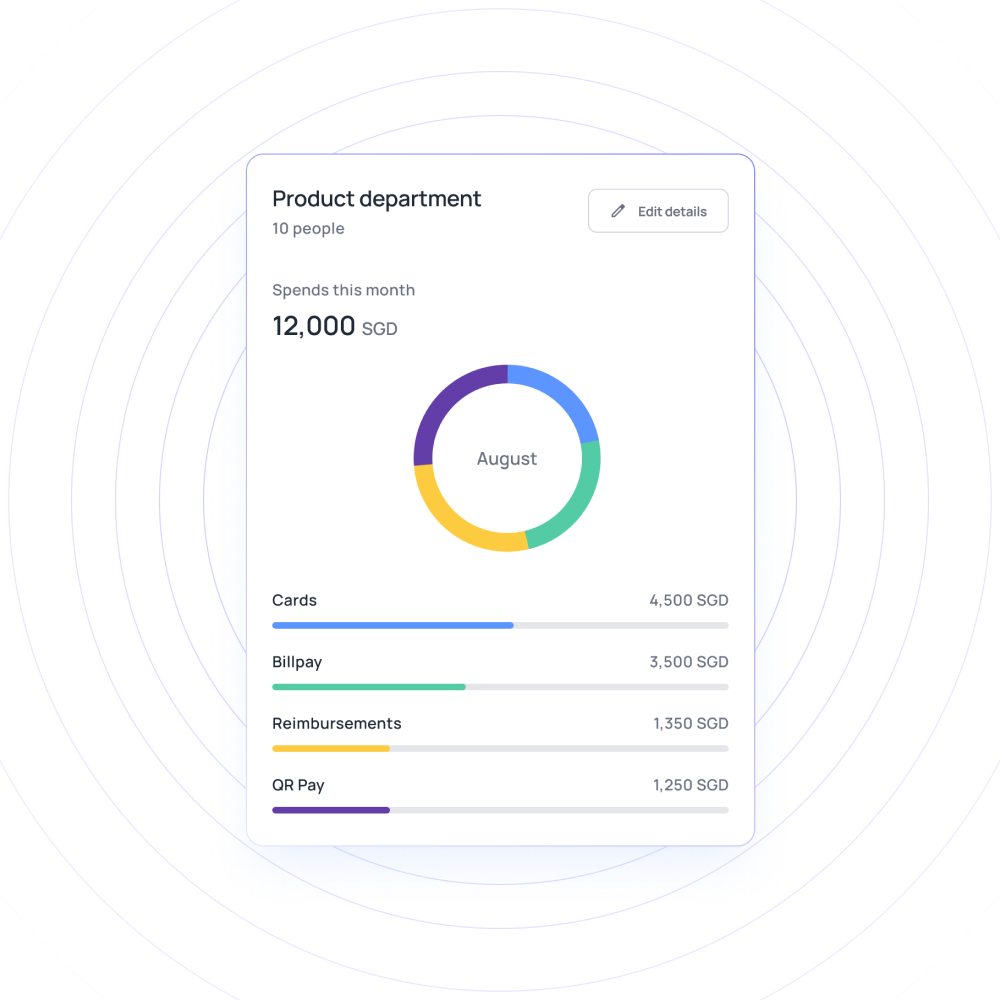

Real-time tracking for all spending

Unlike a traditional corporate card Singapore offering, you don’t need to wait for an end-of-month statement with these cards. Instead, transactions are recorded as and when they happen.

Every line item on the spend-tracker can be supplemented with the place of purchase, time, amount, as well as details and receipts added by the user. Transparent management of finances made entirely possible.

Expense reporting streamlined

Expense reporting should be insightful and dynamic. Instead of it becoming a dreaded task with tons of paperwork, the Volopay dashboard simplifies everything by automating spend tracking.

Card spends are updated automatically whenever a card is swiped. This reflects on the mobile app, too, making reporting accessible. Not a single penny unaccounted for.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why should your business opt for corporate card?

Easy reimbursement process

Employees who constantly travel hate the reimbursement process due to its complications. It’s equally challenging for employees, as they can’t keep tabs on employee expenses. But corporate cards make the process simpler for all.

Employees don’t have to spend their money or collect and hold receipts for longer durations. With readily available funds, employees can book tickets earlier and save money.

Improves business cash flow

Cash flow challenges mainly arise due to improperly planned finances. With Volopay, you can stay up to date with current spending and forecast future expenses. In-app credit also helps in balancing current expenses without reaching for emergency funds or savings.

With additional funds, your growth plans and strategies can easily pan out, bringing more revenue.

Reduced expense frauds

Unauthorized spending, producing fake bills, and submitting the same expense report twice are some commonly occurring expense fraud. To save your money, you must have a transparent system that allows expenses and make the data available to every authority.

Thus, your employees can enjoy their allowed privileges while finance teams can remain vigilant to prevent misuse and fraud.

Improves business credit score

The only way to build credit from scratch or reverse a damaged credit is by borrowing responsibly and repaying on time. You can apply for Volopay credit, use that during the spending period, and repay at the earliest.

It takes over two to three years for businesses to build a positive credit score through business loans. With monthly credit, you can improve your business credit score in lesser time.

Ensure seamless business travel

When employees have to use their personal funds to make business travel arrangements, limited fund availability can delay that. Also, employees are required to promptly collect receipts and bills till they come back and apply for a reimbursement.

With corporate cards and added credits, both drawbacks are excluded, and employees can travel stress-free. They spend less time organizing bills and focus fully on their trip.

Simplifies vendor management

A significant part of your business funds go for vendor payments. If you want to streamline and track them, corporate cards can help you. Each vendor can be assigned a card through which their payments can be made from time to time.

You can tag the vendor to the respective department. Now finding how much you have spent on the vendor and department-wise vendor payments will be quicker and more accurate than ever.

Be on top of your business expenses with corporate cards

Factors to consider when choosing a corporate card provider

Type of card offered

Corporate cards can be used in many ways. Depending on the use, they can be one-time cards, recurring payment cards, virtual cards for travel, physical cards, and many more.

When you choose a corporate card provider, make sure you get the type of cards your business needs. If you have many monthly subscription payments, cards that process recurring payments should be considered.

Fees and other charges

Corporate cards generally have an annual payment structure. Research the payment plans of different card companies and choose based on your needs.

Some corporate card companies also have hidden charges that they charge when you make payments. Others might only offer a limited number of free payments and will start charging you after that.

Ease of applying

Lengthy application forms, endless document requests, and physically appearing in the bank location can be a waste of time. Gathering old documents can take time and further delay the process.

Opt for corporate card providers that offer online applications you can fill in minutes. This can save time for business owners.

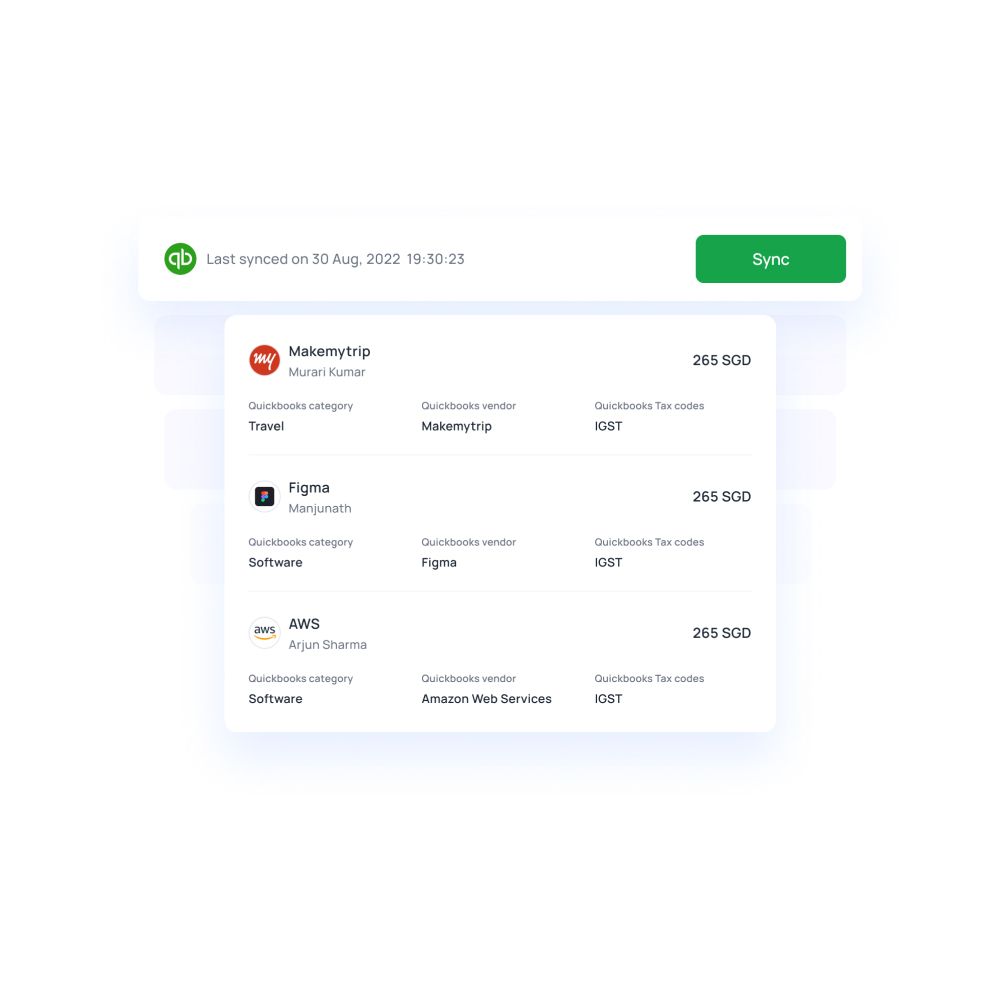

Software integrations

Accounts payable applications synchronizing with ERP software can minimize manual data entry tasks. To make the data transfer happen automatically, you need to choose software that offers integration facilities.

By connecting two applications, syncing your payments in real-time with the accounting applications becomes simple.

Why should you choose Volopay corporate cards?

Card security

As one corporate card isn’t dependent on another, each card can be isolated from the network by freezing or blocking it, thus making it safer than regular credit cards.

Physical and virtual cards

Get whatever suits your business. Volopay has both physical and virtual corporate cards which can be operated within the same platform.

Multi-currency wallet

Don’t waste pennies and time on international payments. Volopay has multi-currency wallets, where you can load money in a different currency and pay using that.

No personal liability

Bad personal credits won’t ruin your chance to get qualified for credit and corporate cards. Volopay only analyses your business spending capacities, credit score, and repayment history.

In-built spend controls

Budgets and departments will ensure limited spending. Set limits on corporate cards above which it will require approval.

No hidden fees

Volopay offers unbeatable exchange rates in the market. You won’t find hidden fees lurking in your domestic and international payments.

Volopay corporate cards vs traditional business cards

Volopay corporate cards vs business cards

- Complete control over your budgets

- Budgeting

- Unlimited cards

- Configure each card and set budgets

- Integration with accounting Software

- AI to detect savings and frauds

- Auditing ease

- Hassle free quick on boarding

- Automated recurring payments

- Requirement for manual inspection of receipts

- Requiring manual data feed

Make secure and convenient business payments with corporate cards

Learn more about our corporate cards

Every single expense management needs collaborated into a single spot. The same expense management center for all admins, employees, and accountants. From cards to approvals, reimbursements and accounting, we have a solution for all.

Physical cards

Allow your employees to spend smarter and wiser with the help of corporate physical cards. Issued with the security and quality of VISA, these cards can be used for various merchant portals and offline transactions. They make expense tracking much simpler, without forcing employees to dip into personal funds.

Virtual cards

Unlimited virtual cards at your fingertips. These cards can be created for employees, departments, or even to manage payments to specific vendors. Functioning the same way as physical cards, they’ve made contactless and online payments much more efficient than before.

Business credit

Need a credit line so that you can take care of important purchases and daily business expenses? You don’t have to wait for months applying for business loans. We offer a business credit line with flexible billing cycles and more affordable rates - all without jumping hoops.

Explore more about corporate cards

Know how corporate cards work and some of the best options to get a corporate card.

Manage your corporate travel expenses with some of the best travel credit card in Singapore.

Get to know what a prepaid card is, benefits, and its use cases for businesses.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Volopay helped BukuWarung in managing their expenses across different countries.

Volopay helped Deputy smoothly integrate with an accounting system.

Using Volopay, AdCombo eliminated the hurdles of cash flow management.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on corporate cards

Corporate cards are payment instruments issued by banks or other financial institutions to the employees of an organisation. Corporate cards are given to the employees of a company to manage their business expenses so that employees don't have to make out of pocket expenses.

Our corporate cards are VISA-issued cards, and they have international payments available. So, yes, both physical and virtual corporate cards can be used to make cross-border payments. Employees can also travel with their cards - both physical, and virtual on the mobile app - to make payments in other countries.

Yes, Volopay does support cross-border payments. Corporate cards are enabled to make payments internationally. Additionally, cards can be created for purely international payments, as well (such as specific SaaS fees, vendors, and international employee allowances).

Yes, that is one of the primary ways in which businesses can financially empower their employees. If your team travels frequently, then they can be given a recurring card that gets reloaded every monthly cycle. If an employee has a one-time travel need, you can give them a card with a limited budget and expiration date. If more funds are required at any time, they can be requested and approved from the dashboard.

All company expense and accounting policies are automatically applied to cards. Aside from these default settings, department-specific rules can also be applied. Along with this, when a card is generated, you can choose who the approvers are, what the reload cycle is, and what the maximum budget allowance is.

Yes. The card transactions are all synced in real-time, with expenses being recorded as they occur. This ledger of transactions is accessible from the website as well as the mobile application, making it easy to track and review card expenses. Approvers also have the ability to request additional information for a transaction, if required.

The main difference between corporate cards and business cards is whom the liability of payment & fees lie upon. The liability to pay any debt or fees for corporate cards lies upon the company whereas the liability to pay any debt or fees with a business card lies upon the primary cardholder.

Corporate cards are suitable for an organisation with employees who need to make business expenses regularly. Anyone can apply but whether your company qualifies for corporate cards is dependent on the provider you choose. There is no standard metric among all the different corporate card providers.

Certain things that definitely affect your eligibility include your companies profitability, credit history, and bank statements to check financial health. Depending on these and a few other financial metrics, a corporate card provider can decide whether you are eligible or not.

Corporate credit cards do not directly affect the user's credit score but builds the credit score for a business entity. Corporate cards indirectly help boost the credit score of an individual by helping them avoid making business expenses from their personal cards and maintain a low credit utilization rate.