Bills payable in accounting: definition, examples, accounting, and strategies

Understanding bills payable

Bills payable are short-term liabilities representing amounts a business owes to creditors for goods or services purchased on credit.

These obligations are typically formalized through written agreements, such as promissory notes or bills of exchange, and are due for payment within a specified period, usually ranging from 30 to 90 days.

Key characteristics

Key characteristics of bills payable include written agreements that formalize the debt, fixed due dates for repayment, and legal obligations that bind the parties involved.

These features make bills payable a reliable and common method of credit in Indian trade, helping businesses manage short-term liabilities with clarity and accountability.

Why track them?

Monitoring bills payable is crucial for maintaining financial transparency, ensuring compliance with contractual obligations, and fostering strong relationships with suppliers.

Timely tracking helps businesses avoid late fees, take advantage of early payment discounts, and manage cash flow effectively.

Importance of bills payable

1. Cash flow control

Bills payable are a key factor affecting your business’s cash flow. When you purchase goods or services on credit, these liabilities represent amounts you owe to suppliers, typically due within a short period. Managing your bills payable carefully ensures you have enough liquidity to cover other essential expenses like payroll and operational costs.

Poor control over these payables can lead to cash shortages, disrupting your daily business functions. By scheduling payments strategically and prioritizing bills, you maintain a healthy cash flow that supports smooth operations and prevents financial strain.

2. Vendor trust

Timely payments on bills payable build strong relationships with your suppliers. When vendors see you consistently pay on or before the due date, they view your business as reliable and trustworthy.

This trust can lead to more favorable credit terms, such as extended payment deadlines or bulk purchase discounts, which directly benefit your cash flow and cost management. Additionally, maintaining good vendor relationships can improve supply chain reliability and open doors for better negotiation opportunities, ultimately strengthening your business network.

3. Regulatory compliance

Compliance with regulatory requirements like RBI guidelines and GST rules is crucial when managing bills payable in India. Properly accounting for bills payable ensures that your financial records reflect accurate liabilities, supporting transparent reporting and audit readiness.

Adhering to GST input credit rules can also impact how you manage payments and tax filings, helping you avoid penalties or interest charges. Staying compliant protects your business from legal risks and maintains its reputation with tax authorities and financial institutions.

4. Strategic planning

Tracking bills payable accurately is essential for effective budgeting and financial forecasting. Knowing your outstanding liabilities and their due dates allows you to plan cash outflows and allocate funds appropriately.

This strategic insight helps you anticipate payment obligations, avoid surprises, and make informed decisions about investments or expansions. Integrating bills payable data into your financial plans ensures you maintain control over working capital and optimize overall business performance.

5. Cost flow management

Efficient management of bills payable enables you to take advantage of early payment discounts offered by some suppliers. These discounts can significantly reduce your purchase costs and improve profit margins.

On the other hand, avoiding late payments prevents penalties and interest charges that increase expenses. By optimizing payment timing, you enhance your cost control and boost financial efficiency, contributing to better overall business health.

6. Credit rating enhancement

Consistent and punctual payments of bills payable positively influence your business credit score. A strong credit rating increases your credibility with lenders and suppliers, making it easier to secure financing on favorable terms.

This improved creditworthiness can help your business grow by providing access to larger credit lines or lower interest rates. Additionally, a good credit profile reflects financial discipline, which can attract potential investors or partners.

Practical examples of bills payable in action

Manufacturing supplies

A manufacturer often purchases raw materials on credit to maintain smooth production without immediate cash outflow. For instance, a textile manufacturer buys fabric worth ₹5,00,000 from a supplier, issuing a bill payable with a 30-day due date. This bill formalizes the obligation to pay within the agreed period, helping the manufacturer manage working capital effectively.

By recording bills payable, the manufacturer ensures proper tracking of liabilities and timely payments, maintaining good vendor relationships.

Retail inventory

Retail businesses frequently rely on credit to stock up inventory. Imagine a retailer purchasing electronics worth ₹2,00,000 with a 45-day payment term. The retailer accepts a bill payable, which represents a formal promise to pay the supplier on the due date.

This arrangement allows the retailer to sell the inventory and generate revenue before the payment is due, improving cash flow management. Accurate recording of bills payable in accounting systems is essential to avoid missed payments and penalties.

IT services

In the IT sector, companies often acquire services on credit. A consultancy firm might receive software development services valued at ₹1,50,000 and formalize the payment through a bill payable due in 30 days.

This practice allows the consultancy to manage cash outflows better while ensuring that vendors are paid on time. Proper management of bills payable here helps maintain supplier trust and uninterrupted service delivery.

Hospitality sector

Hotels regularly buy supplies like linens, food, and cleaning materials on credit to support operations. For example, a hotel orders bulk supplies worth ₹3,00,000 with a bill payable due in 60 days.

By using bills payable, the hotel can balance its cash flow, scheduling payments to suppliers without disrupting daily operations. Maintaining a clear record of these payables aids in budgeting and vendor relationship management.

Construction industry

Construction companies frequently purchase expensive equipment on credit. A construction firm might acquire machinery worth ₹10,00,000, with a bill payable due within 90 days.

This arrangement provides the company time to allocate funds strategically across ongoing projects. Timely payment of bills payable prevents disruptions and supports smooth project execution.

Accounting processes for bills payable

When a bill payable is issued, record the transaction with a journal entry by debiting the purchases or relevant expense account and crediting the bills payable account. This entry acknowledges the obligation to pay your supplier and reflects the acquisition of goods or services on credit.

Proper documentation at this stage ensures accurate tracking of liabilities and supports transparent financial reporting.

When you make a payment on a bill payable, log the transaction by debiting the bills payable account to reduce the liability and crediting your cash or bank account to reflect the outflow of funds.

This entry updates your financial records by showing the settlement of the debt, helping maintain accuracy in both your liabilities and cash balances.

Bills payable are recorded as current liabilities on your balance sheet because they represent debts due within one year. Properly classifying bills payable is crucial for assessing your company’s short-term financial obligations.

This classification aids in providing a clear view of your liquidity and financial health to stakeholders, including investors and lenders, ensuring transparency and trust in your business’s financial statements.

If your bills payable include interest charges, record the interest expense separately by debiting the interest expense account and crediting cash or bills payable, depending on payment terms.

This ensures that the cost of borrowing is accurately captured in your financial statements, reflecting the true cost of credit purchases and allowing better expense management and profitability analysis.

Reconcile your bills payable monthly by comparing your accounts payable ledger with vendor statements. This process helps identify discrepancies such as missing invoices, payment errors, or unrecorded transactions.

Timely reconciliation ensures your financial records are accurate, reduces the risk of disputes with suppliers, and maintains strong vendor relationships through reliable and transparent accounting practices.

When you take advantage of early payment discounts offered by suppliers, record these discounts by reducing your accounts payable and crediting cash for the amount paid. The discount is recognized as a reduction in purchase costs, improving your profit margins.

Properly accounting for early payment discounts helps optimize your cash flow and reflects accurate expenses in your financial reports.

Tools to streamline bills payable management

Payment scheduling software

Payment scheduling software helps you plan and automate bill payments, ensuring you never miss a due date. By scheduling payments in advance, you avoid late fees and optimize your cash flow, allowing your business to maintain healthy liquidity.

These tools can send reminders and alerts to keep your payable process on track and efficient.

Approval systems

Approval systems streamline your bills payable workflow by enforcing structured payment authorizations. These systems reduce errors and fraud risks by ensuring that only authorized personnel approve invoices before payment.

Implementing approval workflows increases accountability, improves compliance, and speeds up the payment process without compromising accuracy.

Multi-currency tools

For businesses dealing with international vendors, multi-currency tools simplify payments by managing currency conversion and exchange rates automatically.

These tools help Indian businesses handle overseas bills payable with ease, minimizing currency risk and improving accuracy in international transactions. They also ensure compliance with foreign exchange regulations.

Automation platforms

Automation platforms reduce manual entry by automating repetitive bills payable tasks like invoice data capture, payment scheduling, and reconciliation.

This minimizes errors, accelerates processing times, and frees up your accounting team to focus on strategic activities. Automation improves overall efficiency and strengthens internal controls in managing bills payable.

Vendor management apps

Vendor management apps allow you to track payment terms, contact details, and payment histories all in one place. These tools enhance communication with suppliers and help maintain positive relationships by ensuring timely payments.

Keeping organized vendor information also simplifies dispute resolution and negotiation processes.

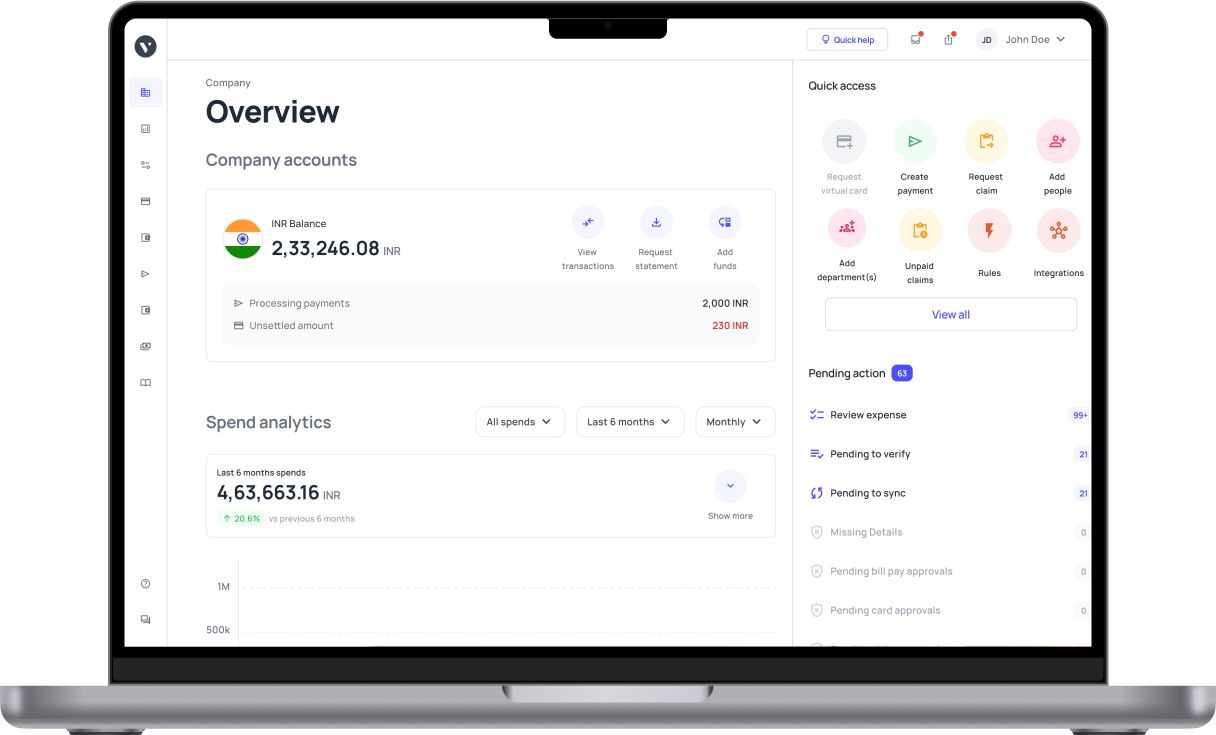

Real-time dashboards

Real-time dashboard tools provide instant visibility into your bills payable status, upcoming due dates, and cash flow impact.

By monitoring this data continuously, you can make informed decisions, avoid payment bottlenecks, and improve financial planning. Dashboards offer a comprehensive view that boosts oversight and control over your payable obligations.

Optimize bills payable—best practices

Clear vendor terms

Negotiating clear and precise vendor terms is essential to optimize bills payable management. By setting payment deadlines that align with your business’s cash flow, you can avoid cash shortages and better plan expenditures.

Clear terms also reduce misunderstandings, helping build trustworthy vendor relationships that support smoother transactions and timely payments.

Timely payments

Scheduling payments on time is crucial to avoid penalties and take advantage of early payment discounts. Consistently meeting payment deadlines improves your vendor trust and can lead to better credit terms in the future.

Using digital payment scheduling tools ensures you never miss a due date, helping maintain healthy cash flow and reducing the risk of costly late fees.

Monthly reconciliation

Perform monthly reconciliation of your bills payable accounts with vendor statements to identify discrepancies early. This process helps ensure accuracy in your financial records, prevents duplicate or missed payments, and strengthens internal controls.

Timely reconciliation supports better financial reporting and helps maintain a transparent payable system, reducing the risk of errors or fraud.

Proactive communication

Maintain proactive communication with your vendors to quickly resolve payment issues and clarify terms. Regular engagement builds stronger vendor relationships, ensuring mutual understanding and cooperation.

This practice also helps address disputes or delays before they escalate, contributing to a more reliable and efficient bills payable process that benefits both parties.

Budget integration

Integrate bills payable with your company’s budgeting and forecasting processes to maintain financial discipline. Accurate tracking of payable obligations supports cash flow projections and helps prevent overspending.

Aligning bills payable with budget goals enables smarter decision-making and improves your company’s overall financial health and planning accuracy.

Internal controls

Implement strong internal controls to prevent unauthorized or fraudulent payments within bills payable. This includes segregation of duties, approval workflows, and audit trails to monitor transactions.

Internal controls ensure compliance with company policies and regulations, safeguarding your business’s financial integrity and reducing risks associated with errors or misuse of funds.

Overcoming common bills payable challenges

Cash flow delays

Late payments disrupt a company’s cash flow and create liquidity problems. Understanding what is bills payable and managing bills payable carefully helps prevent these delays. Proper scheduling of bills payable ensures your business maintains healthy cash flow, meets financial obligations on time, and avoids unnecessary penalties or interest.

Effective bills payable management is essential to keep operations smooth and cash flow predictable.

Manual errors

Manual handling of bills payable often leads to errors such as duplicate payments or missed due dates. Knowing the bills payable meaning helps you appreciate the need for automation and digitization.

Using accounting software to process bills payable reduces human mistakes and increases accuracy. Automated systems track payment schedules, record transactions properly, and save time, allowing your accounting team to focus on higher-value tasks.

Fraud risks

Bills payable processes without proper controls can expose your business to fraud risks, including unauthorized or fake payments. By understanding what is bills payable in accounting, you can implement internal controls like approval workflows and segregation of duties.

These measures prevent fraudulent activities and protect your business’s financial health, ensuring that only legitimate bills payable are processed and paid on time.

Compliance issues

Non-compliance with regulatory requirements such as GST and RBI rules can result in penalties and legal problems. Accurate recording and timely settlement of bills payable play a key role in regulatory compliance.

Understanding the bills payable meaning in the context of taxation and accounting standards ensures your business meets all legal obligations and avoids costly fines, strengthening your financial integrity.

Vendor disputes

Unclear or misunderstood payment terms often lead to disputes with vendors. Knowing what is bills payable lets you establish clear payment terms and expectations upfront.

Consistent communication and well-documented bills payable agreements help prevent conflicts, build vendor trust, and maintain positive business relationships, ensuring uninterrupted supply chains and services.

Data overload

Managing numerous bills payable manually can cause confusion, errors, and missed payments. Leveraging technology designed for bills payable management helps organize and track large volumes of data efficiently.

When you understand what is bills payable in accounting and use real-time dashboards or software, it improves visibility and control, reduces errors, and streamlines your entire accounts payable workflow.

Benefits of streamlined bills payable processes

Better cash flow

Efficient bills payable management directly impacts your cash flow by ensuring timely payments without unnecessary delays. Knowing what is bills payable enables you to schedule payments carefully, avoiding cash shortages or excessive outflows at once.

This control over liquidity supports financial stability, allowing your business to meet operational costs and seize new opportunities without stress.

Stronger vendor ties

Reliable and timely payments build stronger relationships with suppliers and vendors. When you understand the bills payable meaning, you realize the importance of honoring payment terms.

Consistent payments foster trust, which can lead to better credit terms, discounts, or priority service. Solid vendor relationships also help maintain uninterrupted supplies, supporting smoother business functions.

Accurate reporting

Proper tracking of bills payable ensures your financial statements are accurate and up to date. Grasping what is bills payable in accounting helps you organize liabilities correctly, giving clear insight into your company’s obligations.

Accurate reports allow business leaders to make smarter financial decisions, forecast budgets effectively, and plan strategically for growth.

Less admin work

Automation tools for bills payable reduce the need for manual data entry, minimizing errors and saving valuable time. Understanding what is bills payable encourages you to implement software that automates invoice processing and payment approvals.

This reduces administrative workload and frees up your finance team to focus on higher-value activities like cash management and financial analysis.

Scalable processes

As your business grows, managing bills payable manually becomes more complex and error-prone. Streamlined systems that integrate well with your accounting processes make scaling easier.

Knowing bills payable meaning encourages adopting workflows and technology that grow with your company, handling increased transaction volumes without adding complexity or risking oversight.

Discover the benefits of streamlined processes and improved efficiency

Emerging technology trends in AP management

AI automation

Artificial intelligence automation is transforming how businesses manage bills payable. AI tools predict payment schedules based on historical data, helping companies avoid late fees and optimize cash flow.

By understanding what is bills payable in accounting, businesses can leverage AI to prioritize payments, reduce manual errors, and increase overall efficiency in accounts payable management. This technology saves time and improves accuracy.

Cloud platforms

Cloud-based platforms provide real-time access to bills payable data from anywhere, enabling seamless management and collaboration. These tools support the entire payment process, from invoice receipt to payment approval, and integrate with existing accounting systems.

Knowing what is bills payable allows businesses to adopt cloud solutions that enhance transparency, reduce paperwork, and provide up-to-date financial insights instantly for better decision-making.

Blockchain security

Blockchain technology is emerging as a secure way to manage bills payable by offering tamper-proof payment records. Its decentralized ledger creates transparency between vendors and buyers, reducing fraud risk and ensuring payment accuracy.

Understanding bills payable meaning highlights how blockchain can build trust with suppliers by maintaining an immutable record of transactions, improving compliance and accountability in AP management.

Mobile apps

Mobile applications now enable bills payable management on-the-go, offering convenience and flexibility. Through these apps, businesses can approve invoices, schedule payments, and monitor outstanding bills anytime, anywhere.

Knowing what is bills payable encourages adopting mobile tools that keep your financial operations agile, responsive, and up to date—critical in today’s fast-paced business environment.

Data analytics

Data analytics tools analyze bills payable data to reveal trends, payment patterns, and potential issues. By leveraging analytics, businesses can forecast cash flow needs, identify inefficiencies, and negotiate better payment terms with vendors.

Awareness of what is bills payable in accounting allows companies to apply data-driven insights to optimize their payment strategies and improve financial planning.

Streamlining bills payable with Volopay

Automated processing

Volopay automates invoice handling and payment scheduling to boost operational efficiency. By digitizing invoice capture and approval workflows, Volopay reduces manual data entry errors and speeds up the payment cycle.

This automated process helps businesses avoid late fees and maintain positive vendor relationships by ensuring bills payable are settled on time.

Real-time insights

With Volopay’s intuitive dashboard, you can track bills payable instantly and get real-time insights into your company’s payables status. This transparency allows finance teams to monitor outstanding invoices, view payment due dates, and analyze cash outflows effectively.

Understanding your bills payable pipeline in real time helps you optimize working capital and make informed financial decisions.

Secure transactions

Security is a top priority in accounts payable management. Volopay ensures payments are SOC 2 compliant and adhere to RBI security regulations, offering a secure platform for transactions.

Multi-level approval workflows and data encryption reduce risks of fraud and unauthorized payments. This robust security framework gives businesses peace of mind while handling bills payable.

Accounting integration

Volopay seamlessly integrates with popular accounting software like QuickBooks and Xero, making reconciliation easy and error-free. This integration syncs payment data automatically, eliminating the need for manual data transfer and reducing accounting discrepancies.

Keeping bills payable records aligned with your accounting system helps maintain accurate financial statements and simplifies audit processes.

Scalable solution

As your business grows, your bills payable process becomes more complex. Volopay supports growing businesses with flexible AP tools designed to scale effortlessly. Whether managing multiple vendor accounts or handling higher transaction volumes, Volopay adapts to your evolving needs.

This scalability ensures your bills payable system remains efficient and effective without additional overhead.

Legal and tax considerations for bills payable

Bills payable must comply with the Goods and Services Tax (GST) rules to claim input tax credit (ITC). Ensure that the invoices from vendors are GST-compliant, with valid tax details, and that payments are made within the prescribed timeline, typically 180 days from the invoice date.

Failure to comply with these filing requirements can lead to ITC reversal and penalties, affecting your business’s tax efficiency and cash flow.

The Reserve Bank of India (RBI) regulates payments related to foreign transactions, which include bills payable to international vendors. It is critical to follow RBI’s Foreign Exchange Management Act (FEMA) rules, especially regarding timely payments and proper documentation.

Non-compliance with RBI guidelines can result in fines and transaction delays. For cross-border bills payable, ensure adherence to remittance limits and disclosure norms set by RBI to avoid regulatory issues.

Maintaining accurate and well-organized records of all bills payable is vital for audit readiness. Clear documentation helps auditors verify the authenticity of transactions and compliance with tax and legal standards.

Implementing an automated accounts payable system can enhance record-keeping efficiency, minimize errors, and simplify audit processes. Being prepared for audits by keeping up-to-date bills payable records protects your business from penalties and improves financial transparency.

The future of bills payable management

Digital transformation

Digital tools are reshaping how businesses handle bills payable by automating invoice processing, payment approvals, and record keeping.

Automation reduces errors and speeds up payment cycles, while cloud-based platforms provide real-time visibility into liabilities and cash flow. These innovations allow finance teams to make faster, more accurate decisions.

Sustainable practices

Eco-friendly digital payments help reduce reliance on paper-based processes, lowering environmental impact.

By shifting to electronic invoicing and digital records, companies cut down on paper waste and postage costs. This green approach aligns with corporate social responsibility goals and supports sustainable business operations.

Global integration

Modern bills payable solutions enable seamless management of cross-border payments, simplifying currency conversion and compliance with international regulations.

Integration with global banking networks helps businesses efficiently handle foreign transactions, minimize fees, and ensure timely payments to international vendors, strengthening global supplier relationships.

Conclusion: take control of your bills payable

Key takeaways

Bills payable management plays a vital role in keeping your business financially stable. Understanding what is bills payable and aligning your processes with smart practices—like timely payments, clear vendor terms, automation, and internal controls—enhances efficiency. When handled well, it improves vendor trust, cash flow, and audit readiness.

A well-managed system also ensures compliance with regulatory requirements and reduces the risk of fraud or errors. Knowing the bills payable meaning in accounting helps teams stay organized, especially as businesses scale. Leveraging digital tools helps overcome common challenges in accounts payable while ensuring visibility, control, and accuracy—key components for a robust financial system.

Next steps

To modernize your AP function, explore how Volopay can help streamline bills payable management. Volopay’s automation features simplify invoice approvals, payment scheduling, and reconciliation while keeping you compliant with RBI and GST guidelines. You get real-time insights, SOC 2-compliant secure transactions, and easy integration with platforms like QuickBooks and Xero.

It’s ideal for businesses looking to reduce manual work and improve accuracy. As digital transformation reshapes how businesses manage accounts payable, adopting a tool like Volopay keeps you ahead of the curve. Manage cross-border payments seamlessly with modern tools and take control of your financial operations with a reliable, scalable AP solution.

Bring Volopay to your business

Get started now

FAQs about bills payable

Bills payable are recorded as a credit in accounting because they represent a liability—money the company owes to creditors. When a bill is accepted, the company credits the bills payable account to reflect the obligation and debits the corresponding asset or expense account, such as inventory or services received.

Delaying payment of bills payable can lead to several issues, including late payment penalties, strained vendor relationships, and disruptions in the supply chain. Additionally, it can cause cash flow problems, making it challenging to meet other financial obligations and potentially hindering business operations.

Volopay automates the accounts payable process by collecting and updating vendor payment details, reducing manual data entry errors. It centralizes invoice tracking, automates approval workflows, and ensures that payments are processed efficiently, thereby streamlining the entire bill payment process.

Yes, Volopay supports multi-currency transactions, allowing businesses to make payments in over 100 countries and 60+ currencies. This feature enables companies to manage cross-border payments seamlessly without the need to create multiple separate accounts through different banks.

Volopay prioritizes payment security by implementing measures such as 3D Secure for enhanced transaction security, encryption, fraud detection, and instant card-freezing capabilities. These features help protect businesses from unauthorized transactions and ensure the safety of financial data.

Volopay offers seamless integration with various accounting and ERP systems, including QuickBooks, Xero, Netsuite, Tally, MYOB, and Deskera. These integrations eliminate manual data entry, reduce errors, and ensure real-time visibility into financial operations, enhancing overall efficiency.